Selected information from the financial statements of GoPro, Inc. is provided below: Assume a statutory tax rate of 35%. A: Compute GoPros net operating profit

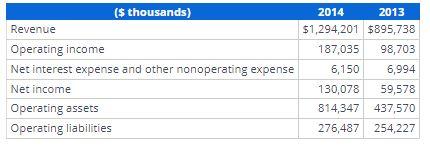

Selected information from the financial statements of GoPro, Inc. is provided below:

Assume a statutory tax rate of 35%.

A: Compute GoPro’s net operating profit margin (NOPM) for each year.

Round answers to one decimal place.

B: Compute GoPro’s return on net operating assets (RNOA) for 2014.

Round answers to one decimal place.

($ thousands) Revenue Operating income Net interest expense and other nonoperating expense Net income Operating assets Operating liabilities 2014 2013 $1,294,201 $895,738 187,035 98,703 6,150 6,994 130,078 59,578 814,347 437,570 276,487 254,227

Step by Step Solution

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Net Operating Margin The net operating profit margin indicates the manner in which the assets are ut...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started