Answered step by step

Verified Expert Solution

Question

1 Approved Answer

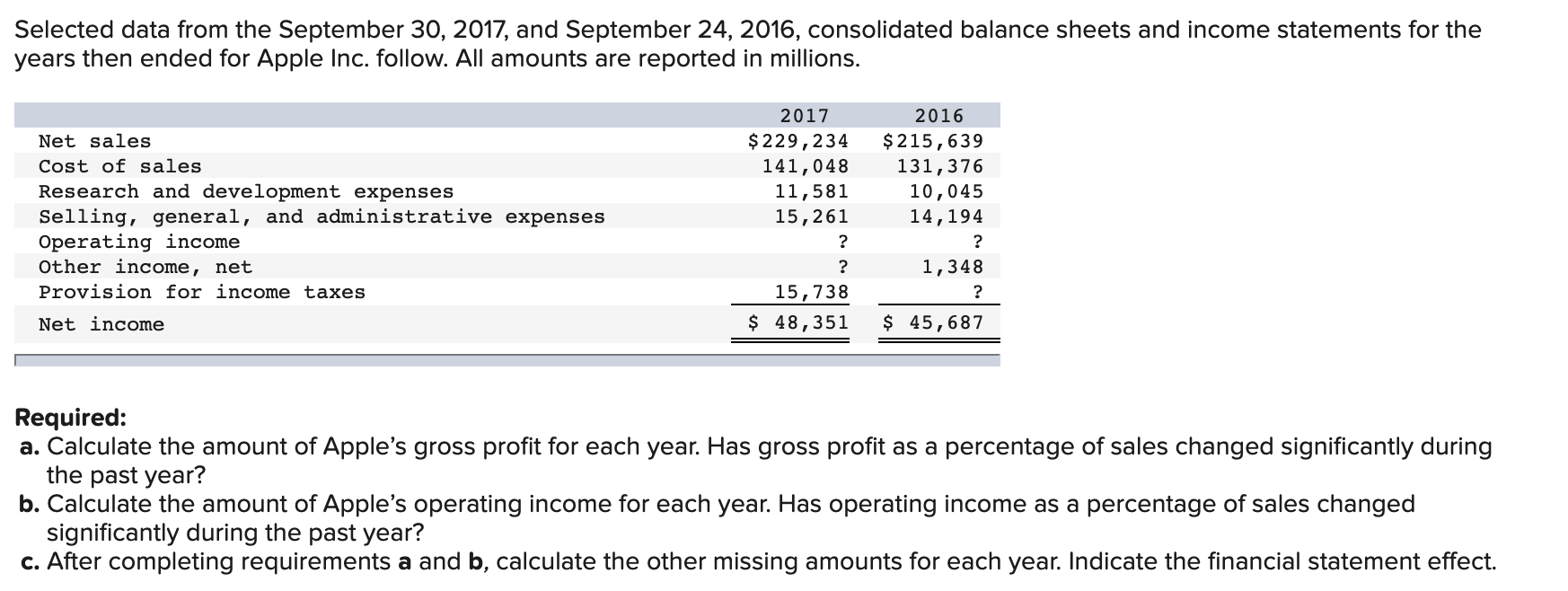

Selected data from the September 30, 2017, and September 24, 2016, consolidated balance sheets and income statements for the years then ended for Apple

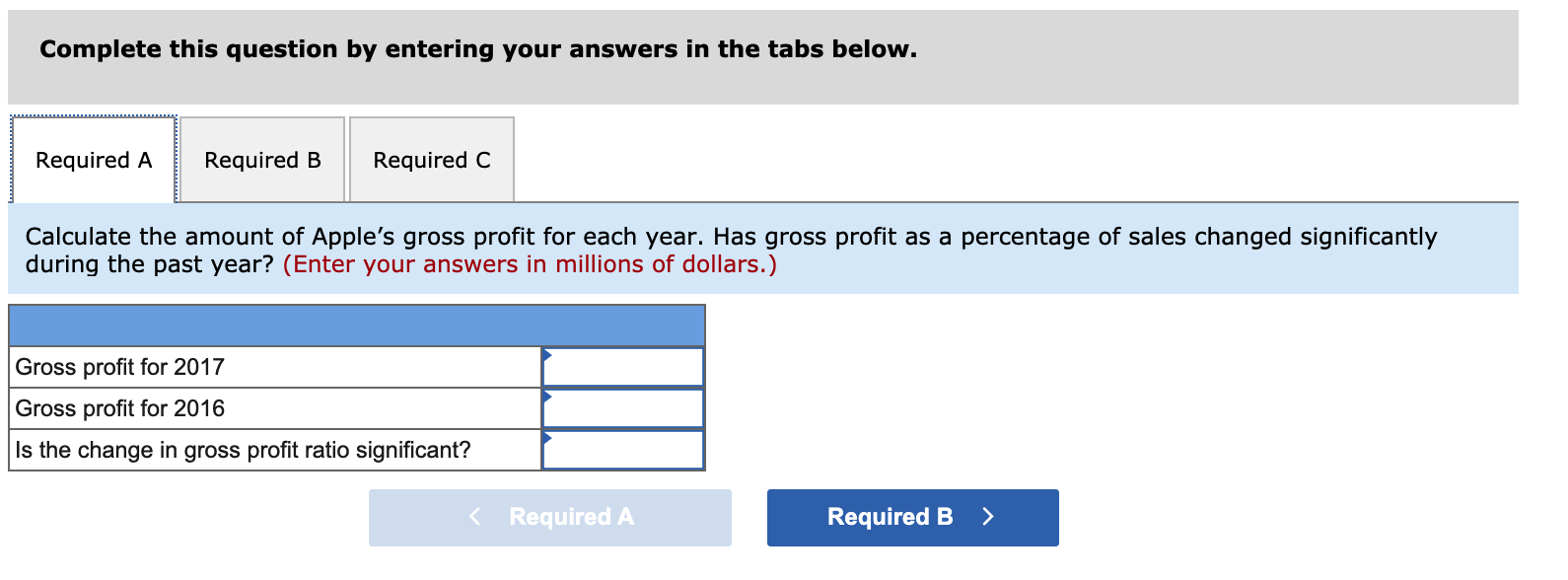

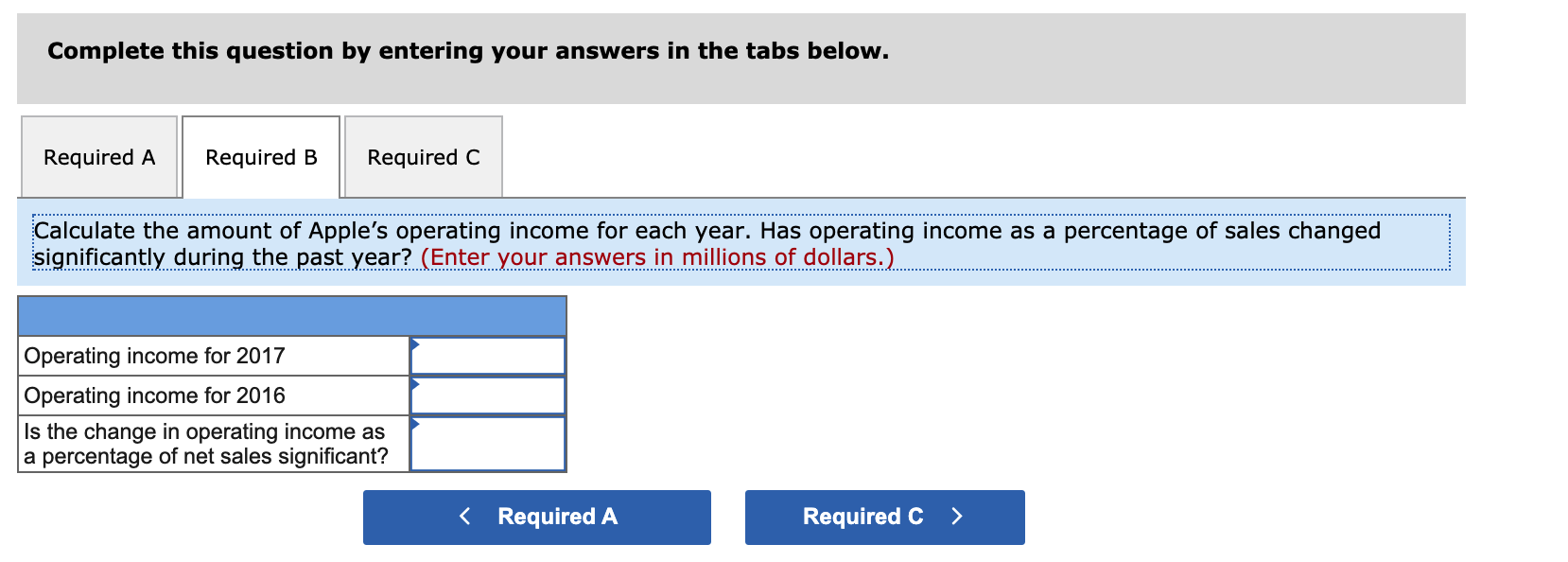

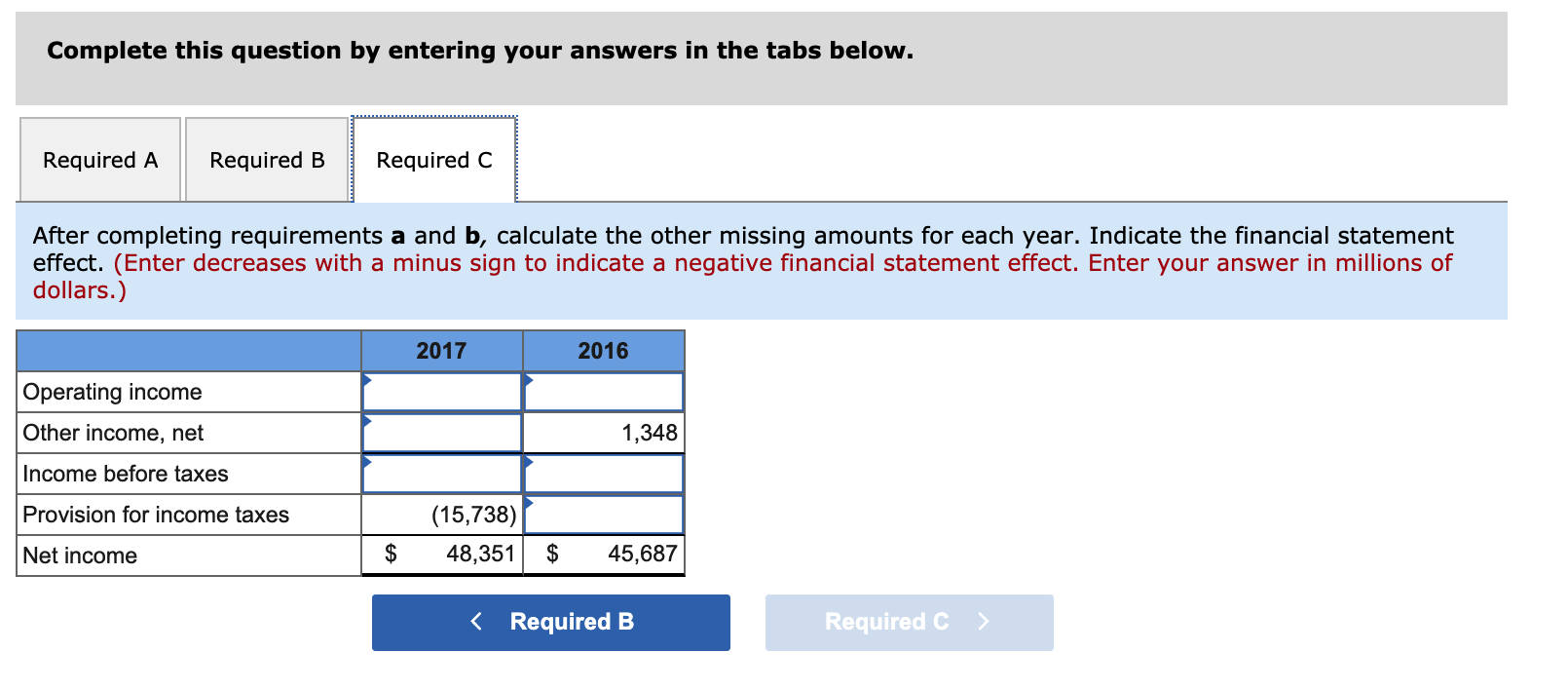

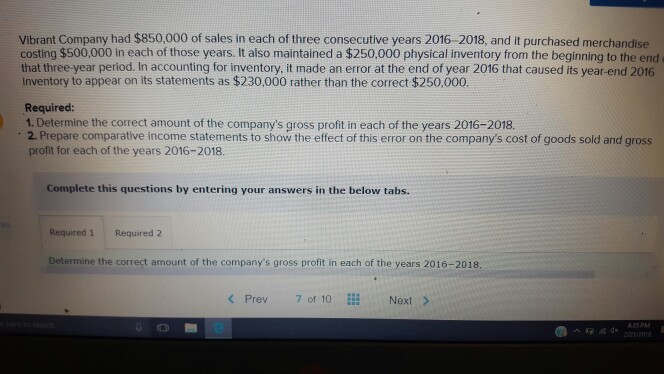

Selected data from the September 30, 2017, and September 24, 2016, consolidated balance sheets and income statements for the years then ended for Apple Inc. follow. All amounts are reported in millions. Net sales 2017 $229,234 Cost of sales Research and development expenses Selling, general, and administrative expenses Operating income Other income, net Provision for income taxes Net income 2016 $215,639 141,048 131,376 11,581 10,045 15,261 14,194 ? ? ? 1,348 15,738 ? $ 48,351 $ 45,687 Required: a. Calculate the amount of Apple's gross profit for each year. Has gross profit as a percentage of sales changed significantly during the past year? b. Calculate the amount of Apple's operating income for each year. Has operating income as a percentage of sales changed significantly during the past year? c. After completing requirements a and b, calculate the other missing amounts for each year. Indicate the financial statement effect. Complete this question by entering your answers in the tabs below. Required A Required B Required C Calculate the amount of Apple's gross profit for each year. Has gross profit as a percentage of sales changed significantly during the past year? (Enter your answers in millions of dollars.) Gross profit for 2017 Gross profit for 2016 Is the change in gross profit ratio significant? < Required A Required B > Complete this question by entering your answers in the tabs below. Required A Required B Required C Calculate the amount of Apple's operating income for each year. Has operating income as a percentage of sales changed significantly during the past year? (Enter your answers in millions of dollars.) Operating income for 2017 Operating income for 2016 Is the change in operating income as a percentage of net sales significant? < Required A Required C > Complete this question by entering your answers in the tabs below. Required A Required B Required C After completing requirements a and b, calculate the other missing amounts for each year. Indicate the financial statement effect. (Enter decreases with a minus sign to indicate a negative financial statement effect. Enter your answer in millions of dollars.) 2017 2016 Operating income Other income, net Income before taxes Provision for income taxes Net income (15,738) 1,348 $ 48,351 $ 45,687 < Required B Required C > Vibrant Company had $850,000 of sales in each of three consecutive years 2016-2018, and it purchased merchandise costing $500,000 in each of those years. It also maintained a $250,000 physical inventory from the beginning to the end that three-year period. In accounting for inventory, it made an error at the end of year 2016 that caused its year-end 2016 Inventory to appear on its statements as $230,000 rather than the correct $250,000. Required: 1. Determine the correct amount of the company's gross profit in each of the years 2016-2018. 2. Prepare comparative income statements to show the effect of this error on the company's cost of goods sold and gross profit for each of the years 2016-2018. Complete this questions by entering your answers in the below tabs. Required 1 Required 2 Determine the correct amount of the company's gross profit in each of the years 2016-2018. here to search < Prev 7 of 10 Next > 435 PM 2/21/2018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started