Answered step by step

Verified Expert Solution

Question

1 Approved Answer

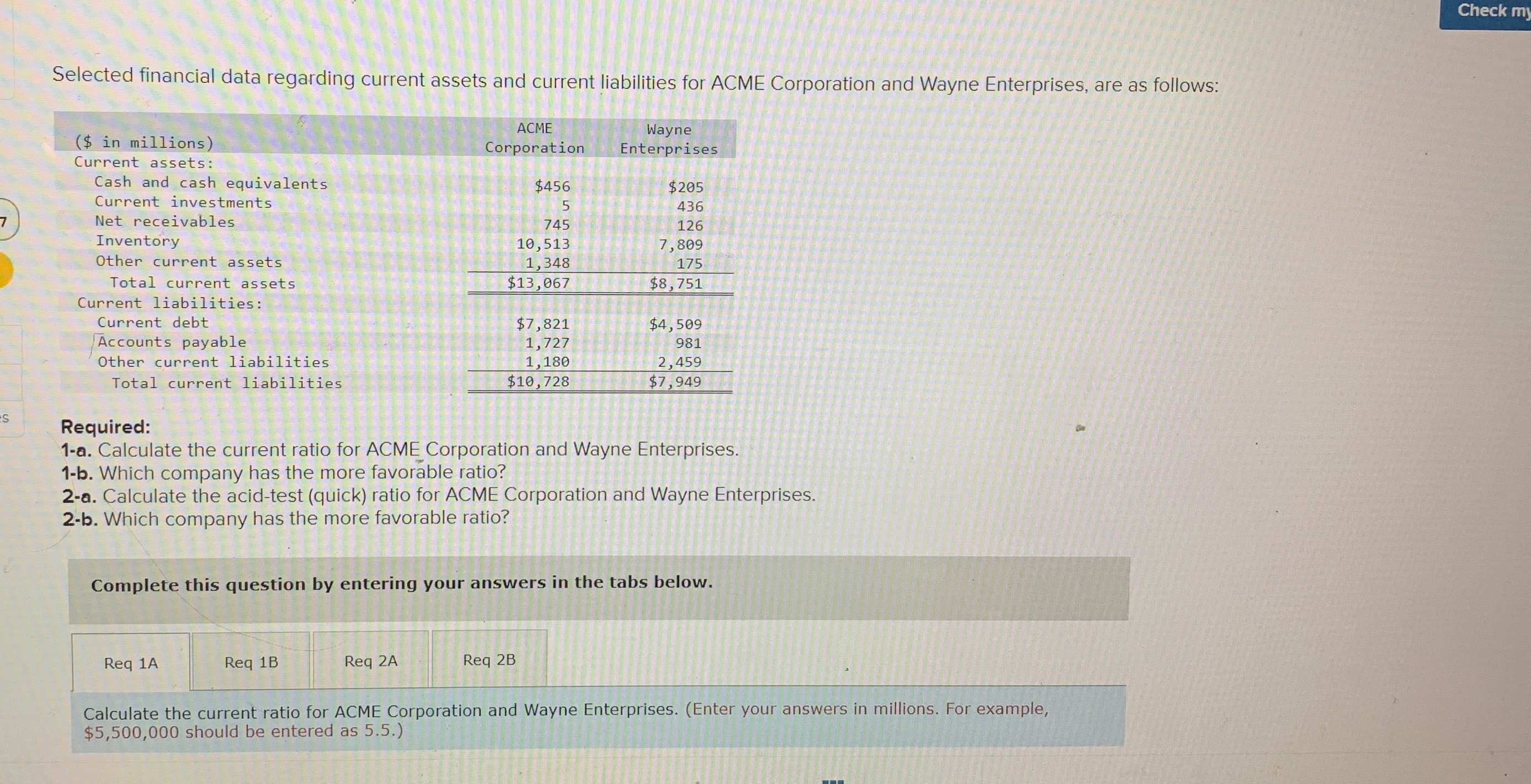

Selected financial data regarding current assets and current liabilities for ACME Corporation and Wayne Enterprises, are as follows: ($ in millions) S ACME Corporation

Selected financial data regarding current assets and current liabilities for ACME Corporation and Wayne Enterprises, are as follows: ($ in millions) S ACME Corporation Wayne Enterprises Current assets: Cash and cash equivalents Current investments Net receivables Inventory $456 $205 5 436 745 126 10,513 7,809 Other current assets 1,348 175 Total current assets $13,067 $8,751 Current liabilities: Current debt Accounts payable $7,821 $4,509 1,727 981 Other current liabilities Total current liabilities Required: 1,180 2,459 $10,728 $7,949 1-a. Calculate the current ratio for ACME Corporation and Wayne Enterprises. 1-b. Which company has the more favorable ratio? 2-a. Calculate the acid-test (quick) ratio for ACME Corporation and Wayne Enterprises. 2-b. Which company has the more favorable ratio? Complete this question by entering your answers in the tabs below. Req 1A Req 1B Req 2A Req 2B Calculate the current ratio for ACME Corporation and Wayne Enterprises. (Enter your answers in millions. For example, $5,500,000 should be entered as 5.5.) Check my

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Req 1A Calculate the current ratio for ACME Corporation and Wayne Enterprises The current ratio is c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started