Answered step by step

Verified Expert Solution

Question

1 Approved Answer

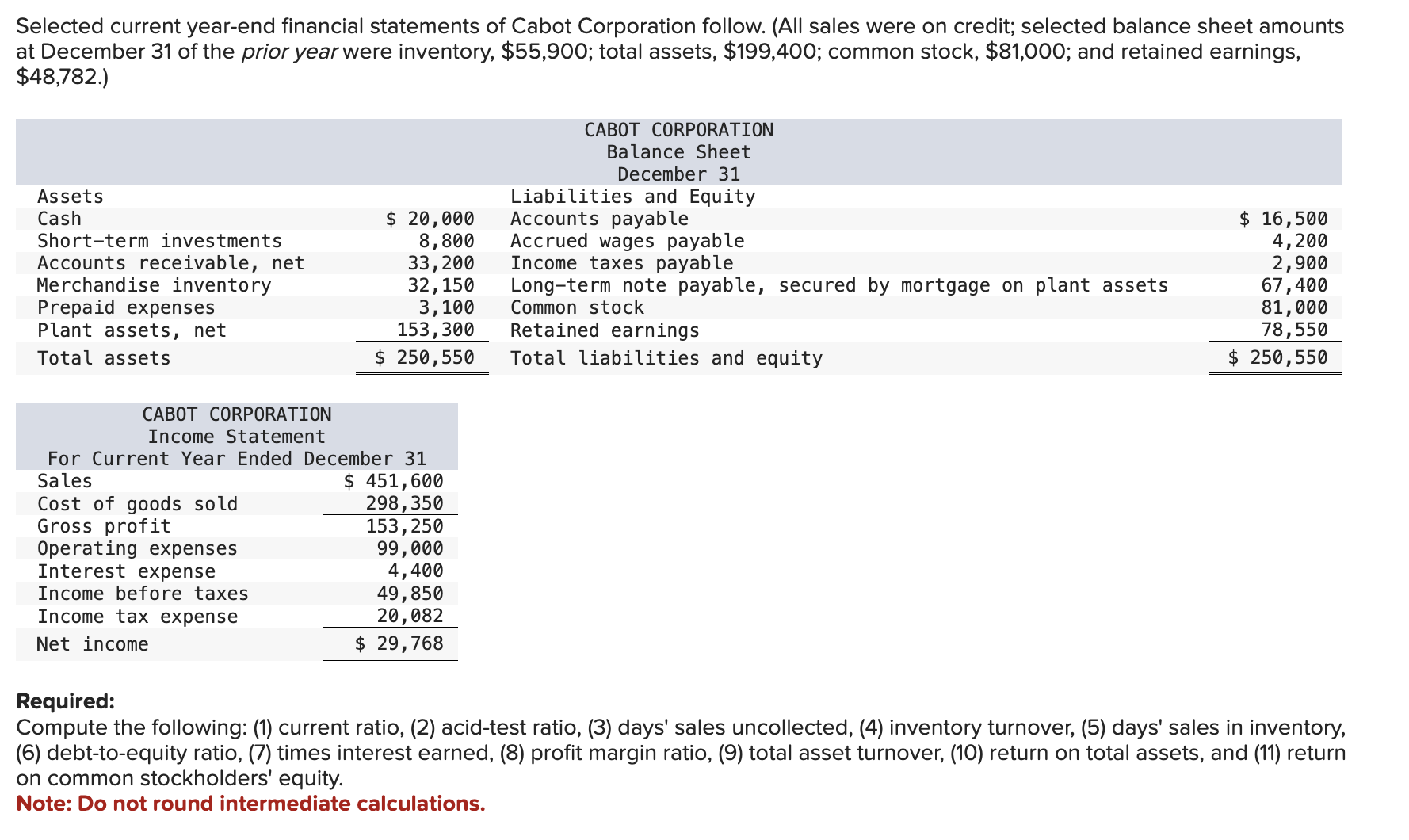

Selected current year-end financial statements of Cabot Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31 of the prior

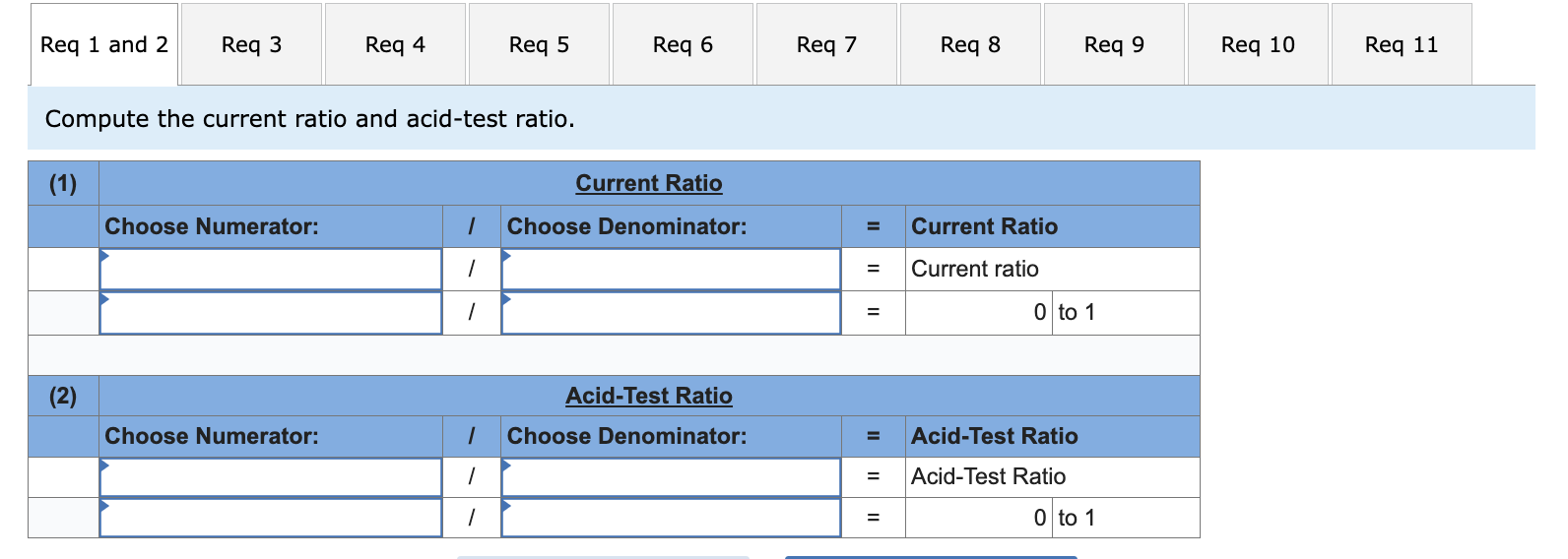

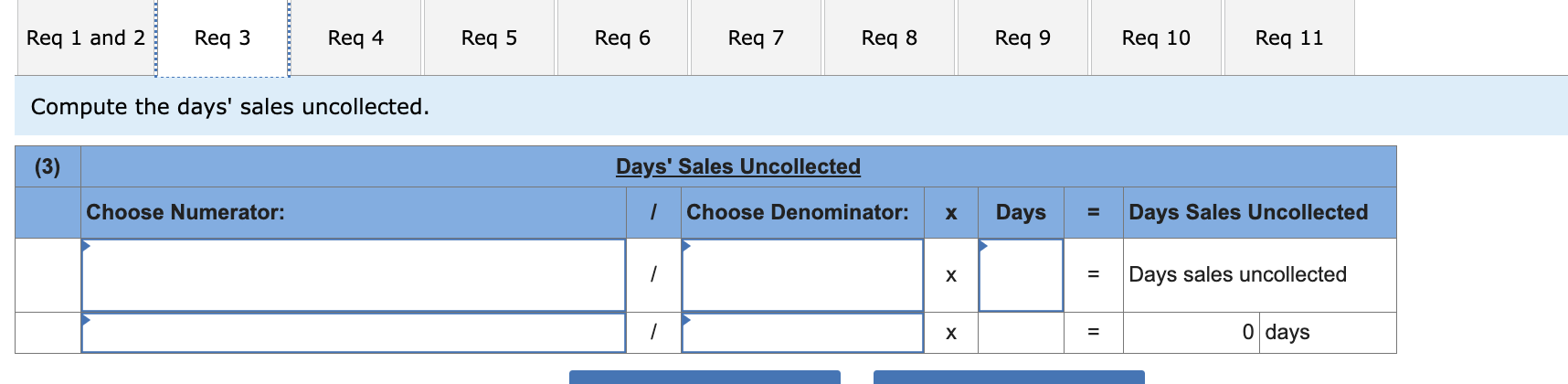

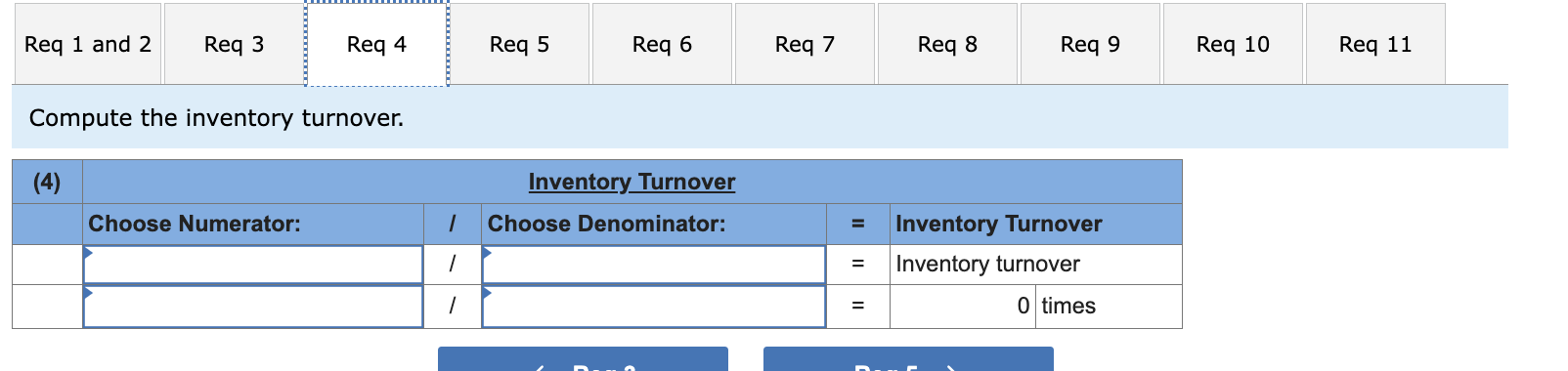

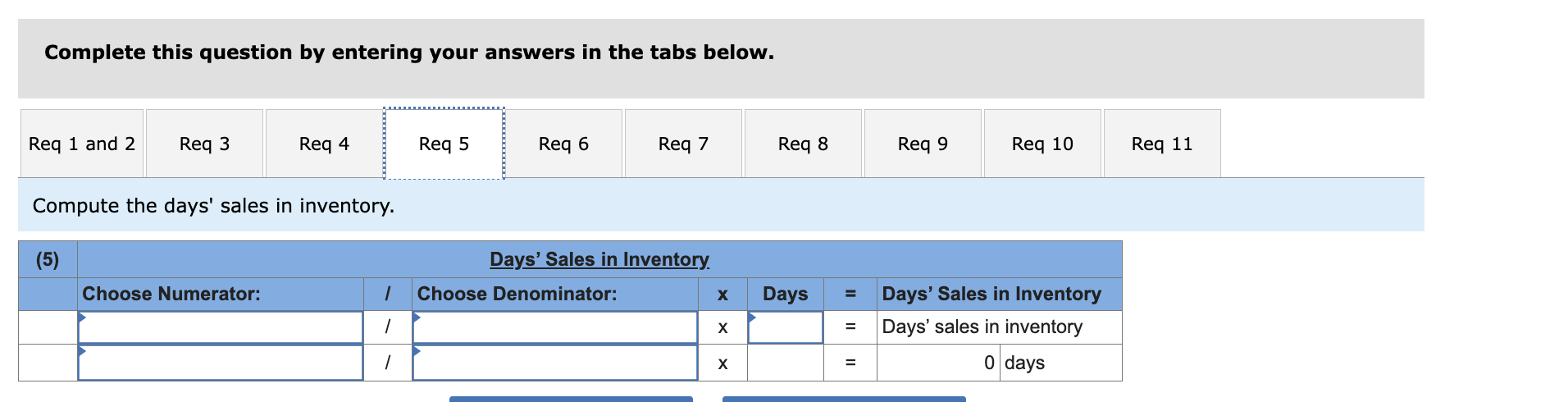

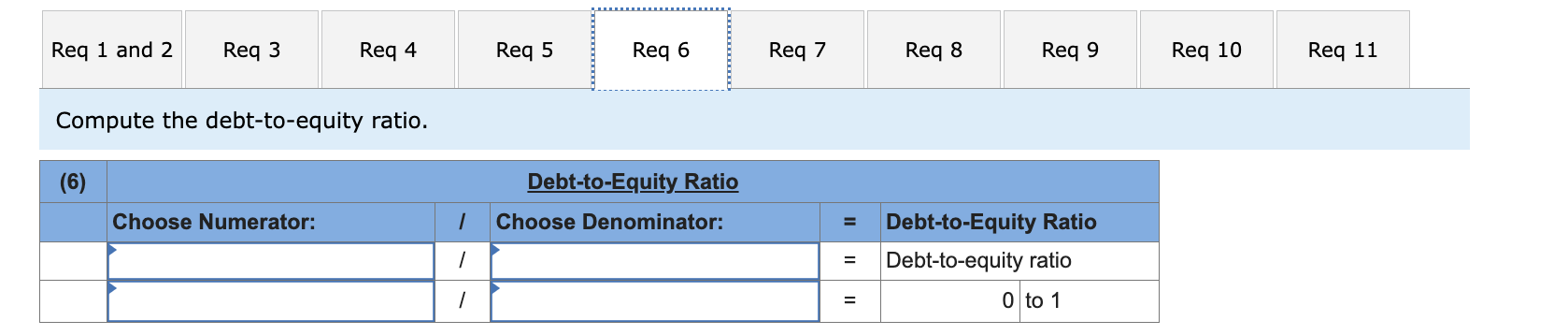

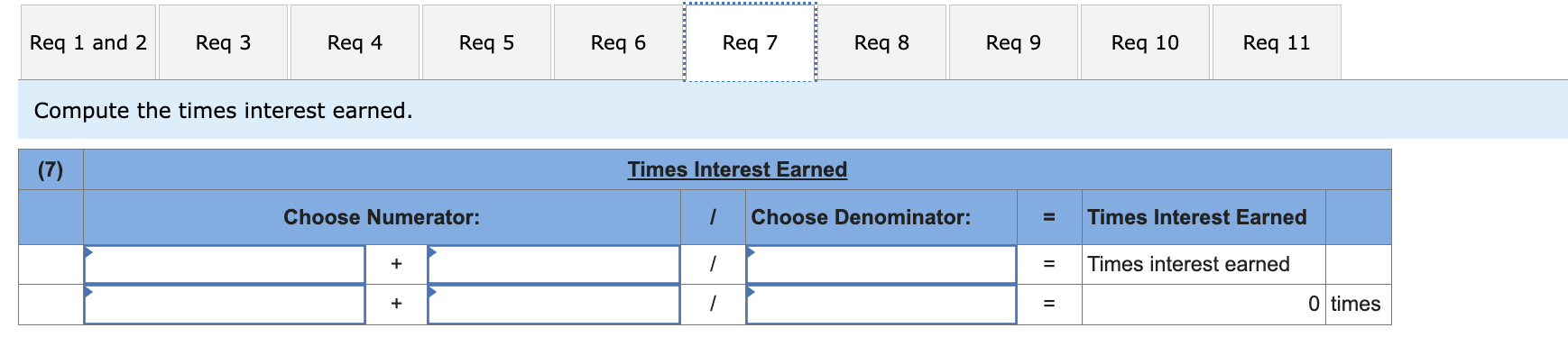

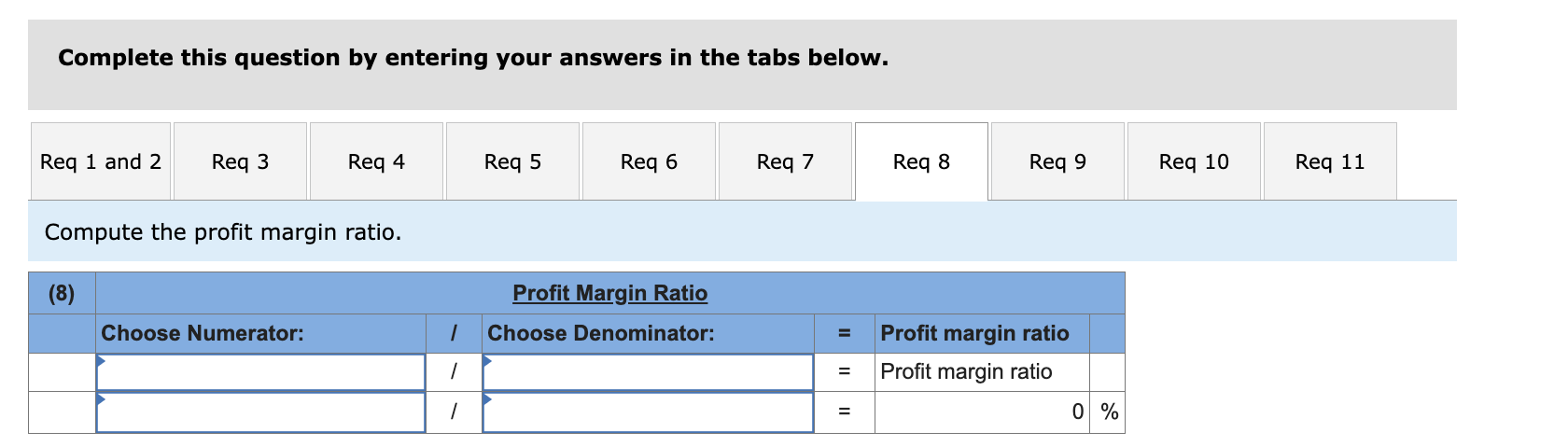

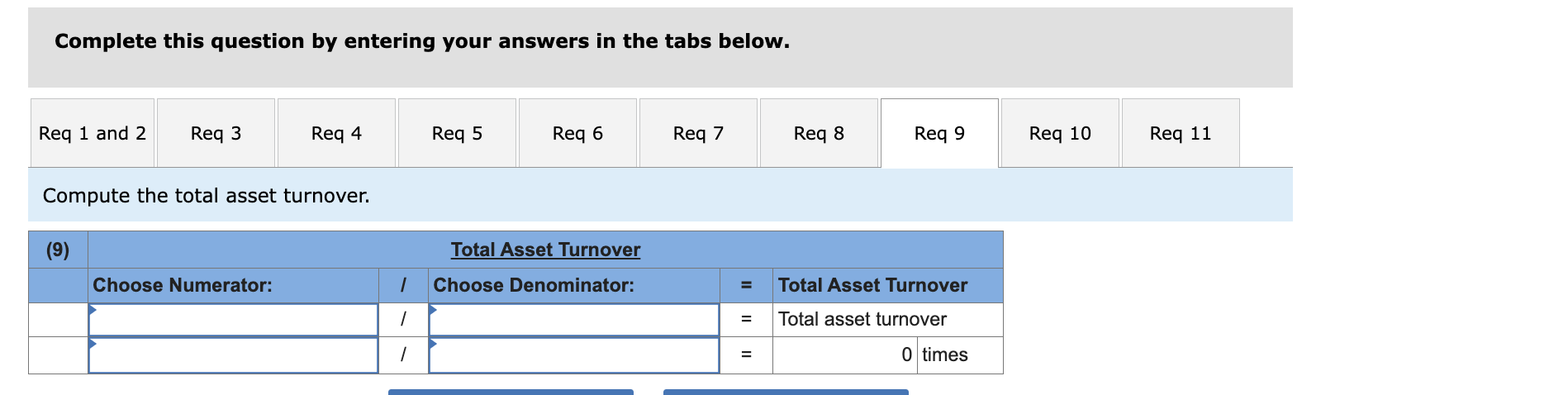

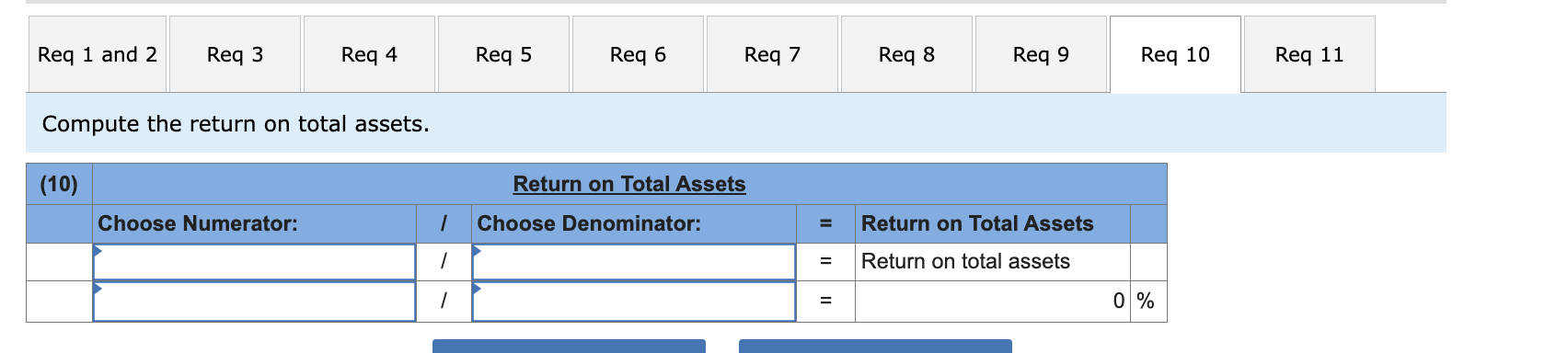

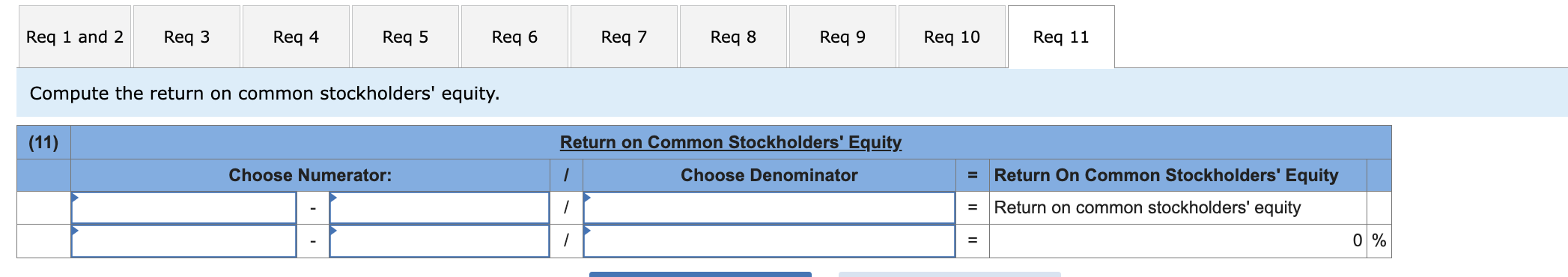

Selected current year-end financial statements of Cabot Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31 of the prior year were inventory, $55,900; total assets, $199,400; common stock, $81,000; and retained earnings, $48,782.) Assets Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net $ 20,000 CABOT CORPORATION Balance Sheet December 31 Liabilities and Equity Accounts payable 8,800 Accrued wages payable 33,200 Income taxes payable 32,150 Long-term note payable, secured by mortgage on plant assets 3,100 153,300 Common stock Retained earnings Total assets $ 250,550 Total liabilities and equity CABOT CORPORATION Income Statement $ 16,500 4,200 2,900 67,400 81,000 78,550 $ 250,550 For Current Year Ended December 31 Sales Cost of goods sold Gross profit Operating expenses Interest expense Income before taxes Income tax expense Net income Required: $ 451,600 298,350 153,250 99,000 4,400 49,850 20,082 $ 29,768 Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory, (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on common stockholders' equity. Note: Do not round intermediate calculations. Req 1 and 2 Req 3 Req 4 Req 5 Req 6 Req 7 Req 8 Req 9 Req 10 Req 11 Compute the current ratio and acid-test ratio. (1) Choose Numerator: Current Ratio Choose Denominator: Current Ratio = Current ratio = II 0 to 1 (2) Acid-Test Ratio Choose Numerator: 1 Choose Denominator: = Acid-Test Ratio I = Acid-Test Ratio = 0 to 1 Req 1 and 2 Reg 3 Req 4 Req 5 Req 6 Req 7 Req 8 Req 9 Req 10 Req 11 Compute the days' sales uncollected. (3) Choose Numerator: Days' Sales Uncollected / Choose Denominator: Days = Days Sales Uncollected = = Days sales uncollected 0 days Req 1 and 2 Req 3 Req 4 Req 5 Req 6 Req 7 Req 8 Req 9 Req 10 Req 11 Compute the inventory turnover. (4) Choose Numerator: / Inventory Turnover Choose Denominator: Inventory Turnover = Inventory turnover = 0 times Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Req 4 Req 5 Req 6 Req 7 Req 8 Req 9 Req 10 Req 11 Compute the days' sales in inventory. (5) Choose Numerator: Days' Sales in Inventory. Choose Denominator: Days = Days' Sales in Inventory X = Days' sales in inventory = 0 days Req 1 and 2 Req 3 Req 4 Req 5 Req 6 Req 7 Req 8 Req 9 Req 10 Req 11 Compute the debt-to-equity ratio. (6) Debt-to-Equity Ratio Choose Numerator: 1 Choose Denominator: = = Debt-to-Equity Ratio Debt-to-equity ratio 0 to 1 Req 1 and 2 Req 3 Req 4 Req 5 Req 6 Req 7 Req 8 Req 9 Req 10 Req 11 Compute the times interest earned. (7) Times Interest Earned Choose Numerator: Choose Denominator: + 1 + Times Interest Earned = Times interest earned = 0 times Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Req 4 Req 5 Req 6 Reg 7 Reg 8 Req 9 Req 10 Req 11 Compute the profit margin ratio. (8) Choose Numerator: Profit Margin Ratio 1 Choose Denominator: Profit margin ratio = Profit margin ratio = 0% Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Req 4 Req 5 Req 6 Req 7 Req 8 Req 9 Req 10 Req 11 Compute the total asset turnover. (9) Choose Numerator: Total Asset Turnover Choose Denominator: Total Asset Turnover = = Total asset turnover 0 times Req 1 and 2 Req 3 Req 4 Req 5 Req 6 Req 7 Req 8 Req 9 Req 10 Req 11 Compute the return on total assets. (10) Return on Total Assets Choose Numerator: 1 Choose Denominator: = Return on Total Assets = Return on total assets I = 0% Req 1 and 2 Req 3 Req 4 Req 5 Req 6 Req 7 Req 8 Req 9 Req 10 Req 11 Compute the return on common stockholders' equity. (11) Choose Numerator: Return on Common Stockholders' Equity Choose Denominator = Return On Common Stockholders' Equity 1 = Return on common stockholders' equity = 0%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started