Answered step by step

Verified Expert Solution

Question

1 Approved Answer

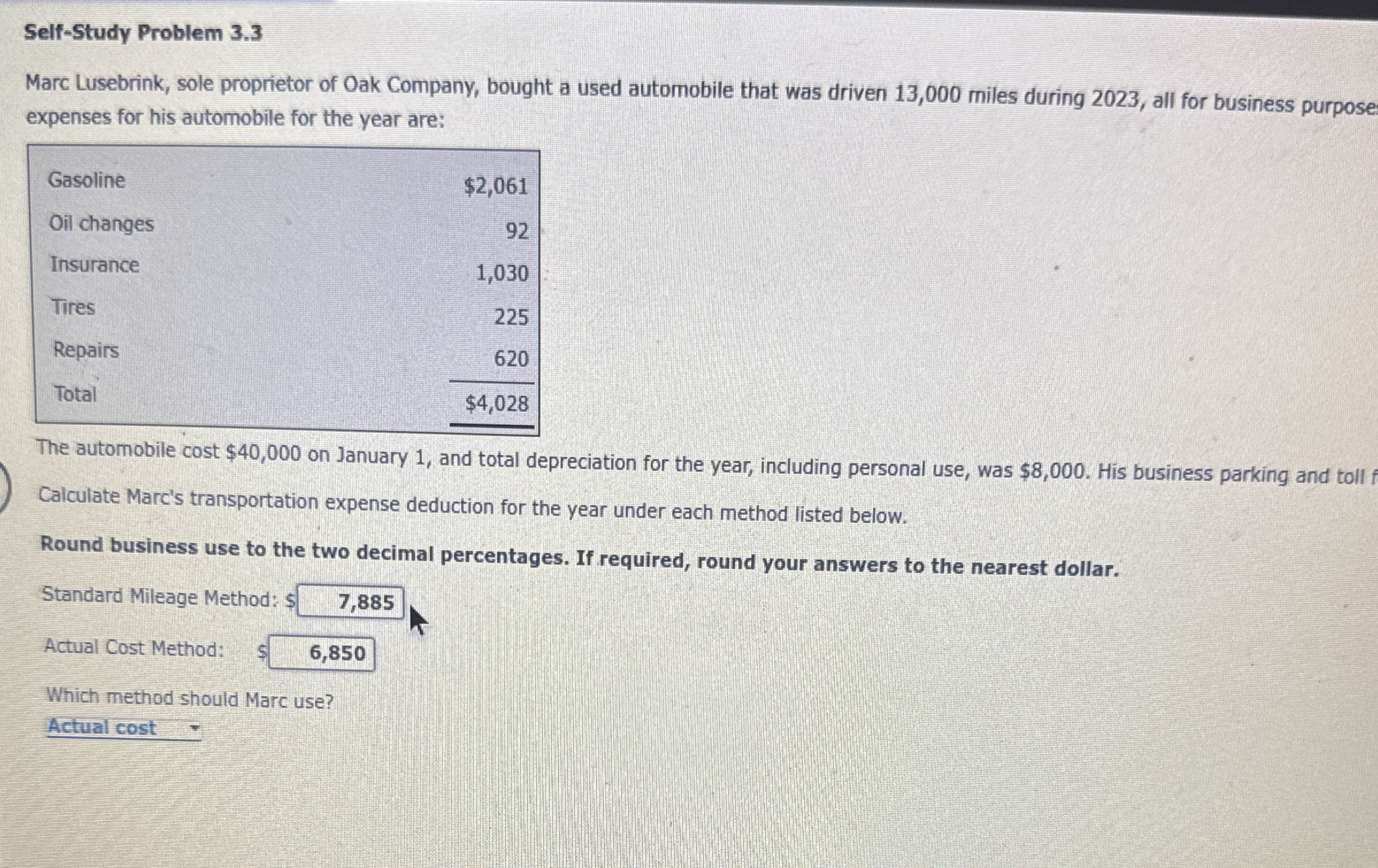

Self - Study Problem 3 . 3 Marc Lusebrink, sole proprietor of Oak Company, bought a used automobile that was driven 1 3 , 0

SelfStudy Problem

Marc Lusebrink, sole proprietor of Oak Company, bought a used automobile that was driven miles during all for business purpose

expenses for his automobile for the year are:

The automobile cost $ on January and total depreciation for the year, including personal use, was $ His business parking and toll

Calculate Marc's transportation expense deduction for the year under each method listed below.

Round business use to the two decimal percentages. If required, round your answers to the nearest dollar.

Standard Mileage Method: $

Actual Cost Method:

Which method should Marc use?

Actual cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started