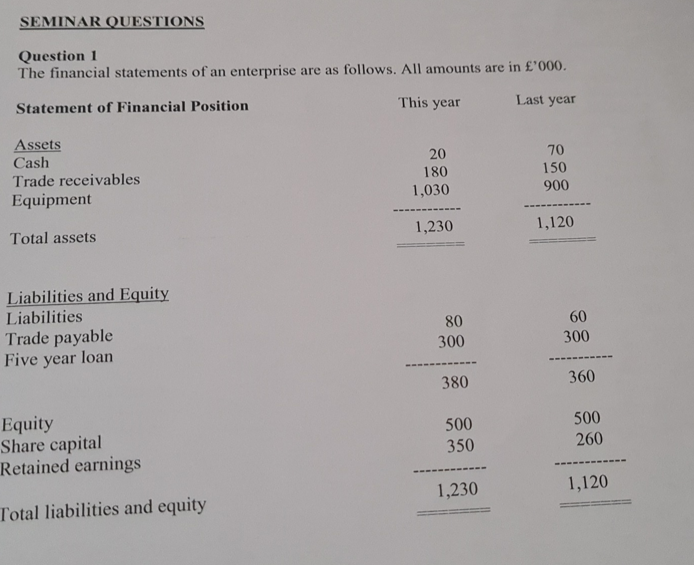

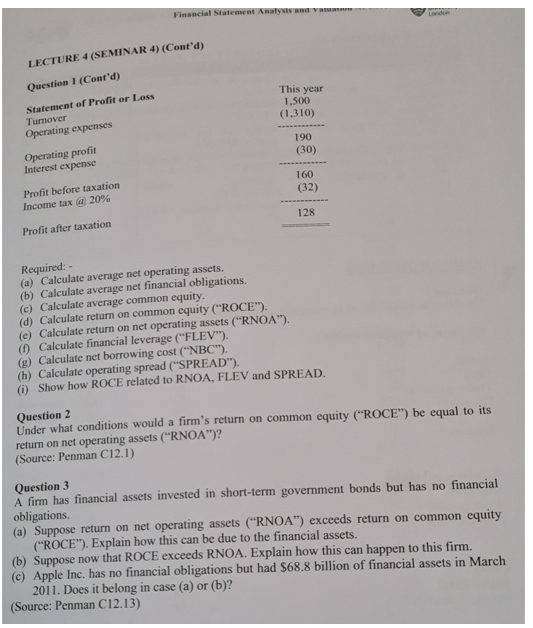

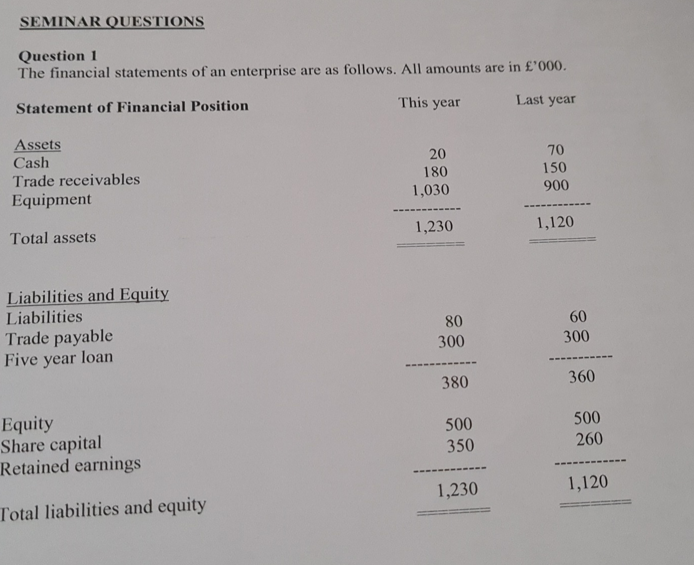

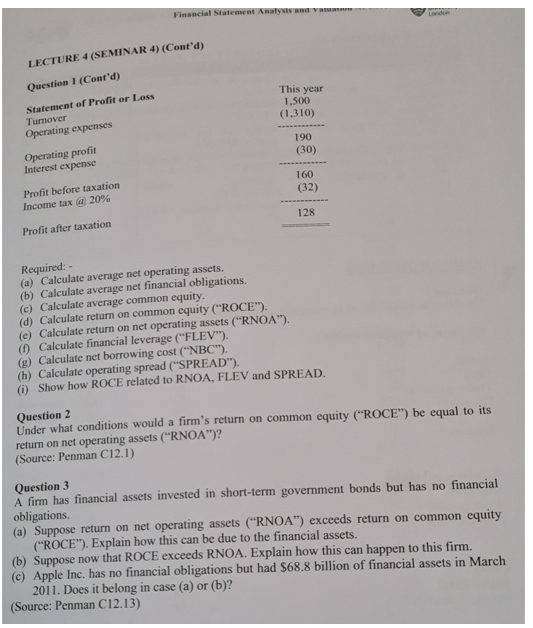

SEMINAR QUESTIONS Question 1 The financial statements of an enterprise are as follows. All amounts are in '000. Statement of Financial Position This year Last year Assets Cash Trade receivables Equipment 20 180 1,030 70 150 900 1,230 1,120 Total assets Liabilities and Equity Liabilities Trade payable Five year loan 80 300 60 300 380 360 500 Equity Share capital Retained earnings 500 350 260 1,230 1,120 Total liabilities and equity Financial Statement Analysis and Led LECTURE 4 (SEMINAR 4) (Cont'd) Question 1 (Cont'd) Statement of Profit or Loss Turnover Operating expenses This year 1,500 (1.310) 190 (30) Operating profit Interest expense 160 (32) Profit before taxation Income tax @ 20% 128 Profit after taxation Required: - (a) Calculate average net operating assets, (b) Calculate average net financial obligations (c) Calculate average common equity. (d) Calculate return on common equity ("ROCE"). (e) Calculate return on net operating assets ("RNOA"). (1) Calculate financial leverage ("FLEV"). (g) Calculate net borrowing cost ("NBC"). (h) Calculate operating spread ("SPREAD"). 0) Show how ROCE related to RNOA, FLEV and SPREAD. Question 2 Under what conditions would a firm's return on common equity ("ROCE") be equal to its return on net operating assets (RNOA")? (Source: Penman C12.1) Question 3 A firm has financial assets invested in short-term government bonds but has no financial obligations (a) Suppose return on net operating assets (RNOA") exceeds return on common equity ("ROCE"). Explain how this can be due to the financial assets. (b) Suppose now that ROCE exceeds RNOA. Explain how this can happen to this firm. (e) Apple Inc. has no financial obligations but had $68.8 billion of financial assets in March 2011. Does it belong in case (a) or (b)? (Source: Penman C12.13) SEMINAR QUESTIONS Question 1 The financial statements of an enterprise are as follows. All amounts are in '000. Statement of Financial Position This year Last year Assets Cash Trade receivables Equipment 20 180 1,030 70 150 900 1,230 1,120 Total assets Liabilities and Equity Liabilities Trade payable Five year loan 80 300 60 300 380 360 500 Equity Share capital Retained earnings 500 350 260 1,230 1,120 Total liabilities and equity Financial Statement Analysis and Led LECTURE 4 (SEMINAR 4) (Cont'd) Question 1 (Cont'd) Statement of Profit or Loss Turnover Operating expenses This year 1,500 (1.310) 190 (30) Operating profit Interest expense 160 (32) Profit before taxation Income tax @ 20% 128 Profit after taxation Required: - (a) Calculate average net operating assets, (b) Calculate average net financial obligations (c) Calculate average common equity. (d) Calculate return on common equity ("ROCE"). (e) Calculate return on net operating assets ("RNOA"). (1) Calculate financial leverage ("FLEV"). (g) Calculate net borrowing cost ("NBC"). (h) Calculate operating spread ("SPREAD"). 0) Show how ROCE related to RNOA, FLEV and SPREAD. Question 2 Under what conditions would a firm's return on common equity ("ROCE") be equal to its return on net operating assets (RNOA")? (Source: Penman C12.1) Question 3 A firm has financial assets invested in short-term government bonds but has no financial obligations (a) Suppose return on net operating assets (RNOA") exceeds return on common equity ("ROCE"). Explain how this can be due to the financial assets. (b) Suppose now that ROCE exceeds RNOA. Explain how this can happen to this firm. (e) Apple Inc. has no financial obligations but had $68.8 billion of financial assets in March 2011. Does it belong in case (a) or (b)? (Source: Penman C12.13)