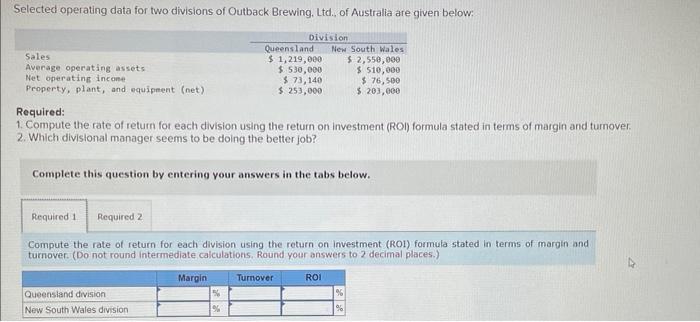

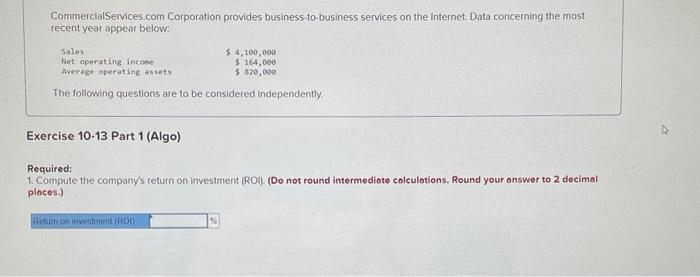

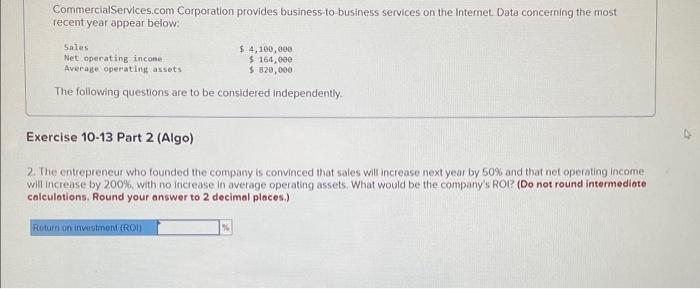

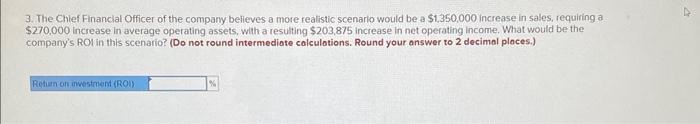

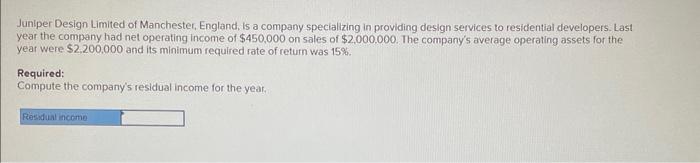

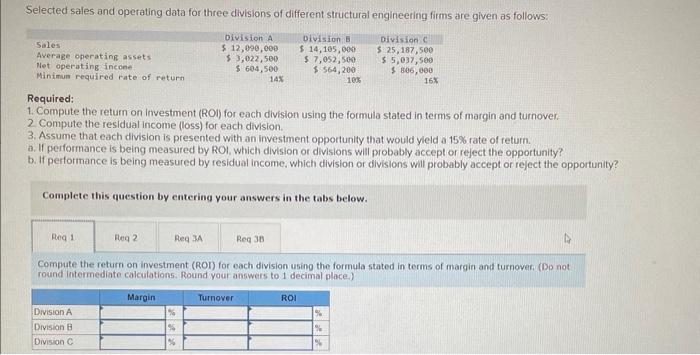

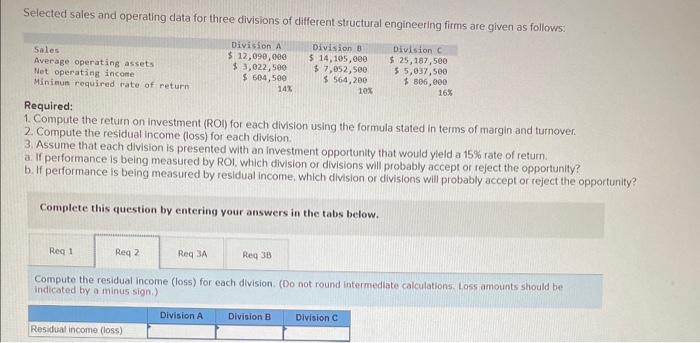

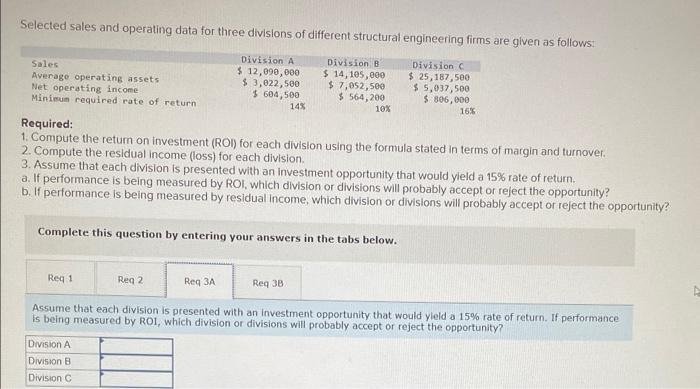

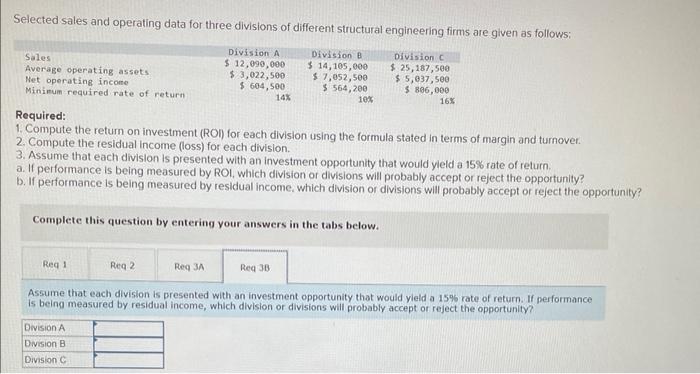

Selected operating data for two divisions of Outback Brewing. Ltd., of Australia are given below: Required: 1. Compute the rate of return for each division using the return on investment (ROI) formula stated in terms of margin and turnover. 2. Which divistonal manager seems to be doing the better job? Complete this question by entering your answers in the tabs below. Compute the rate of return for each division using the return on investment (RO1) formula stated in terms of margin and turnover. (Do not round intermediate calculations, Round your answers to 2 decimal places.) CommercialServices com Corporation provides business-to-business services on the Internet. Data concerning the most recent year appear below: The following questions are to be considered independently. Exercise 10-13 Part 1 (Algo) Required: 1. Compute the company's return on investment (RO), (Do not round intermediote colculations. Round your answer to 2 decimol places.) CommercialServices.com Corporation provides business-to-business services on the Internet. Data concerning the most recent year appear below: The following questions are to be considered independently. Exercise 10-13 Part 2 (Algo) The entreprencur whio founded the company is convinced that sales will increase next year by 50% and that net operating income will increase by 200%, with no increase in average operating assets. What would be the company's ROI? (Do not round intermediate colculations. Round your answer to 2 decimal places.) 3. The Chief Financial Officer of the company believes a more realistic scenarlo would be a $1,350,000 increase in sales, requiring a $270,000 increase in average operating assets, with a resulting $203,875 increase in net operating income. What would be the company's ROI in this scenario? (Do not round intermediate calculotions. Round your onswer to 2 decimal ploces.) Junlper Design Limited of Manchester, England, Is a company specializing in providing design services to residential developers. Last year the company had net operating income of $450,000 on sales of $2,000.000. The company's average operating assets for the year were $2,200,000 and its minimum required rate of return was 15%. Required: Compute the company's residual income for the year. Selected sales and operating data for three divisions of different structural engineering firms are given as follows: Required: 1. Compute the return on investment (ROl) for each division using the formula stated in terms of margin and turnover: 2 Compute the residual income (loss) for each division. 3. Assume that each division is presented with an investment opportunity that would yleld a 15% rate of return. 3. If performance is being measured by ROI, which division or divisions will probably accept or reject the opportunity? b. If performance is being measured by residual income, which division or divisions will probably accept or reject the opportunity? Complete this question by entering your answers in the tabs below. Compute the return on investment (ROD) for each division using the formula stated in terms of margin and turnover. (Do not round intermediate calculations. Round your answers to 1 decimal place.) Selected sales and operating data for three divisions of different structural engineering firms are given as follows: Required: 1. Compute the return on investment (ROI) for each division using the formula stated in terms of margin and turnover. 2. Compute the residual income (loss) for each division. 3. Assume that each division is presented with an investment opportunity that would yield a 15% rate of return. a. If performance is being measured by ROI, which division or divisions will probably accept or reject the opportunity? b. If performance is being measured by residual income, which division or divisions will probably accept or reject the opportunity? Complete this question by entering your answers in the tabs below. Compute the residual income (loss) for each division. (Do not round intermediate calculations: Loss amounts should be indicated by a minus sign.) Selected sales and operating data for three divisions of different structural engineering firms are given as follows: Required: 1. Compute the retum on investment (ROI) for each division using the formula stated in terms of margin and turnover. 2. Compute the residual income (loss) for each division. 3. Assume that each division is presented with an investment opportunity that would yleld a 15% rate of return. a. If performance is being measured by ROI, which division or divisions will probably accept or refect the opportunity? b. If performance is being measured by residual income, which divislon or divisions will probably accept or reject the opportu Complete this question by entering your answers in the tabs below. Assume that each division is presented with an investment opportunity that would yleld a 15% rate of return. If performance is being measured by ROI, which division or divisions will probably accept or reject the opportunity? Selected sales and operating data for three divisions of different structural engineering firms are given as follows; Required: 1. Compute the retum on investment (ROI) for each division using the formula stated in terms of margin and turnover. 2. Compute the residual income (loss) for each division. 3. Assume that each division is presented with an investment opportunity that would yield a 15% rate of relurn. a. If performance is being measured by ROI, which division or divisions will probably accept or reject the opportunity? b. If performance is being measured by residual income. which division or divisions will probably accept or reject the opportunity Complete this question by entering your answers in the tabs below. Assume that each division is presented with an investment opportunity that would yield a 15% rate of return. If performance is being measured by residual income, which division or divisions will probably accept or reject the opportunity