Answered step by step

Verified Expert Solution

Question

1 Approved Answer

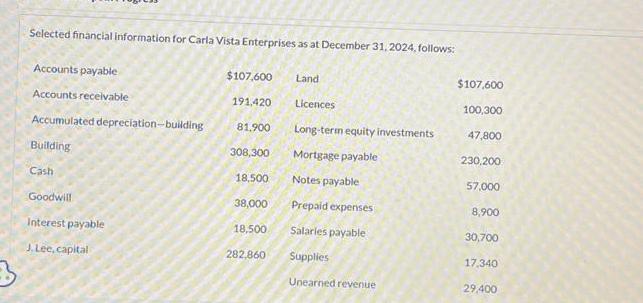

Selected financial information for Carla Vista Enterprises as at December 31, 2024, follows: Accounts payable Accounts receivable Accumulated depreciation-building Building Cash Goodwill Interest payable

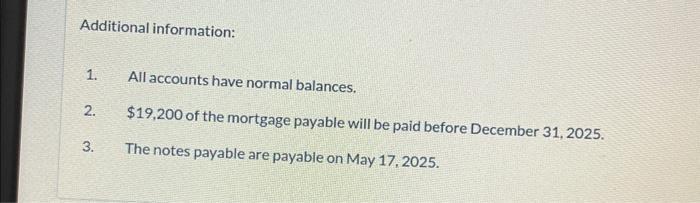

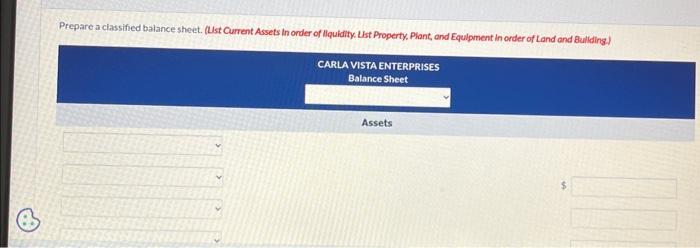

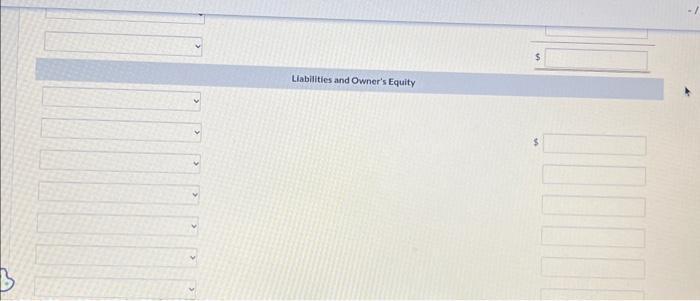

Selected financial information for Carla Vista Enterprises as at December 31, 2024, follows: Accounts payable Accounts receivable Accumulated depreciation-building Building Cash Goodwill Interest payable J. Lee, capital $107,600 191,420 81,900 308,300 18,500 38,000 18,500 282,860 Land Licences Long-term equity investments Mortgage payable Notes payable Prepaid expenses Salaries payable Supplies Unearned revenue $107,600 100,300 47,800 230,200 57,000 8,900 30,700 17,340 29,400 Additional information: 1. 2. 3. All accounts have normal balances. $19,200 of the mortgage payable will be paid before December 31, 2025. The notes payable are payable on May 17, 2025. Prepare a classified balance sheet. (List Current Assets In order of liquidity. List Property, Plant, and Equipment in order of Land and Building.) CARLA VISTA ENTERPRISES Balance Sheet Assets Liabilities and Owner's Equity QUOT

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Carla Vista Enterprise Balance Sheet As at December 31 2024 Assets N...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started