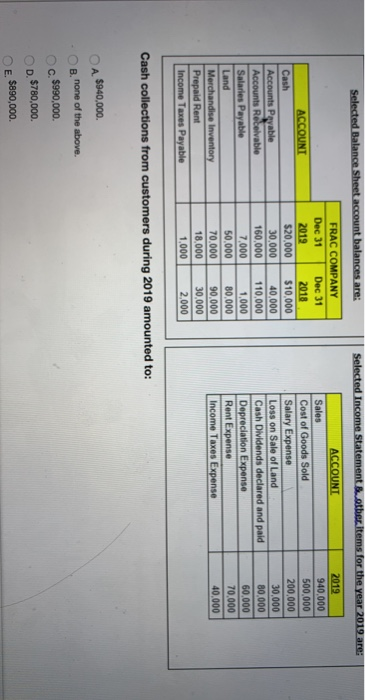

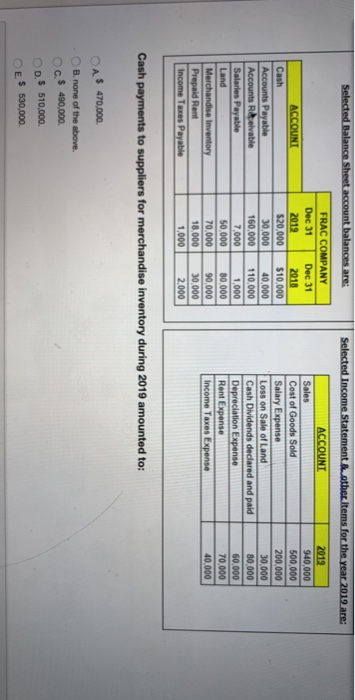

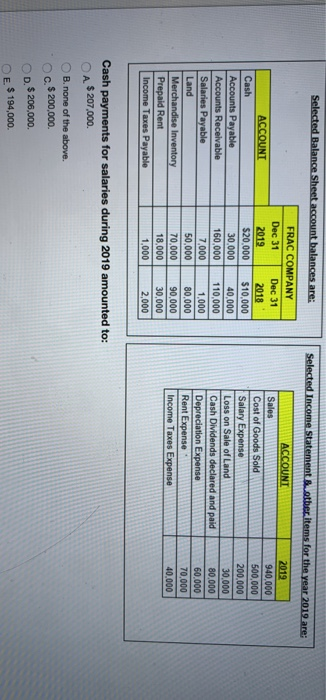

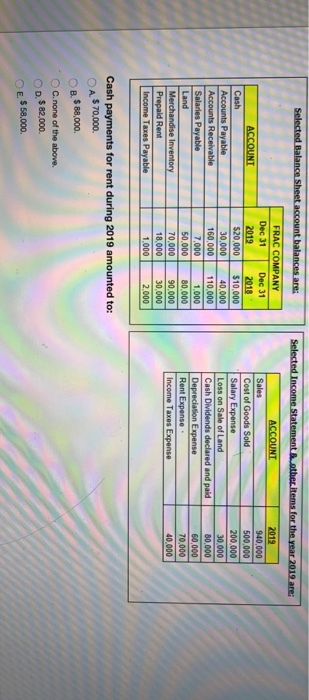

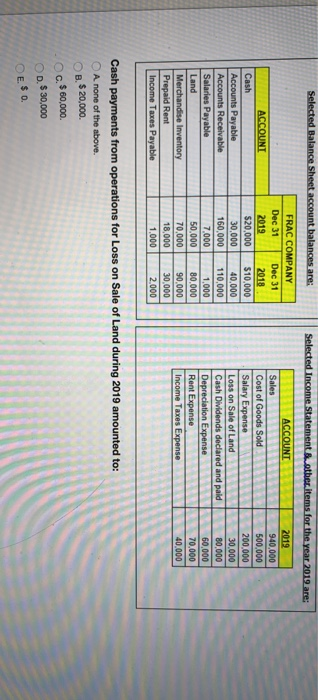

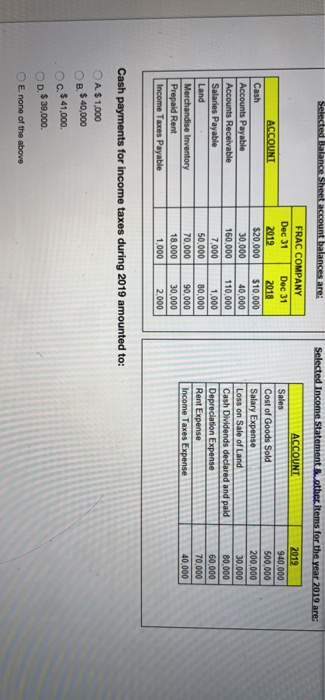

Selected Balance Sheet account balances are: Selected Income statement ether items for the year 2019 are: ACCOUNT Cash Accounts Payable Accounts Receivable Salaries Payable Land Merchandise Inventory Prepaid Rent Income Taxes Payable FRAC COMPANY Dec 31 Dec 31 2019 2018 $20,000 $10,000 30,000 40.000 160,000 110,000 7,000 1,000 50.000 80,000 70.000 90.000 18,000 30,000 1,000 2,000 ACCOUNT Sales Cost of Goods Sold Salary Expense Loss on Sale of Land Cash Dividends declared and paid Depreciation Expense Rent Expense Income Taxes Expense 2019 940,000 500,000 200,000 30,000 80,000 60,000 70,000 40,000 Cash collections from customers during 2019 amounted to: - O A $940,000 B. none of the above. c. $990,000 D. $780,000 E $890,000 Selected Balance Sheet account balances are: Selected Income Statement & other items for the year 2019 are: 2019 940,000 500,000 200 000 30.000 ACCOUNT Cash Accounts Payable Accounts R elvable Salaries Payable Land Merchandise Inventory Prepaid Rent Income Taxes Payable ACCOUNT Sales Cost of Goods Sold Salary Expense Loss on Sale of Land Cash Dividends declared and paid Depreciation Expense Rent Expense Income Taxes Expense FRAC COMPANY Dec 31 Dec 31 2019 2018 $20,000 $10,000 30,000 40,000 160.000 110,000 7,000 1.000 50,000 80,000 70,000 90,000 18.000 30,000 1,000 2.000 50.000 70 000 40,000 Cash payments to suppliers for merchandise inventory during 2019 amounted to: - OAS 470,000 B. none of the above. c. $ 490,000 DS 510,000 ES 530,000 Selected Balance Sheet account balances are: Selected Income Statement other.Items for the year 2019 are: ACCOUNT Cash Accounts Payable Accounts Receivable Salaries Payable Land Merchandise Inventory Prepaid Rent Income Taxes Payable FRAC COMPANY Dec 31 Dec 31 2019 2018 $20.000 $10.000 30,000 40,000 160,000 110,000 7,000 1,000 50,000 80.000 70.000 90.000 18,000 30,000 1,000 2.000 AL ACCOUNT Sales Cost of Goods Sold Salary Expense Loss on Sale of Land Cash Dividends declared and paid Depreciation Expense Rent Expense Income Taxes Expense 2012 940 000 500,000 200,000 30,000 80,000 60,000 70,000 40,000 Cash payments for salaries during 2019 amounted to: A $ 207.000 B. none of the above. c. $ 200,000 D. $ 205,000 E $ 194,000 Selected Balance Sheet account balances are: Selected Income Statement other items for the year 2019 are: FRAC COMPANY Dec 31 Dec 31 2012 ACCOUNT 940,000 Accounts Payable Accounts Receivable Salaries Payable 110.000 Sales Cost of Goods Sold Salary Expense Loss on Sale of Land Cash Dividends declared and paid Depreciation Expense Rent Expense Income Taxes Expense Merchandise Inventory Prepaid Rent Income Taxes Payable 30,000 Cash payments for rent during 2019 amounted to: A $70.000 a $ 88.000 OC.none of the above $ 82,000 E $ 58,000 Selected Balance Sheet account balances are: Selected Income Statement & other items for the year 2019 are: ACCOUNT Cash Accounts Payable Accounts Receivable Salaries Payable Land Merchandise Inventory Prepaid Rent Income Taxes Payable FRAC COMPANY Dec 31 Dec 31 2019 2018 $20,000 $10,000 30.000 40,000 160,000 110,000 7.000 1.000 50.000 80.000 70.000 90.000 18,000 30.000 1.000 2.000 ACCOUNT Sales Cost of Goods Sold Salary Expense Loss on Sale of Land Cash Dividends declared and paid Depreciation Expense Rent Expense Income Taxes Expense 2019 940,000 500,000 200.000 30,000 80,000 60.000 70.000 40.000 Cash payments from operations for Loss on Sale of Land during 2019 amounted to: A none of the above. B. $20,000 c. $ 60,000 D. $30,000 i Selected Balance Sheet account balances are: Selected Income Statement other items for the year 2019 are: 2019 940 000 ACCOUNT Cash FRAC COMPANY Dec 31 Dec 31 2019 2018 $20,000 $10,000 30,000 40.000 160,000 110,000 7.000 1.000 50,000 80,000 70.000 90,000 18.000 30,000 1,000 2.000 ACCOUNT Sales Cost of Goods Sold Salary Expense Loss on Sale of Land Cash Dividends declared and paid 500,000 200,000 30,000 80,000 Accounts Payable Accounts Receivable Salaries Payable Land Merchandise Inventory Prepaid Rent Income Taxes Payable Depreciation Expen Rent Expense 60,000 70.000 Cash payments for income taxes during 2019 amounted to: O A $1,000 OB. $ 40,000 c. $ 41,000 OD. $ 39,000 O E none of the above