Answered step by step

Verified Expert Solution

Question

1 Approved Answer

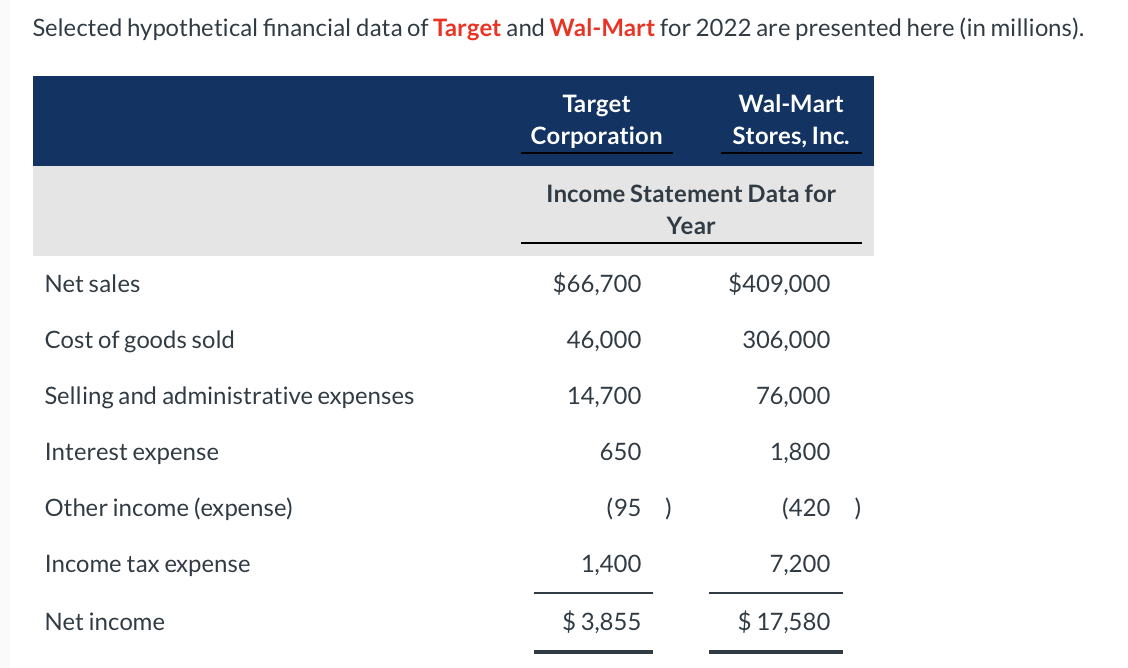

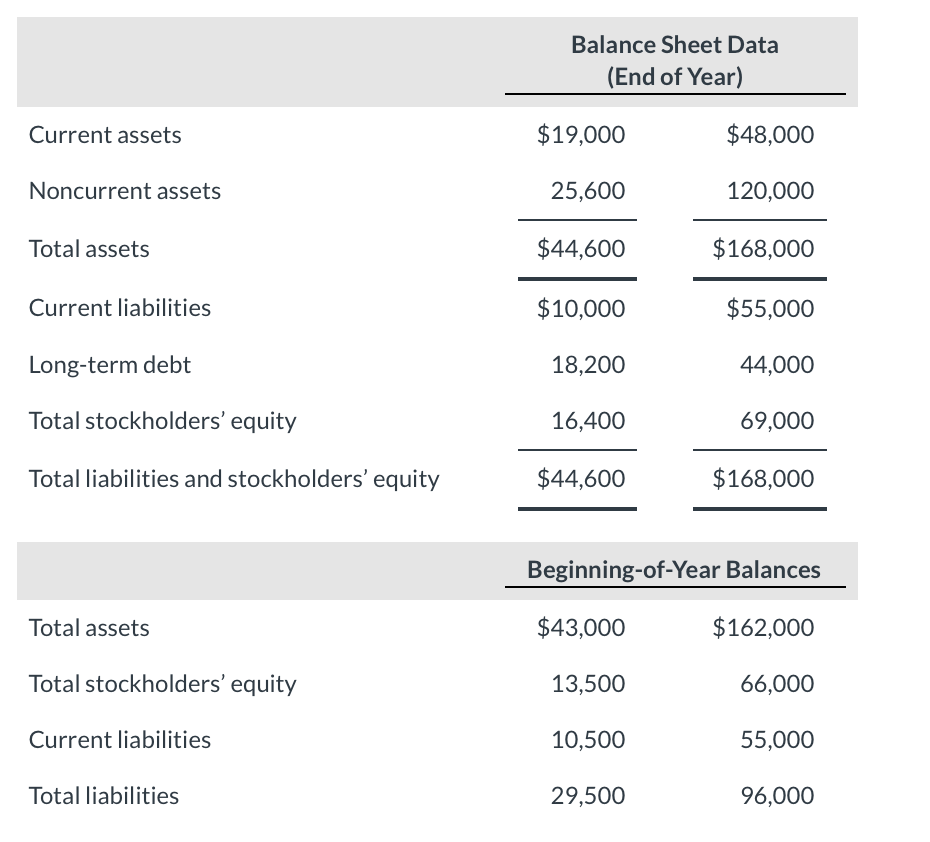

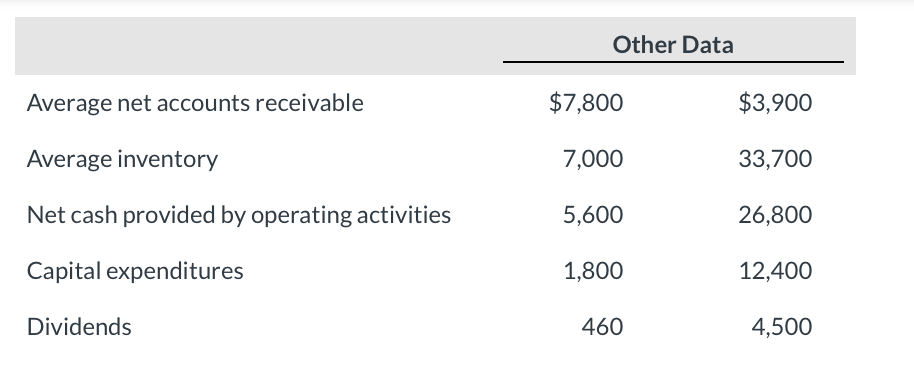

Selected hypothetical financial data of Target and Wal-Mart for 2022 are presented here (in millions). begin{tabular}{lrr} & multicolumn{2}{c}{ Other Data } cline { 2

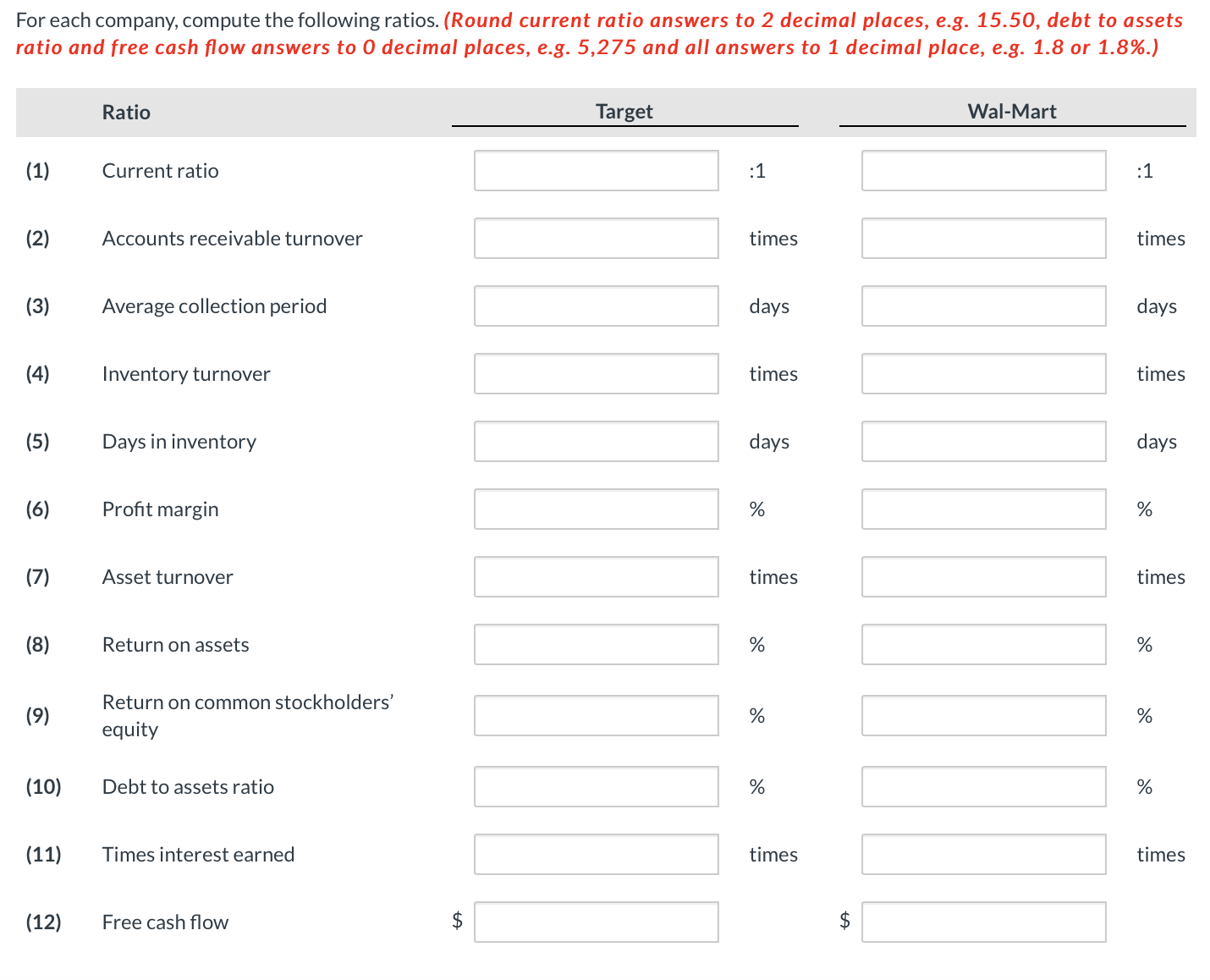

Selected hypothetical financial data of Target and Wal-Mart for 2022 are presented here (in millions). \begin{tabular}{lrr} & \multicolumn{2}{c}{ Other Data } \\ \cline { 2 - 3 } Average net accounts receivable & $7,800 & $3,900 \\ Average inventory & 7,000 & 33,700 \\ Net cash provided by operating activities & 5,600 & 26,800 \\ Capital expenditures & 1,800 & 12,400 \\ Dividends & 460 & 4,500 \end{tabular} For each company, compute the following ratios. (Round current ratio answers to 2 decimal places, e.g. 15.50 , debt to assets ratio and free cash flow answers to 0 decimal blaces. e.g. 5.275 and all answers to 1 decimal blace. e.g. 1.8 or 1.8%.)

Selected hypothetical financial data of Target and Wal-Mart for 2022 are presented here (in millions). \begin{tabular}{lrr} & \multicolumn{2}{c}{ Other Data } \\ \cline { 2 - 3 } Average net accounts receivable & $7,800 & $3,900 \\ Average inventory & 7,000 & 33,700 \\ Net cash provided by operating activities & 5,600 & 26,800 \\ Capital expenditures & 1,800 & 12,400 \\ Dividends & 460 & 4,500 \end{tabular} For each company, compute the following ratios. (Round current ratio answers to 2 decimal places, e.g. 15.50 , debt to assets ratio and free cash flow answers to 0 decimal blaces. e.g. 5.275 and all answers to 1 decimal blace. e.g. 1.8 or 1.8%.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started