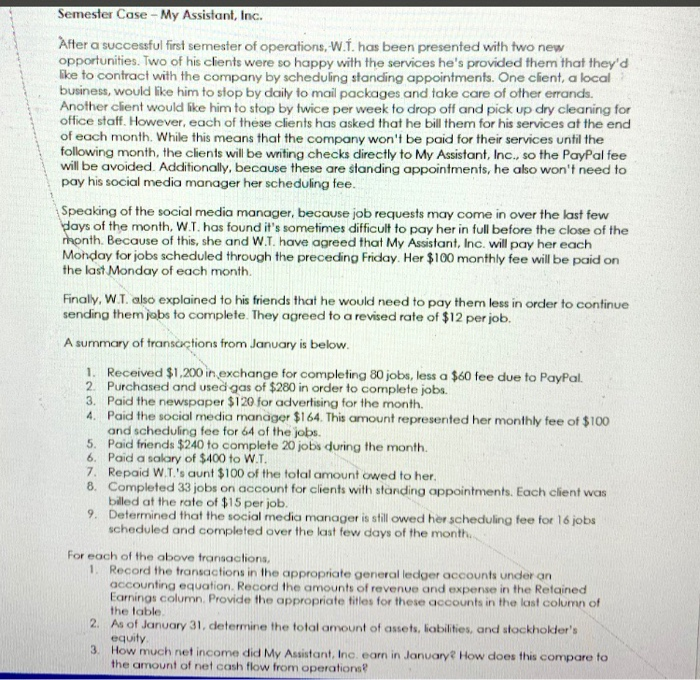

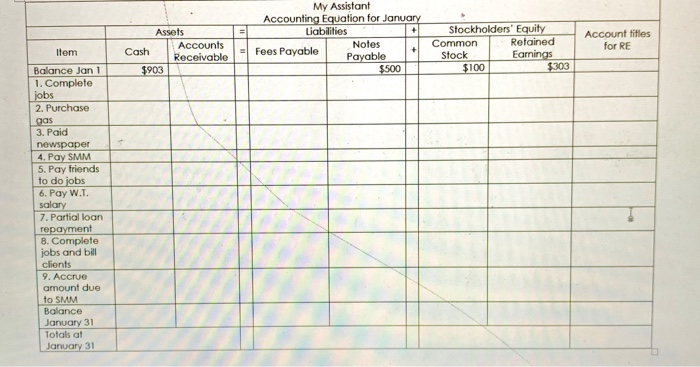

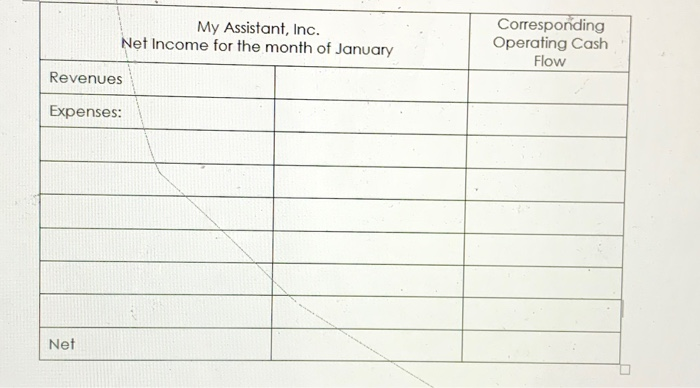

Semester Case - My Assistant, Inc. After a successful first semester of operations, W.1 has been presented with two new opportunities. Two of his clients were so happy with the services he's provided them that they'd like to contract with the company by scheduling standing appointments. One client, a local business, would like him to stop by daily lo mail packages and take care of other errands. Another client would like him to stop by twice per week to drop off and pick up dry cleaning for office staff. However, each of these clients has asked that he bill them for his services at the end of each month. While this means that the company won't be paid for their services until the following month, the clients will be writing checks directly to My Assistant, Inc., so the PayPal fee will be avoided. Additionally, because these are standing appointments, he also won't need to pay his social media manager her scheduling fee. Speaking of the social media manager, because job requests may come in over the last few Ways of the month, W.T. has found it's sometimes difficult to pay her in full before the close of the rhonth. Because of this, she and W.T. have agreed that My Assistant, Inc. will pay her each Monday for jobs scheduled through the preceding Friday. Her $100 monthly fee will be paid on the last Monday of each month. Finally, W.T. also explained to his friends that he would need to pay them less in order to continue sending them jobs to complete. They agreed to a revised rate of $12 per job. A summary of transactions from January is below. 1. Received $1,200 in exchange for completing 80 jobs, less a $60 fee due to PayPal. 2. Purchased and used gas of $280 in order to complete jobs. 3. Paid the newspaper $120 for advertising for the month. 4. Paid the social media manager $164. This amount represented her monthly fee of $100 and scheduling fee for 64 of the jobs. 5. Paid friends $240 to complete 20 jobs during the month 6. Paid a salary of $400 to W.T. 7. Repaid W.T.'s aunt $100 of the total amount owed to her. 8. Completed 33 jobs on account for clients with standing appointments. Each client was billed at the rate of $15 per job. 9. Determined that the social media manager is still owed her scheduling fee for 16 jobs scheduled and completed over the last few days of the month For each of the above transactions. 1. Record the transactions in the appropriate general ledger accounts under an accounting equation Record the amounts of revenue and expense in the Retained Earnings column Provide the appropriate titles for these accounts in the last column of the table 2. As of January 31, determine the total amount of assets, liabilities, and stockholder's equity 3. How much net income did My Assistant, Inc. eam in January How does this compare to the amount of net cash flow from operations? My Assistant Accounting Equation for January Liabilities + Notes Fees Payable P ayable $500 Assets Accounts Cash Receivable $903 Item Stockholders' Equity Common Retained Stock Earnings $100 $303 Account titles for RE Balance Jan 1 1. Complete jobs 2. Purchase Loas 3. Paid newspaper 4. Pay SMM E 5. Pay friends to do jobs 6. Pay W.T. salary 7. Partial loan repayment 8. Complete jobs and bill clients 9. Accrue amount due to SMM Balance January 31 Totals at January 31 My Assistant, Inc. Net Income for the month of January Corresponding Operating Cash Flow Revenues Expenses: Net