Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Self Study Problem Ten-4 (RRSP Contributions) During 2018, Ms. Storm is employed in Vernon by a large public company. The employer sponsors a defined contribution

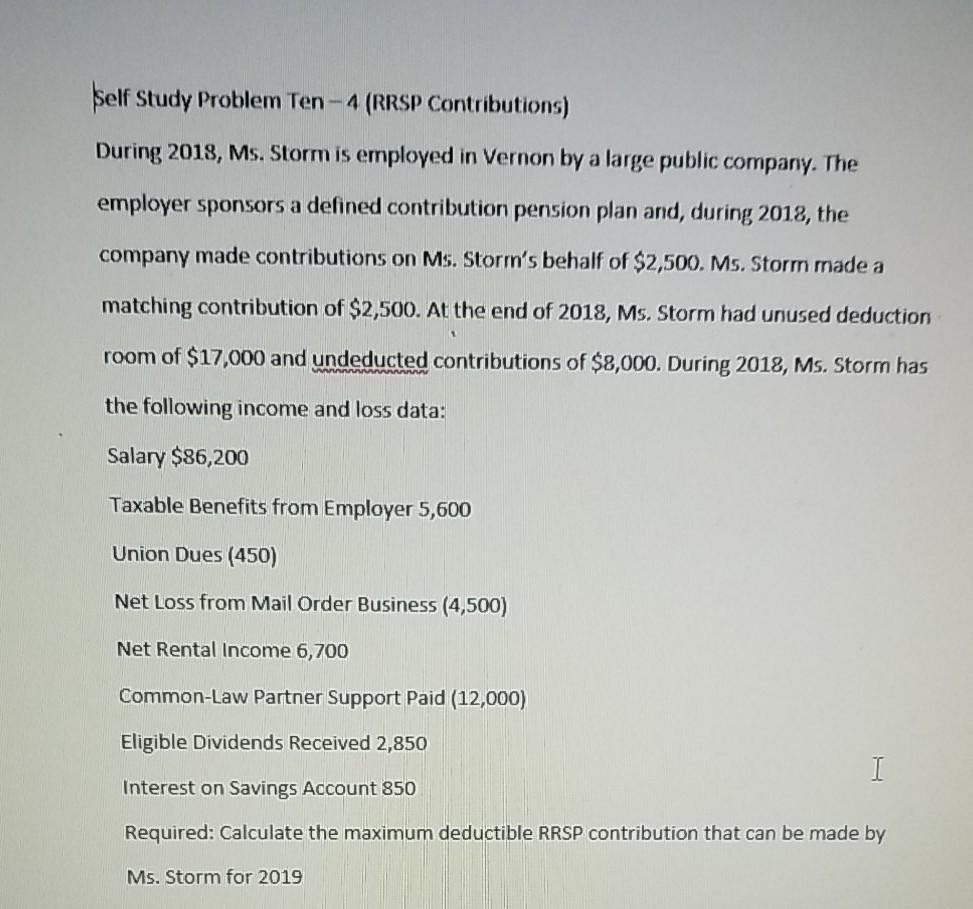

Self Study Problem Ten-4 (RRSP Contributions) During 2018, Ms. Storm is employed in Vernon by a large public company. The employer sponsors a defined contribution pension plan and during 2018, the company made contributions on Ms. Storm's behalf of $2,500. Ms. Storm made a matching contribution of $2,500. At the end of 2018, Ms. Storm had unused deduction room of $17,000 and undeducted contributions of $8,000. During 2018, Ms. Storm has the following income and loss data: Salary $86,200 Taxable Benefits from Employer 5,600 Union Dues (450) Net Loss from Mail Order Business (4,500) Net Rental Income 6,700 Common-Law Partner Support Paid (12,000) Eligible Dividends Received 2,850 I Interest on Savings Account 850 Required: Calculate the maximum deductible RRSP contribution that can be made by Ms. Storm for 2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started