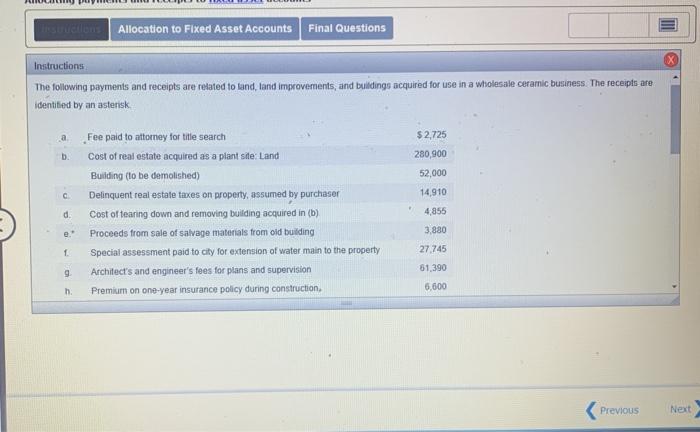

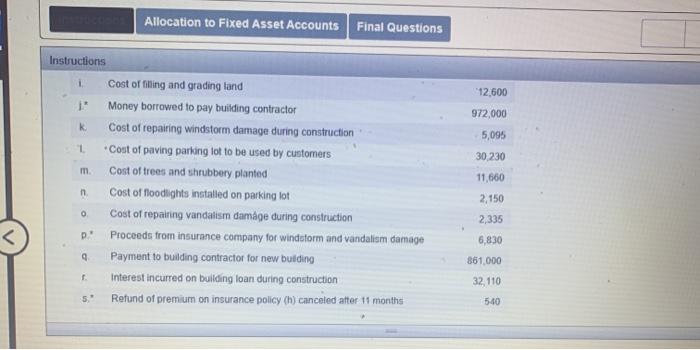

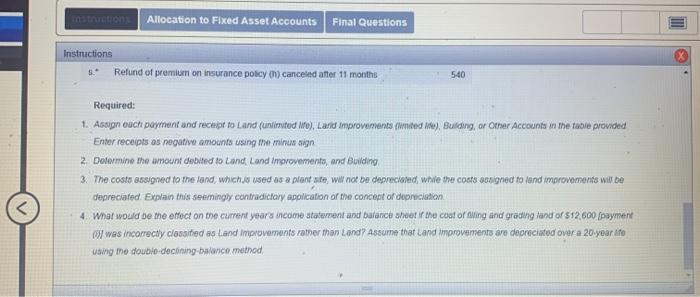

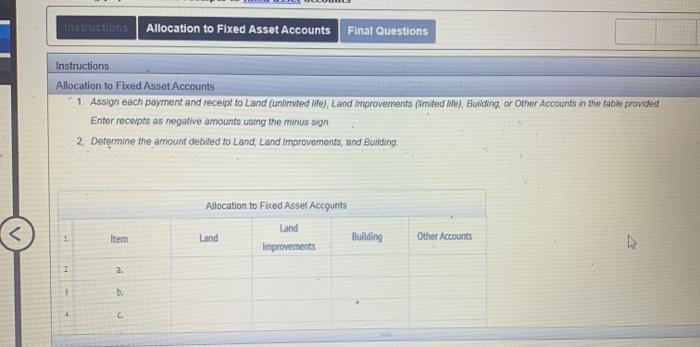

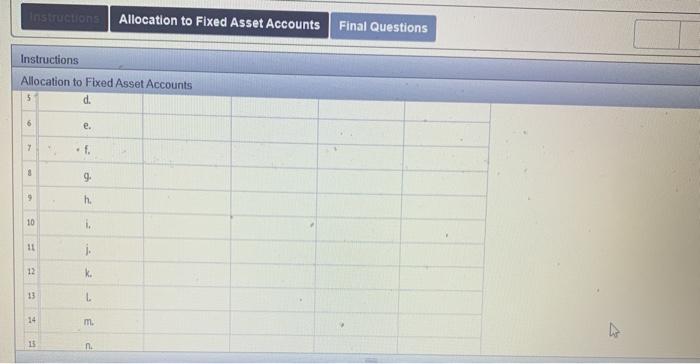

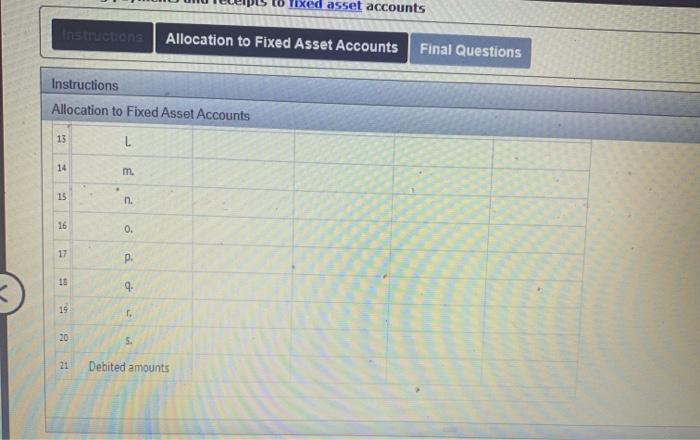

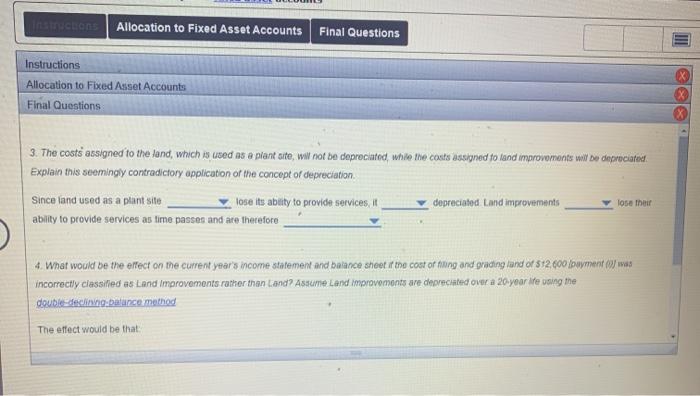

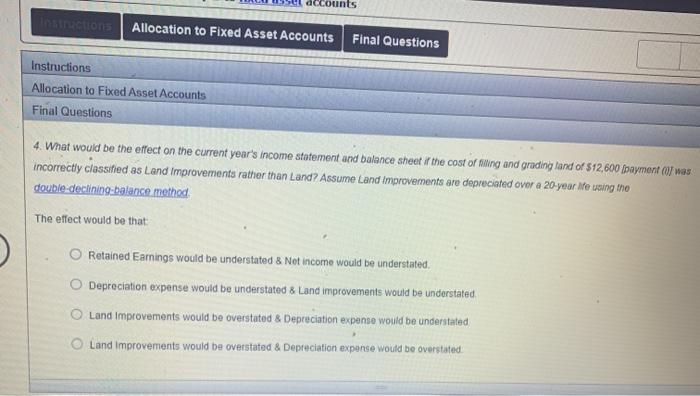

Selon Allocation to Fixed Asset Accounts Final Questions Instructions The following payments and receipts are related to tand, land improvements, and buildings acquired for use in a wholesale ceramic business. The receipts are identified by an asterisk $ 2,725 280,900 52,000 14,910 a Fee paid to attorney for title search b. Cost of real estate acquired as a plant site: Land Buliding (to be demolished Delinquent real estate taxes on property, assumed by purchaser Cost of tearing down and removing building acquired in (b) Proceeds from sale of salvage materials from old building Special assessment paid to city for extension of water main to the property Architect's and engineer's fees for plans and supervision Premium on one-year insurance policy during construction, d. 4,855 3,880 1 27 745 9 61.390 6,600 h Previous Next Allocation to Fixed Asset Accounts Final Questions 12,600 972,000 1 Instructions Cost of filing and grading tand Money borrowed to pay building contractor K Cost of repairing windstorm damage during construction Cost of paving parking lot to be used by customers Cost of trees and shrubbery planted Cost of floodlights installed on parking lot Cost of repairing vandalism damage during construction Proceeds from insurance company for windstorm and vandalism damage Payment to building contractor for new building Interest incurred on building loan during construction 5." Refund of premium on insurance policy (h) canceled after 11 months 5,095 30 230 11,660 m n 2,150 O D 2,335 6,830 9 861,000 32.110 5:40 Allocation to Fixed Asset Accounts Final Questions Instructions Refund of premium on Insurance policy m) canceled after 11 months 540 Required: 1. Assign euch payment and recept to Land (united MO), Land Improvements (mited ). Buding, or Other Accounts in the table provided Enter receipts as negative amounts using the minus sign 2. Determine the amount dotted to Land Land imovovements, and Building 3. The costs assigned to the land, which is used as a plant site, will not be depreciated while the costs assigned to land improvements wabe depreciated Explain this seemingly contradictory application ar the concept or depreciation 4. What would be me effect on the current years income statement and balance sheet if the cost of Aling and grading tand of $12.600 payment W was incorrectly classified as Land improvements rather than Land? Assume that and improvements are depreciated over a 20-year dife using me double-declining balance method Instructions Allocation to Fixed Asset Accounts Final Questions Instructions Allocation to Fixed Asset Accounts 1. Assign each payment and receipt to Land (unlimited Me), Land Improvements (imited Me). Building, or Other Accounts in the table provided Entor recepts as negative amounts using the minus sign 2. Determine the amount detited to Land, Land improvements, and Buiding Allocation to Fived Asset Accounts Land Item Land Building Other Accounts Improvements 2 a. * b. C Instructions Allocation to Fixed Asset Accounts Final Questions Instructions Allocation to Fixed Asset Accounts 5 d. 6 e. . f. 9. 9 h. 10 11 i 12 k. 13 L 14 m. 13 n fixed asset accounts instructions Allocation to Fixed Asset Accounts Final Questions Instructions Allocation to Fixed Asset Accounts 13 L 14 m. . 15 n. 16 0. 17 p. 18 9. 15 20 5. 21 Debited amounts ccounts Allocation to Fixed Asset Accounts Final Questions Instructions Allocation to Fixed Asset Accounts Final Questions 4. What would be the effect on the current year's income statement and balance sheet in the cost of filing and grading land of $12,600 (payment was incorrectly classified as Land improvements rather than Land? Assume Land improvements are depreciated over a 20 year Meuning the double-declining balance method The effect would be that Retained Earnings would be understated & Not income would be understated, O Depreciation expense would be understated & Land improvements would be understated Land Improvements would be overstated & Depreciation expense would be understated Land improvements would be overstated & Depreciation expense would be overstated