Question

Selecting the better financing option and do not use excel to do calculations Please Show : Calculating the internal rate of return of a proposed

Selecting the better financing option and do not use excel to do calculations

Please Show:

- Calculating the internal rate of return of a proposed investment

- Establishing equivalence between present amounts and uniform series of payments

- Comparing alternatives on a level playing field

The Problem:

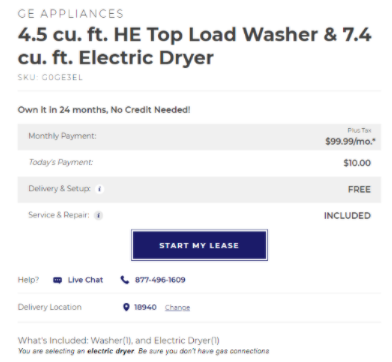

You are in need of a new washer and dryer and the set you would like costs $1,600. You do not have access to enough cash to pay for the washer and dryer in full at time of purchase and are exploring your financing options. You have seen the following advertisement on television:

Paying $100 a month will work with your budget. You also have that emergency credit card in your wallet that charges 24% annually compounded monthly. Which of these two methods of financing would be your best option?

Please Include:

Evaluate the two financing options and decide which one is better for you. Include the following in your report:

- The decision criteria you used to make your decision (such as effective interest rate).

- The calculation of your decision criteria for each alternative.

- The decision you made and why you made it.

- Any assumptions you felt you needed to compare the alternatives.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started