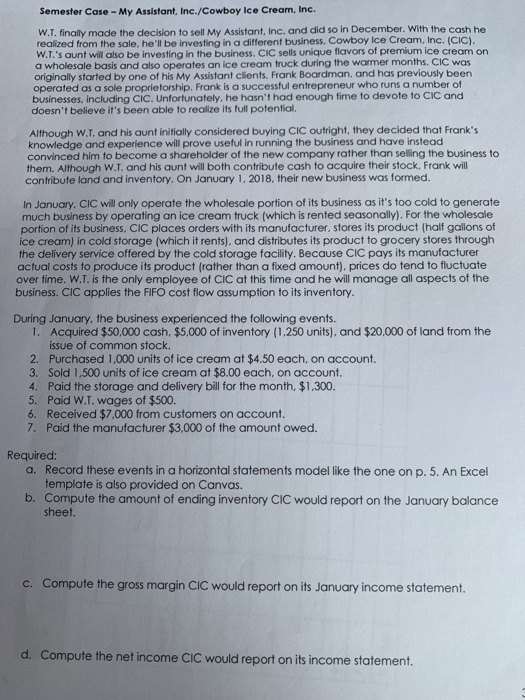

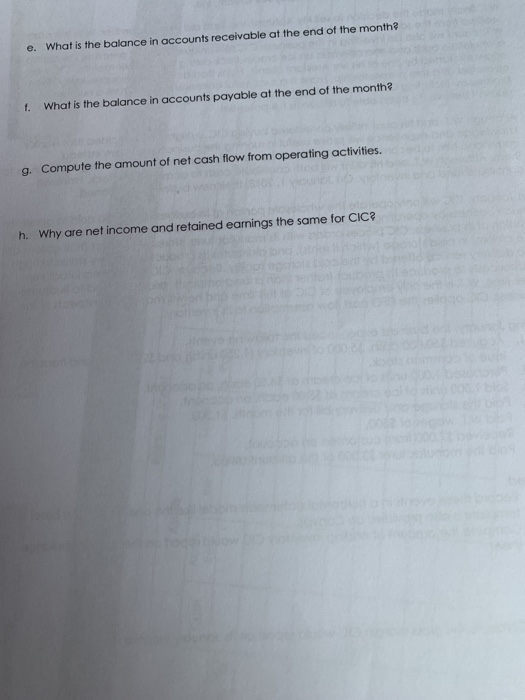

Semester Case - My Assistant, Inc./Cowboy Ice Cream, Inc. W.T. finally made the decision to sell My Assistant, Inc. and did so in December. With the cash he realized from the sale, he'll be investing in a different business. Cowboy Ice Cream, Inc. (CIC). W.T.'s aunt will also be investing in the business. CIC sells unique flavors of premium ice cream on a wholesale basis and also operates an ice cream truck during the warmer months. CIC was originally started by one of his My Assistant clients, Frank Boardman, and has previously been operated as a sole proprietorship. Frank is a successful entrepreneur who runs a number of businesses, including Cic. Unfortunately, he hasn't had enough time to devote to CIC and doesn't believe it's been able to realize its full potential. Although W.T. and his aunt initially considered buying CIC Outright, they decided that Frank's knowledge and experience will prove useful in running the business and have instead convinced him to become a shareholder of the new company rather than selling the business to them. Although W.T. and his aunt will both contribute cash to acquire their stock, Frank will contribute land and inventory. On January 1, 2018, their new business was formed. In January, CIC will only operate the wholesale portion of its business as it's too cold to generate much business by operating an ice cream truck (which is rented seasonally). For the wholesale portion of its business, CIC places orders with its manufacturer, stores its product (half gallons of ice cream) in cold storage (which it rents), and distributes its product to grocery stores through the delivery service offered by the cold storage facility. Because CIC pays its manufacturer actual costs to produce its product rather than a fixed amount), prices do tend to fluctuate over time. W.T. is the only employee of CIC at this time and he will manage all aspects of the business. CIC applies the FIFO cost flow assumption to its inventory. During January, the business experienced the following events. 1. Acquired $50,000 cash. $5,000 of inventory (1.250 units), and $20,000 of land from the issue of common stock. 2. Purchased 1,000 units of ice cream at $4.50 each, on account. 3. Sold 1,500 units of ice cream at $8.00 each, on account. 4. Paid the storage and delivery bill for the month $1,300. 5. Paid W.1. wages of $500. 6. Received $7.000 from customers on account. 7. Paid the manufacturer $3,000 of the amount owed. Required: a. Record these events in a horizontal statements model like the one on p. 5. An Excel template is also provided on Canvas. b. Compute the amount of ending inventory CIC would report on the January balance sheet. C. Compute the gross margin CIC would report on its January income statement d. Compute the net income CIC would report on its income statement. e. What is the balance in accounts receivable at the end of the month 1. What is the balance in accounts payable at the end of the month g. Compute the amount of net cash flow from operating activities. h. Why are net income and retained earnings the same for CIC Semester Case - My Assistant, Inc./Cowboy Ice Cream, Inc. W.T. finally made the decision to sell My Assistant, Inc. and did so in December. With the cash he realized from the sale, he'll be investing in a different business. Cowboy Ice Cream, Inc. (CIC). W.T.'s aunt will also be investing in the business. CIC sells unique flavors of premium ice cream on a wholesale basis and also operates an ice cream truck during the warmer months. CIC was originally started by one of his My Assistant clients, Frank Boardman, and has previously been operated as a sole proprietorship. Frank is a successful entrepreneur who runs a number of businesses, including Cic. Unfortunately, he hasn't had enough time to devote to CIC and doesn't believe it's been able to realize its full potential. Although W.T. and his aunt initially considered buying CIC Outright, they decided that Frank's knowledge and experience will prove useful in running the business and have instead convinced him to become a shareholder of the new company rather than selling the business to them. Although W.T. and his aunt will both contribute cash to acquire their stock, Frank will contribute land and inventory. On January 1, 2018, their new business was formed. In January, CIC will only operate the wholesale portion of its business as it's too cold to generate much business by operating an ice cream truck (which is rented seasonally). For the wholesale portion of its business, CIC places orders with its manufacturer, stores its product (half gallons of ice cream) in cold storage (which it rents), and distributes its product to grocery stores through the delivery service offered by the cold storage facility. Because CIC pays its manufacturer actual costs to produce its product rather than a fixed amount), prices do tend to fluctuate over time. W.T. is the only employee of CIC at this time and he will manage all aspects of the business. CIC applies the FIFO cost flow assumption to its inventory. During January, the business experienced the following events. 1. Acquired $50,000 cash. $5,000 of inventory (1.250 units), and $20,000 of land from the issue of common stock. 2. Purchased 1,000 units of ice cream at $4.50 each, on account. 3. Sold 1,500 units of ice cream at $8.00 each, on account. 4. Paid the storage and delivery bill for the month $1,300. 5. Paid W.1. wages of $500. 6. Received $7.000 from customers on account. 7. Paid the manufacturer $3,000 of the amount owed. Required: a. Record these events in a horizontal statements model like the one on p. 5. An Excel template is also provided on Canvas. b. Compute the amount of ending inventory CIC would report on the January balance sheet. C. Compute the gross margin CIC would report on its January income statement d. Compute the net income CIC would report on its income statement. e. What is the balance in accounts receivable at the end of the month 1. What is the balance in accounts payable at the end of the month g. Compute the amount of net cash flow from operating activities. h. Why are net income and retained earnings the same for CIC