Answered step by step

Verified Expert Solution

Question

1 Approved Answer

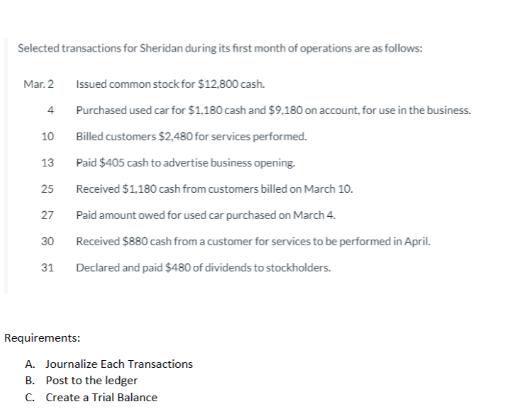

Selected transactions for Sheridan during its first month of operations are as follows: Mar.2 Issued common stock for $12,800 cash. 4 10 13 25

Selected transactions for Sheridan during its first month of operations are as follows: Mar.2 Issued common stock for $12,800 cash. 4 10 13 25 27 30 31 Purchased used car for $1.180 cash and $9.180 on account, for use in the business. Billed customers $2,480 for services performed. Paid $405 cash to advertise business opening. Received $1,180 cash from customers billed on March 10. Paid amount owed for used car purchased on March 4. Received $880 cash from a customer for services to be performed in April. Declared and paid $480 of dividends to stockholders. Requirements: A. Journalize Each Transactions B. Post to the ledger C. Create a Trial Balance

Step by Step Solution

★★★★★

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Solution A Journalize Each Transaction 1 Mar 2 Issued common stock for 12800 cash Cash Dr 12800 Comm...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started