Answered step by step

Verified Expert Solution

Question

1 Approved Answer

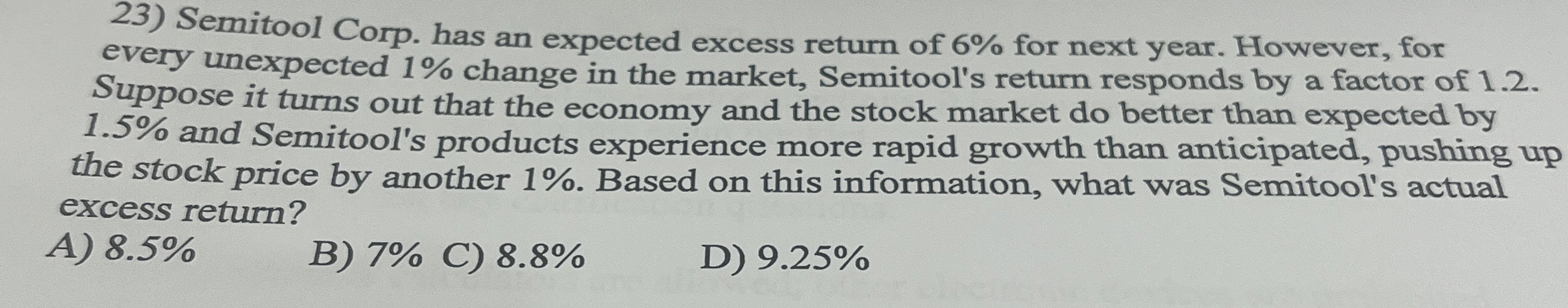

Semitool Corp. has an expected excess return of 6 % for next year. However, for every unexpected 1 % change in the market, Semitool's return

Semitool Corp. has an expected excess return of for next year. However, for

every unexpected change in the market, Semitool's return responds by a factor of

Suppose it turns out that the economy and the stock market do better than expected by

and Semitool's products experience more rapid growth than anticipated, pushing up

the stock price by another Based on this information, what was Semitool's actual

excess return?

A

B

C

D

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started