Answered step by step

Verified Expert Solution

Question

1 Approved Answer

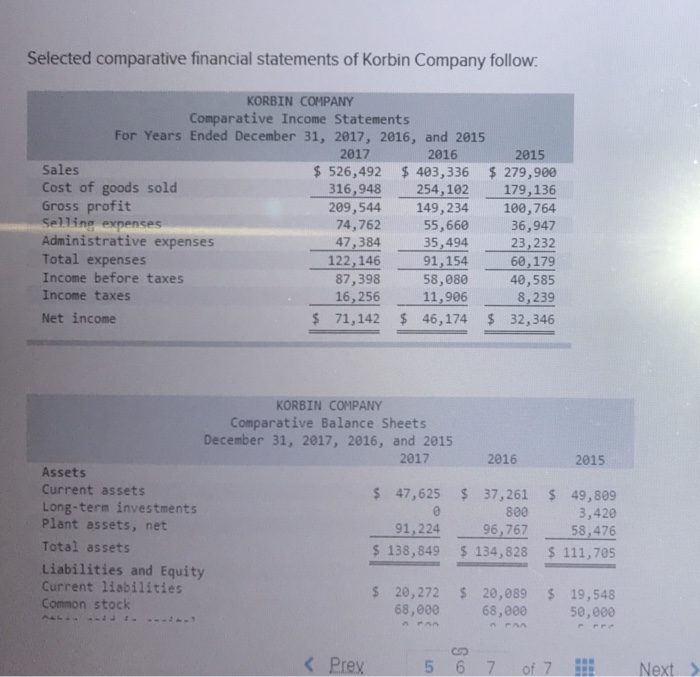

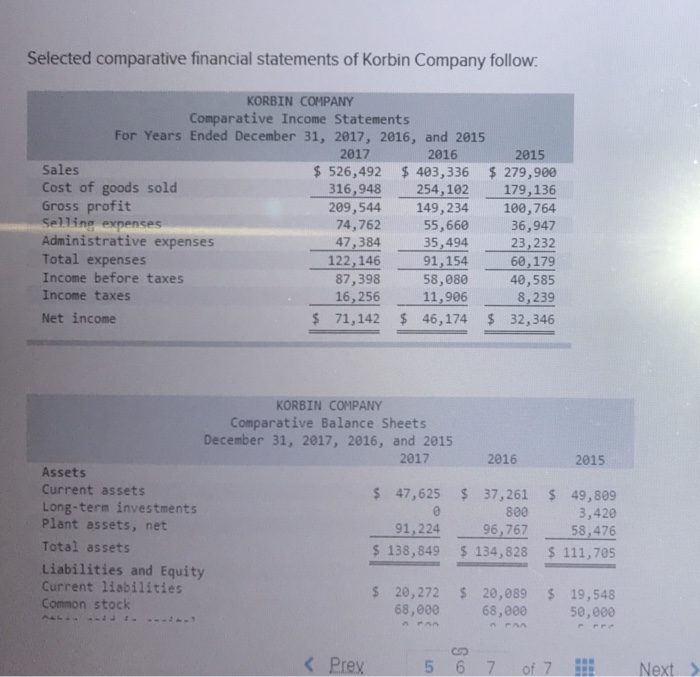

Selected Comparative financial statements of Korbin Company follow: Selected comparative financial statements of Korbin Company follow KORBIN COMPANY Comparative Income Statements For Years Ended December

Selected Comparative financial statements of Korbin Company follow:

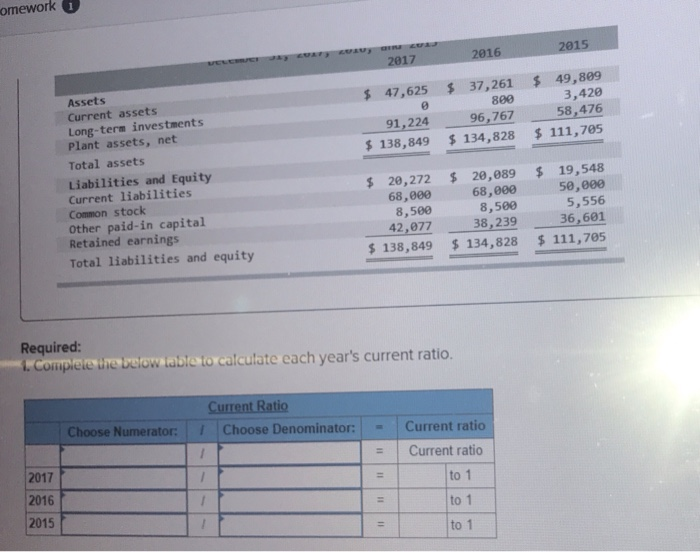

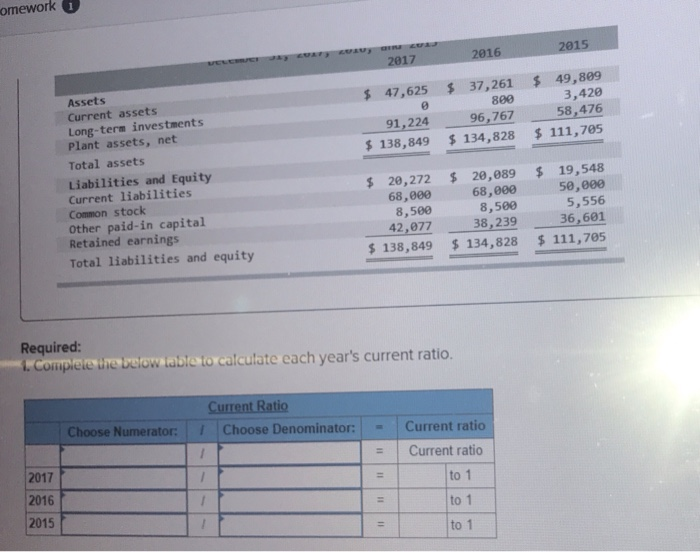

Selected comparative financial statements of Korbin Company follow KORBIN COMPANY Comparative Income Statements For Years Ended December 31, 2017, 2016, and 2015 2017 2016 2015 Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income taxes Net income 526,492 403,336 279,900 316,948 254,102 209,544 149,234 100,764 74,76255,660 36,947 35,494 91,154 58,080 11,906 179,136 23,232 60,179 40,585 8,239 $ 71,142 46,174 $ 32,346 47,384 122,146 87,398 16,256 KORBIN COMPANY Comparative Balance Sheets December 31, 2017, 2016, and 2015 2017 2016 2015 Assets Current assets Long-term investments Plant assets, net Total assets s 47,625 37,261 49,809 3,420 91,224 96,7658,476 s 138,849 134,828 111,705 800 :2249012307 Liabilities and Equity Current 1iabilities Common stock s 20,272 20,089 19,548 68,00068,000 50,000 Prey 5 6 7 of 7 Next> omework 0 2017 Assets Current assets Long-term investments Plant assets, net Total assets 47,625 37,261 49,809 96, 767 138,849134,828 111,785 3,420 58,476 800 91,224 Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings 50,000 5,556 38,239 36,601 $ 138,849 134,828 111,705 20,272 20,089 $19,548 68,000 8,500 68,000 8,580 42,077 Total liabilities and equity Required: L Compiete tne boow aste to calculate cach year's current ratio. Current Ratio Choose Denominator:Current ratio Choose Numerator: Current ratio 2017 2016 2015 to 1 to 1 to 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started