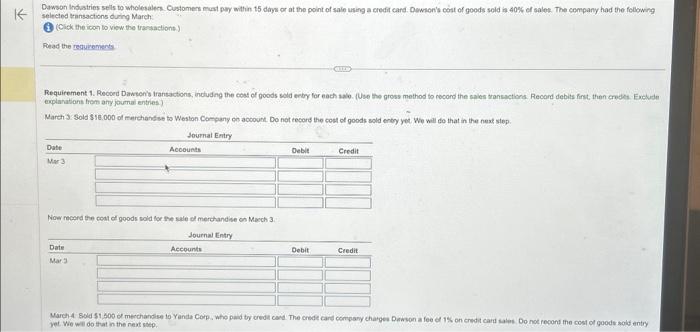

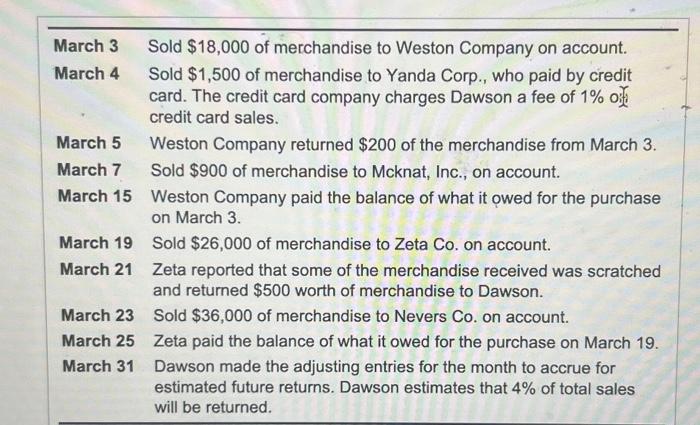

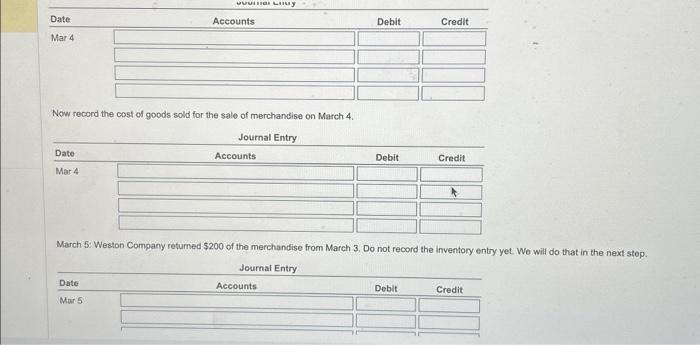

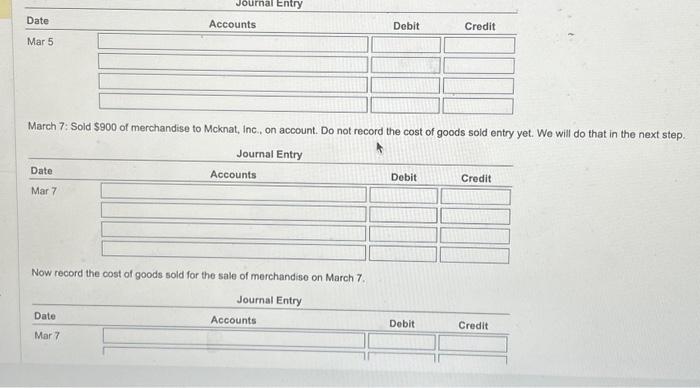

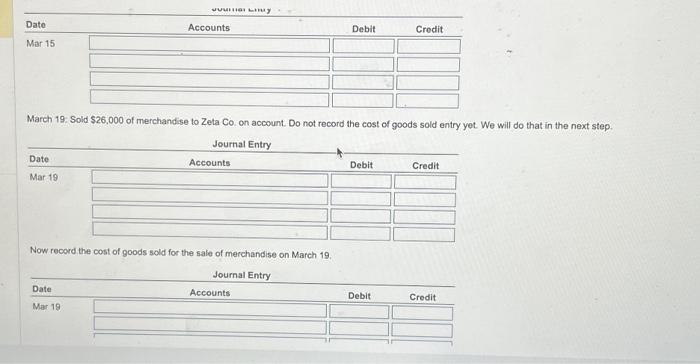

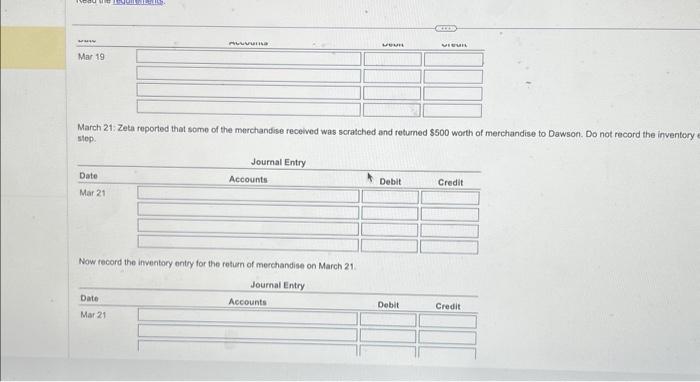

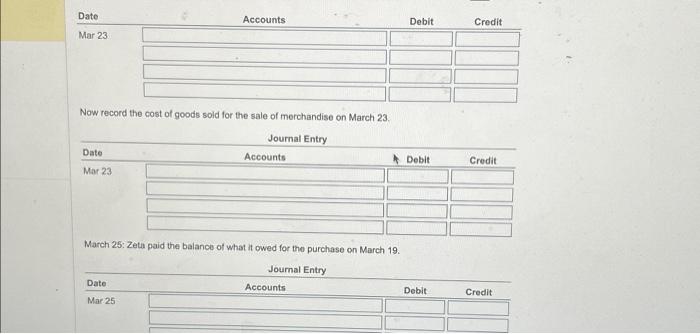

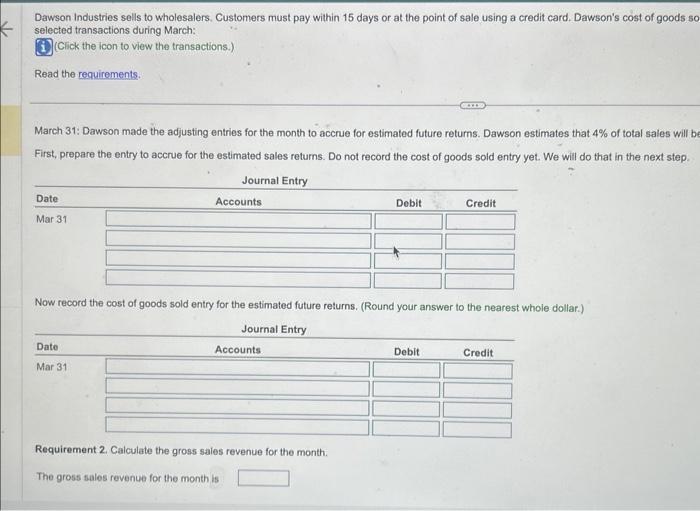

selected tansactions during March: (1) (Cick the icon bo view the trarsactiont) Read the reguinements Requirement 1. Recoed Dawron's trantactions, indudng the cost of goods sold enby for each sale. (Use the gross method to recond the sales transactons. Record debits first then credes. Exolude empinhation frem ary joumai entries) March 3: Sold sse. 000 of merchandse to Weston Company oo acooupt. Do not tecord the cos of goods sold entey yet We will do that in the next siep. Now recerd bie codt el goods sold for the sele of merchandise on Macch 3 March 3 Sold $18,000 of merchandise to Weston Company on account. March 4 Sold $1,500 of merchandise to Yanda Corp., who paid by credit card. The credit card company charges Dawson a fee of 1% or. credit card sales. March 5 Weston Company returned $200 of the merchandise from March 3. March 7 Sold $900 of merchandise to Mcknat, Inc., on account. March 15 Weston Company paid the balance of what it owed for the purchase on March 3. March 19 Sold $26,000 of merchandise to Zeta Co. on account. March 21 Zeta reported that some of the merchandise received was scratched and returned $500 worth of merchandise to Dawson. March 23 Sold $36,000 of merchandise to Nevers Co. on account. March 25 Zeta paid the balance of what it owed for the purchase on March 19. March 31 Dawson made the adjusting entries for the month to accrue for estimated future returns. Dawson estimates that 4% of total sales will be returned. Now record the cost of goods sold for the sale of merchandise on March 4 . Now record the cost of goods sold for the sale of merchandise on March 7. Now record the cost of goods sold for the sale of merchandise on March 19 . March 21: Zeta reported that some of the merchandise received was scratched and retumed $500 worth of merchandise to Dawson. Do not record the inventor stop. Auw recoru une ifvertocy nntry for the retum of merchandise on March 21 Now record the cost of goods sold for the sale of merchandise on March 23. March 25: Zeta paid the balance of what it owed for the purchase on March 19. Dawson industries sells to wholesalers. Customers must pay within 15 days or at the point of sale using a credit card. Dawson's cost of goods so selected transactions during March: (Cick the icon to view the transactions.) Read the reguirements. March 31: Dawson made the adjusting entries for the month to accrue for estimated future returns. Dawson estimates that 4% of total sales will b First, prepare the entry to accrue for the estimated sales returns. Do not record the cost of goods sold entry yet. We will do that in the next step. Now record the cost of goods sold entry for the estimated future returns. (Round your answer to the nearest whole dollar.) Requirement 2. Calculate the gross sales revenue for the month. The gross sales revenue for the month is