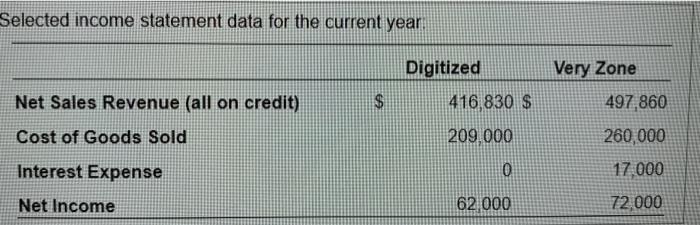

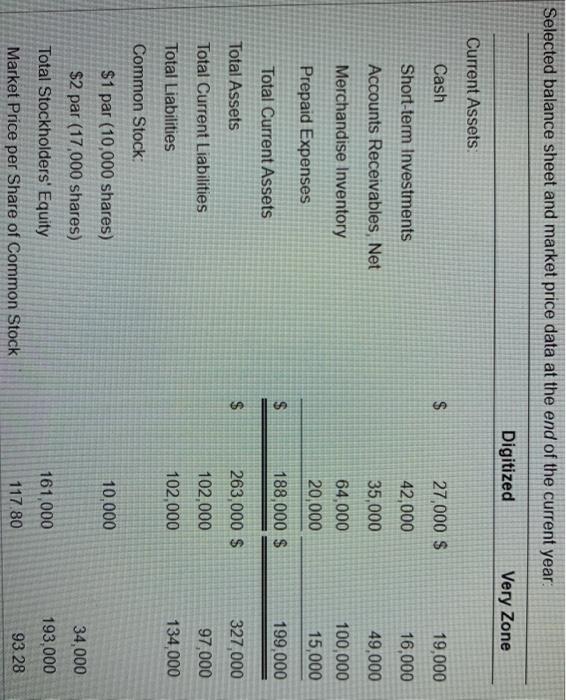

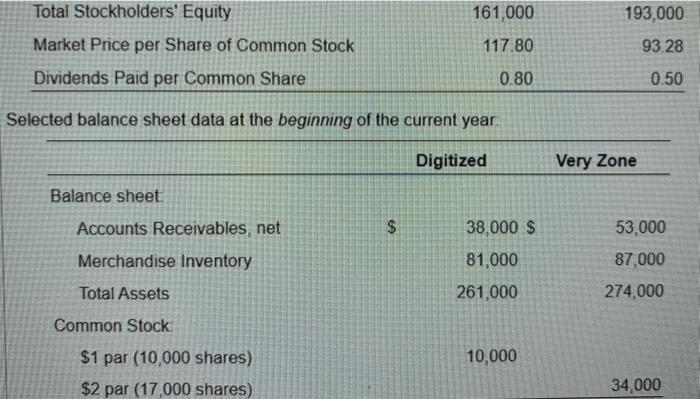

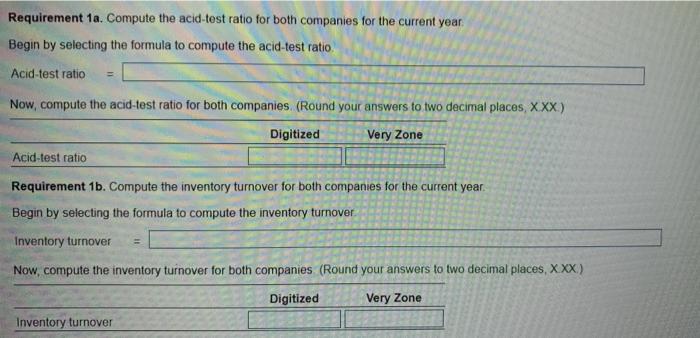

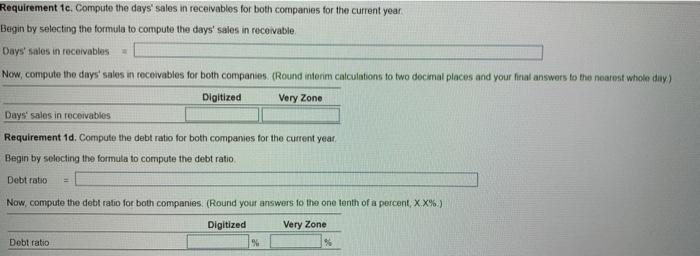

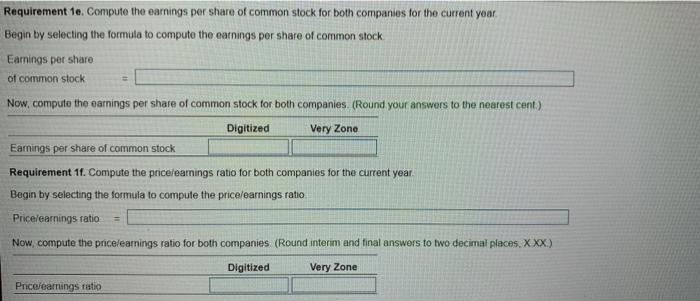

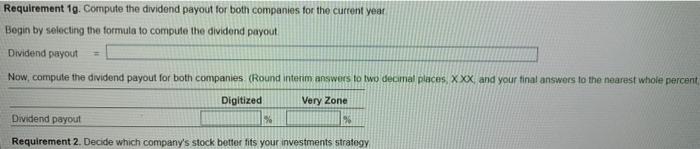

Selected income statement data for the current year Very Zone Digitized 416 830 $ Net Sales Revenue (all on credit) $ 497 860 Cost of Goods Sold 209.000 260,000 Interest Expense 0. 17.000 Net Income 62000 72.000 Selected balance sheet and market price data at the end of the current year Digitized Very Zone Current Assets Cash $ 27,000 $ Short-term Investments 42,000 35,000 Accounts Receivables, Net Merchandise Inventory 19,000 16,000 49,000 100,000 15,000 64,000 20,000 Prepaid Expenses $ 188,000 $ 199,000 Total Current Assets Total Assets $ Total Current Liabilities 263,000 $ 102.000 102,000 327,000 97,000 134,000 Total Liabilities Common Stock: 10.000 $1 par (10,000 shares) $2 par (17,000 shares) Total Stockholders' Equity Market Price per Share of Common Stock 161,000 34,000 193,000 9328 117.80 161,000 193,000 Total Stockholders' Equity Market Price per Share of Common Stock Dividends Paid per Common Share 117.80 93.28 0.80 0.50 Selected balance sheet data at the beginning of the current year Digitized Very Zone Balance sheet: Accounts Receivables, net Merchandise Inventory $ $ 53,000 38,000 $ 81,000 87,000 Total Assets 261,000 274,000 Common Stock 10,000 $1 par (10,000 shares) $2 par (17,000 shares) 34,000 Requirement 1a. Compute the acid-test ratio for both companies for the current year Begin by selecting the formula to compute the acid-test ratio Acid-test ratio Now, compute the acid-test ratio for both companies (Round your answers to two decimal places, XXX) Digitized Very Zone Acid-test ratio Requirement 1b. Compute the inventory turnover for both companies for the current year Begin by selecting the formula to compute the inventory turnover Inventory turnover Now, compute the inventory turnover for both companies (Round your answers to two decimal places, XXX) Digitized Very Zone Inventory turnover Requirement 1c. Compute the days' sales in receivables for both companies for the current year Begin by selecting the formula to compute the days' sales in receivable Days' sales in receivables Now, compute the days' sales in receivables for both companies (Round interim calculations to two decimal places and your final answers to the nearest whole day) Digitized Very Zone Days sales in receivables Requirement 1d. Compute the debt ratio for both companies for the current year Begin by selecting the formula to compute the debt ratio Debt ratio Now.compute the debt ratio for both companies. (Round your answers to the one tenth of a percent, XX%) Digitized % Very Zone % Debt ratio Requirement 1e. Compute the earnings per share of common stock for both companies for the current year Begin by selecting the formula to compute the earnings per share of common stock Earnings per share of common stock Now, compute the earnings per share of common stock for both companies (Round your answers to the nearest cent) Digitized Very Zone Earnings per share of common stock Requirement 11. Compute the price/earnings ratio for both companies for the current year. Begin by selecting the formula to compute the price/earnings ratio Pricelearnings ratio= Now, compute the price learnings ratio for both companies (Round interim and final answers to two decimal places, Xxx.) Digitized Very Zone Price/earnings ratio Requirement 1g. Compute the dividend payout for both companies for the current year Begin by selecting the formula to compute the dividend payout Dividend payout Now, compute the dividend payout for both companies (Round interim answers to two decimal places, XXX, and your final answers to the nearest whole percent Digitized Very Zone Dividend payout % % Requirement 2. Decide which company's stock better fits your investments strategy