Answered step by step

Verified Expert Solution

Question

1 Approved Answer

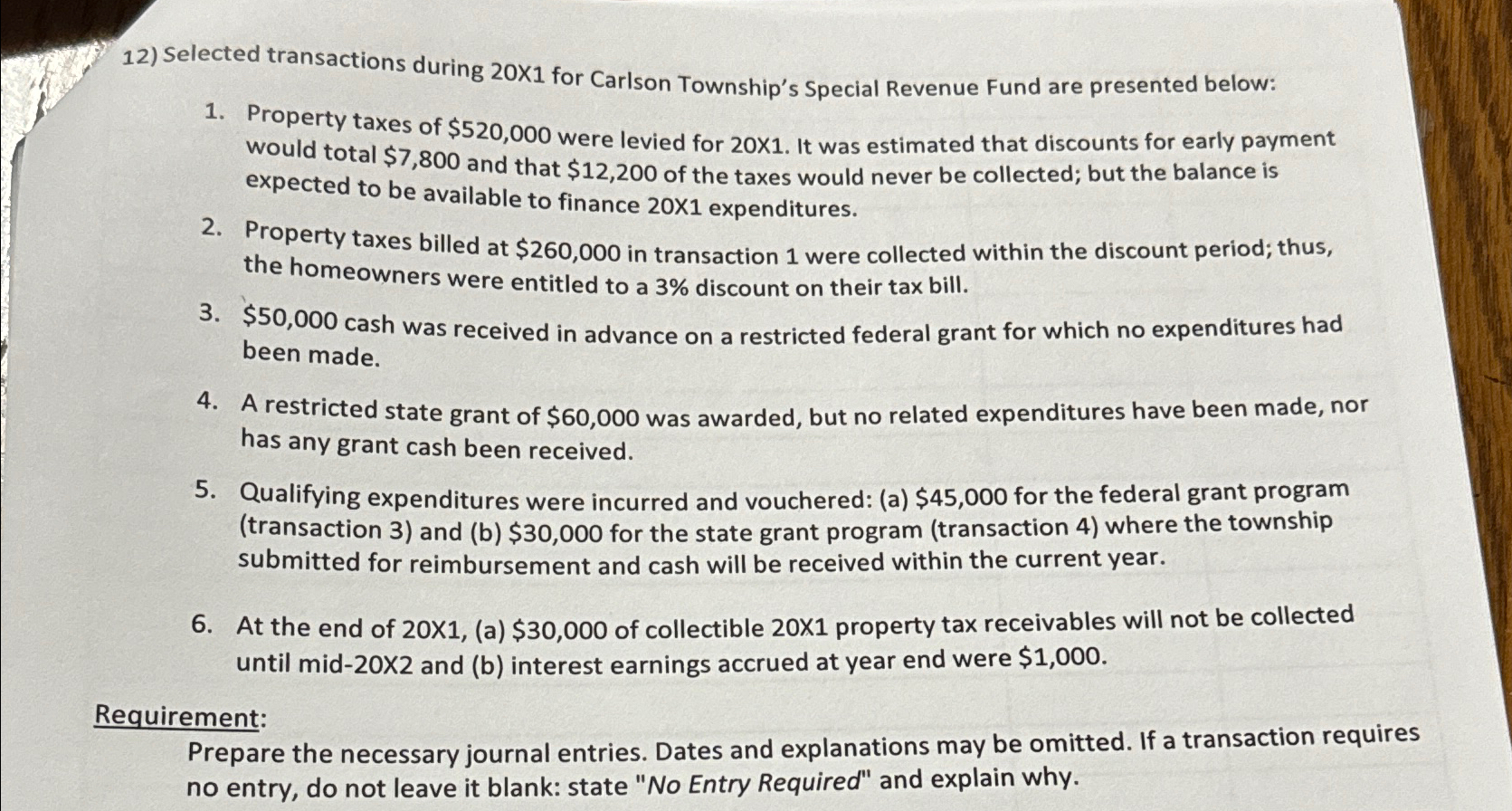

Selected transactions during 2 0 1 for Carlson Township's Special Revenue Fund are presented below: Property taxes of $ 5 2 0 , 0 0

Selected transactions during for Carlson Township's Special Revenue Fund are presented below:

Property taxes of $ were levied for It was estimated that discounts for early payment would total $ and that $ of the taxes would never be collected; but the balance is expected to be available to finance expenditures.

Property taxes billed at $ in transaction were collected within the discount period; thus, the homeowners were entitled to a discount on their tax bill.

$ cash was received in advance on a restricted federal grant for which no expenditures had been made.

A restricted state grant of $ was awarded, but no related expenditures have been made, nor has any grant cash been received.

Qualifying expenditures were incurred and vouchered: a $ for the federal grant program transaction and b $ for the state grant program transaction where the township submitted for reimbursement and cash will be received within the current year.

At the end of a $ of collectible property tax receivables will not be collected until midX and b interest earnings accrued at year end were $

Requirement:

Prepare the necessary journal entries. Dates and explanations may be omitted. If a transaction requires no entry, do not leave it blank: state No Entry Required" and explain why.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started