Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Selected information from Carla Vista Ltd.'s statement of financial position and statement of income is as follows: CARLA VISTA LTD. Statement of Financial Position (partial)

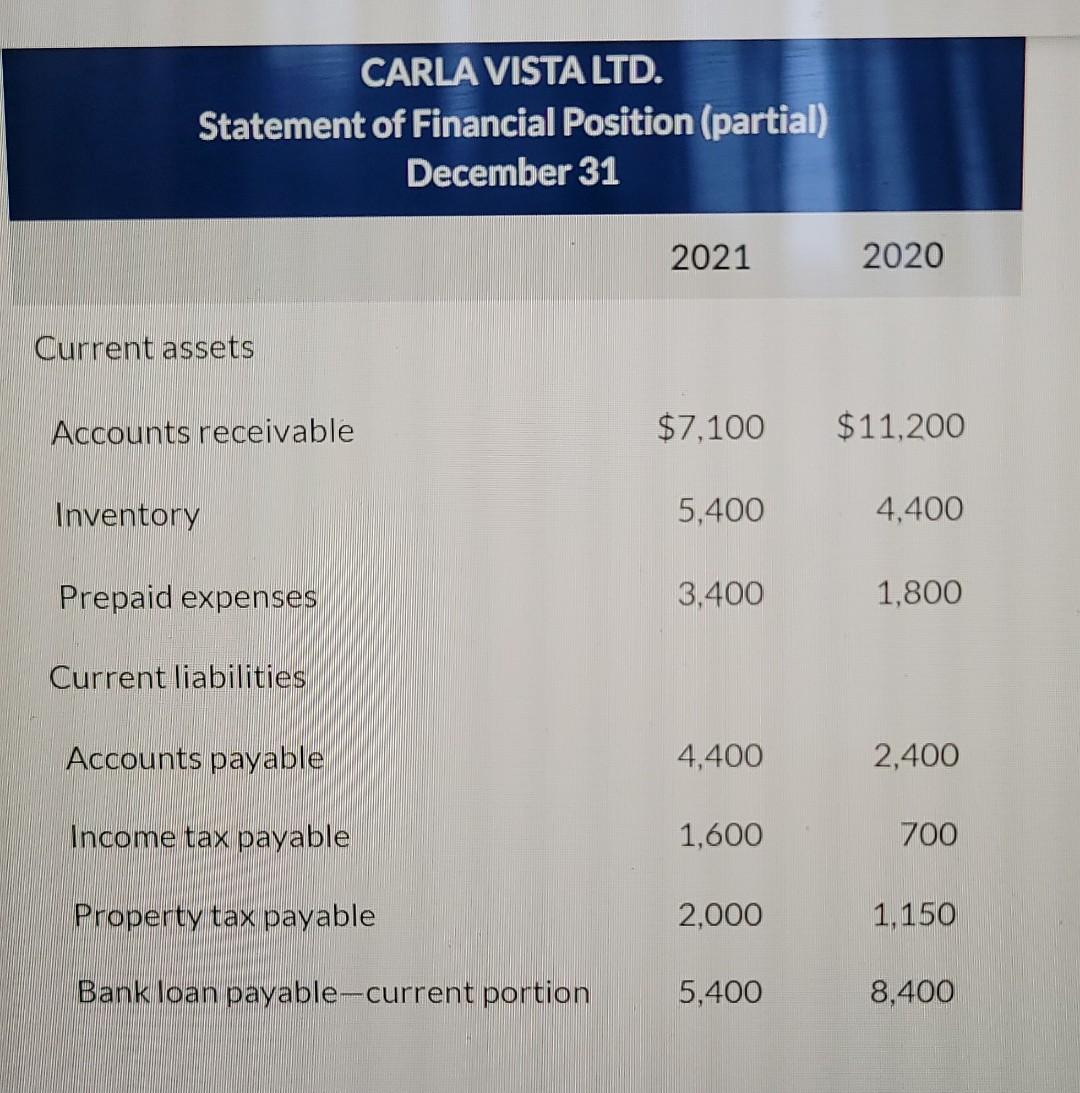

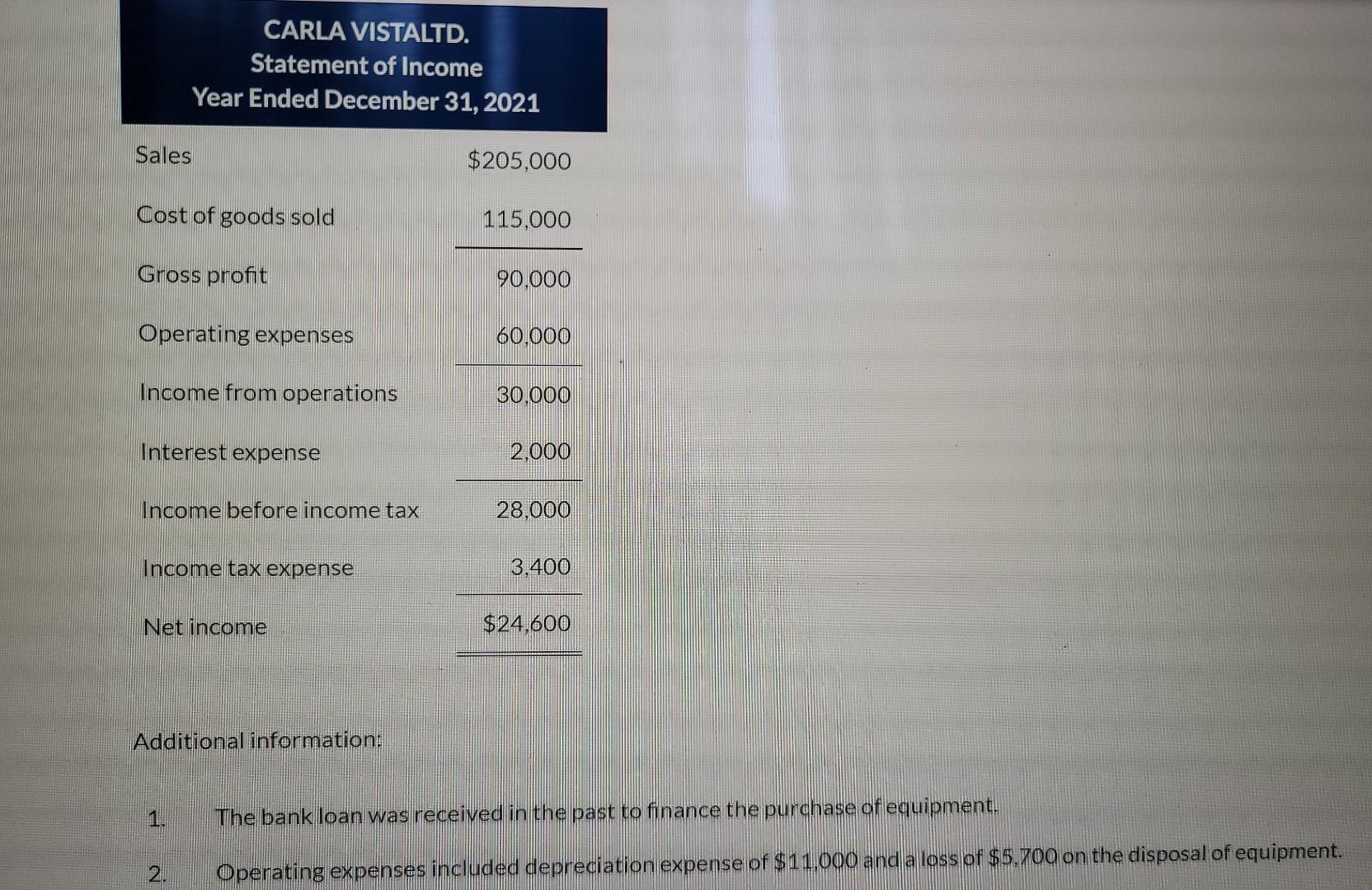

Selected information from Carla Vista Ltd.'s statement of financial position and statement of income is as follows: CARLA VISTA LTD. Statement of Financial Position (partial) December 31 2021 2020 Current assets Accounts receivable $7,100 $11,200 Inventory 5,400 4,400 Prepaid expenses 3,400 1,800 Current liabilities Accounts payable 4,400 2,400 Income tax payable 1,600 700 Property tax payable 2,000 1,150 Bank loan payable-current portion 5,400 8,400 CARLA VISTALTD. Statement of Income Year Ended December 31, 2021 Sales $205,000 Cost of goods sold 115,000 Gross profit 90.000 Operating expenses 60.000 Income from operations 30.000 Interest expense 2,000 Income before income tax 28,000 Income tax expense 3.400 Net income $24.600 Additional information: 1. The bank loan was received in the past to finance the purchase of equipment. 2 Operating expenses included depreciation expense of $11,000 and a loss of $5.700 on the disposal of equipment. CARLA VISTA LTD. Statement of Cash Flows (Partial) Month Ended December 31, 2021 Operating activities Net income $ Adjustments to reconcile net income to Net cash provided by operating activities v Depreciation expense $ Decrease in accounts receivable Increase in inventory Increase in prepaid expenses Increase in prepaid expenses Increase in accounts payable Increase in income tax payable Increase in property tax payable V $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started