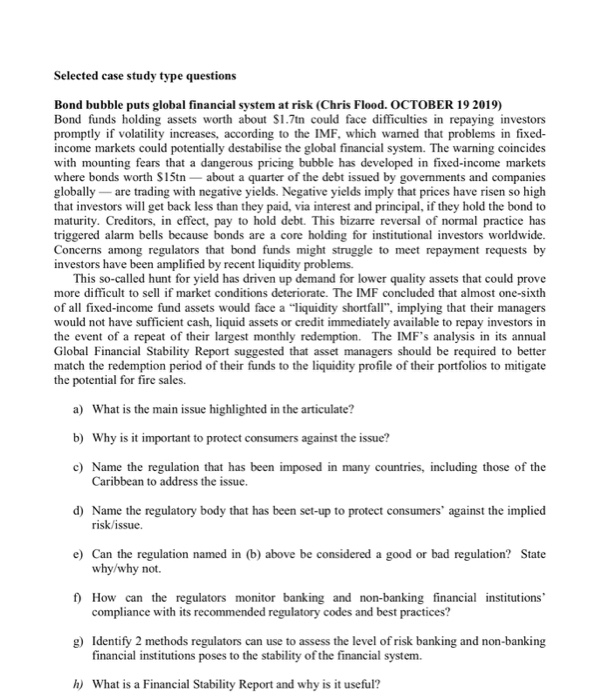

Selected case study type questions Bond bubble puts global financial system at risk (Chris Flood. OCTOBER 19 2019) Bond funds holding assets worth about $1.7tn could face difficulties in repaying investors promptly if volatility increases, according to the IMF, which warned that problems in fixed- income markets could potentially destabilise the global financial system. The warning coincides with mounting fears that a dangerous pricing bubble has developed in fixed-income markets where bonds worth $15tn - about a quarter of the debt issued by governments and companies globally - are trading with negative yields. Negative yields imply that prices have risen so high that investors will get back less than they paid, via interest and principal, if they hold the bond to maturity. Creditors, in effect, pay to hold debt. This bizarre reversal of normal practice has triggered alarm bells because bonds are a core holding for institutional investors worldwide. Concerns among regulators that bond funds might struggle to meet repayment requests by investors have been amplified by recent liquidity problems. This so-called hunt for yield has driven up demand for lower quality assets that could prove more difficult to sell if market conditions deteriorate. The IMF concluded that almost one-sixth of all fixed-income fund assets would face a liquidity shortfall", implying that their managers would not have sufficient cash, liquid assets or credit immediately available to repay investors in the event of a repeat of their largest monthly redemption. The IMF's analysis in its annual Global Financial Stability Report suggested that asset managers should be required to better match the redemption period of their funds to the liquidity profile of their portfolios to mitigate the potential for fire sales. a) What is the main issue highlighted in the articulate? b) Why is it important to protect consumers against the issue? c) Name the regulation that has been imposed in many countries, including those of the Caribbean to address the issue. d) Name the regulatory body that has been set-up to protect consumers' against the implied risk/issue. e) Can the regulation named in (b) above be considered a good or bad regulation? State why/why not. f) How can the regulators monitor banking and non-banking financial institutions compliance with its recommended regulatory codes and best practices? g) Identify 2 methods regulators can use to assess the level of risk banking and non-banking financial institutions poses to the stability of the financial system. h) What is a Financial Stability Report and why is it useful