Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SemiCom Corporation produces a semiconductor chip used on communications. The direct materials are added at the start of the production process while conversion costs

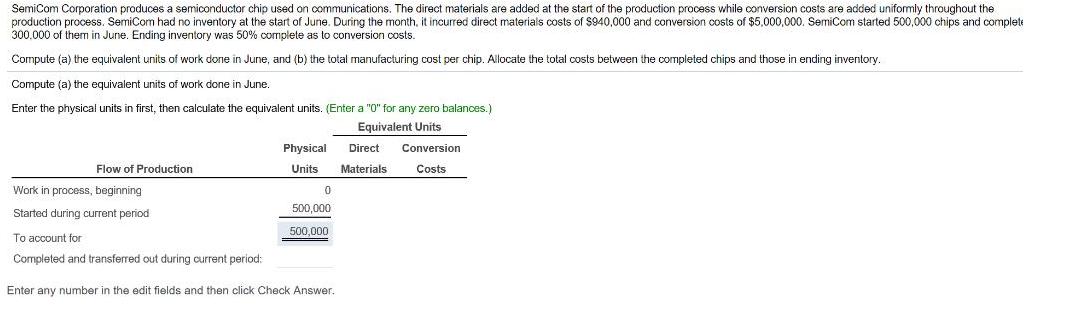

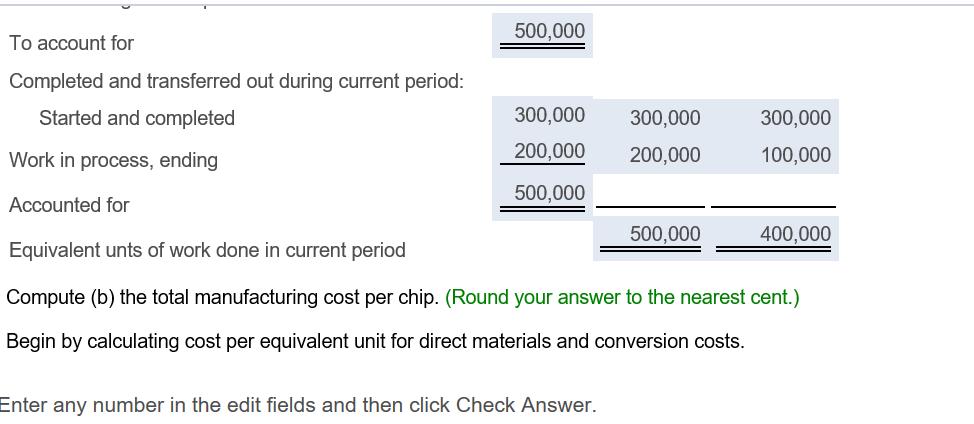

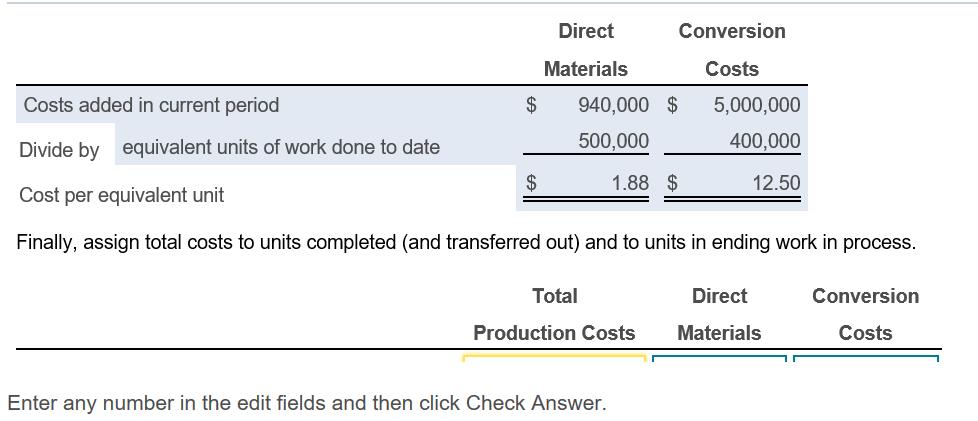

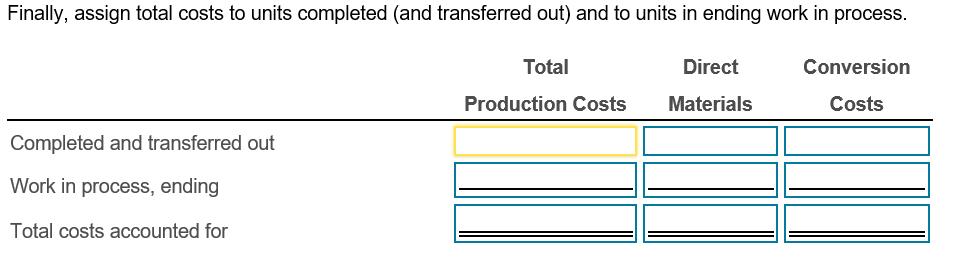

SemiCom Corporation produces a semiconductor chip used on communications. The direct materials are added at the start of the production process while conversion costs are added uniformly throughout the production process. SemiCom had no inventory at the start of June. During the month, it incurred direct materials costs of $940,000 and conversion costs of $5.000,000. SemiCom started 500,000 chips and complete 300.000 of them in June. Ending inventory was 50% complete as to conversion costs. Compute (a) the equivalent units of work done in June, and (b) the total manufacturing cost per chip. Allocate the total costs between the completed chips and those in ending inventory. Compute (a) the equivalent units of work done in June. Enter the physical units first, then calculate the equivalent units. (Enter a "O" for any zero balances.) Equivalent Units Physical Direct Conversion Flow of Production Units Materials Costs Work in process, beginning 500,000 Started during current period 500,000 To account for Completed and transferred out during current period: Enter any number in the edit fields and then click Check Answer. 500,000 To account for Completed and transferred out during current period: Started and completed 300,000 300,000 300,000 Work in process, ending 200,000 200,000 100,000 500,000 Accounted for 500,000 400,000 Equivalent unts of work done in current period Compute (b) the total manufacturing cost per chip. (Round your answer to the nearest cent.) Begin by calculating cost per equivalent unit for direct materials and conversion costs. Enter any number in the edit fields and then click Check Answer. Direct Conversion Materials Costs Costs added in current period 2$ 940,000 $ 5,000,000 Divide by equivalent units of work done to date 500,000 400,000 $4 1.88 $ 12.50 Cost per equivalent unit Finally, assign total costs to units completed (and transferred out) and to units in ending work in process. Total Direct Conversion Production Costs Materials Costs Enter any number in the edit fields and then click Check Answer. Finally, assign total costs to units completed (and transferred out) and to units in ending work in process. Total Direct Conversion Production Costs Materials Costs Completed and transferred out Work in process, ending Total costs accounted for SemiCom Corporation produces a semiconductor chip used on communications. The direct materials are added at the start of the production process while conversion costs are added uniformly throughout the production process. SemiCom had no inventory at the start of June. During the month, it incurred direct materials costs of $940,000 and conversion costs of $5.000,000. SemiCom started 500,000 chips and complete 300.000 of them in June. Ending inventory was 50% complete as to conversion costs. Compute (a) the equivalent units of work done in June, and (b) the total manufacturing cost per chip. Allocate the total costs between the completed chips and those in ending inventory. Compute (a) the equivalent units of work done in June. Enter the physical units first, then calculate the equivalent units. (Enter a "O" for any zero balances.) Equivalent Units Physical Direct Conversion Flow of Production Units Materials Costs Work in process, beginning 500,000 Started during current period 500,000 To account for Completed and transferred out during current period: Enter any number in the edit fields and then click Check Answer. 500,000 To account for Completed and transferred out during current period: Started and completed 300,000 300,000 300,000 Work in process, ending 200,000 200,000 100,000 500,000 Accounted for 500,000 400,000 Equivalent unts of work done in current period Compute (b) the total manufacturing cost per chip. (Round your answer to the nearest cent.) Begin by calculating cost per equivalent unit for direct materials and conversion costs. Enter any number in the edit fields and then click Check Answer. Direct Conversion Materials Costs Costs added in current period 2$ 940,000 $ 5,000,000 Divide by equivalent units of work done to date 500,000 400,000 $4 1.88 $ 12.50 Cost per equivalent unit Finally, assign total costs to units completed (and transferred out) and to units in ending work in process. Total Direct Conversion Production Costs Materials Costs Enter any number in the edit fields and then click Check Answer. Finally, assign total costs to units completed (and transferred out) and to units in ending work in process. Total Direct Conversion Production Costs Materials Costs Completed and transferred out Work in process, ending Total costs accounted for

Step by Step Solution

★★★★★

3.46 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Total Direct Conversion Production Materi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started