Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Semivariance as a Measure of Risk. Recall the Markowitz mean-variance model discussed in the lectures. The Hauck Financial Service company wants to construct a portfolio

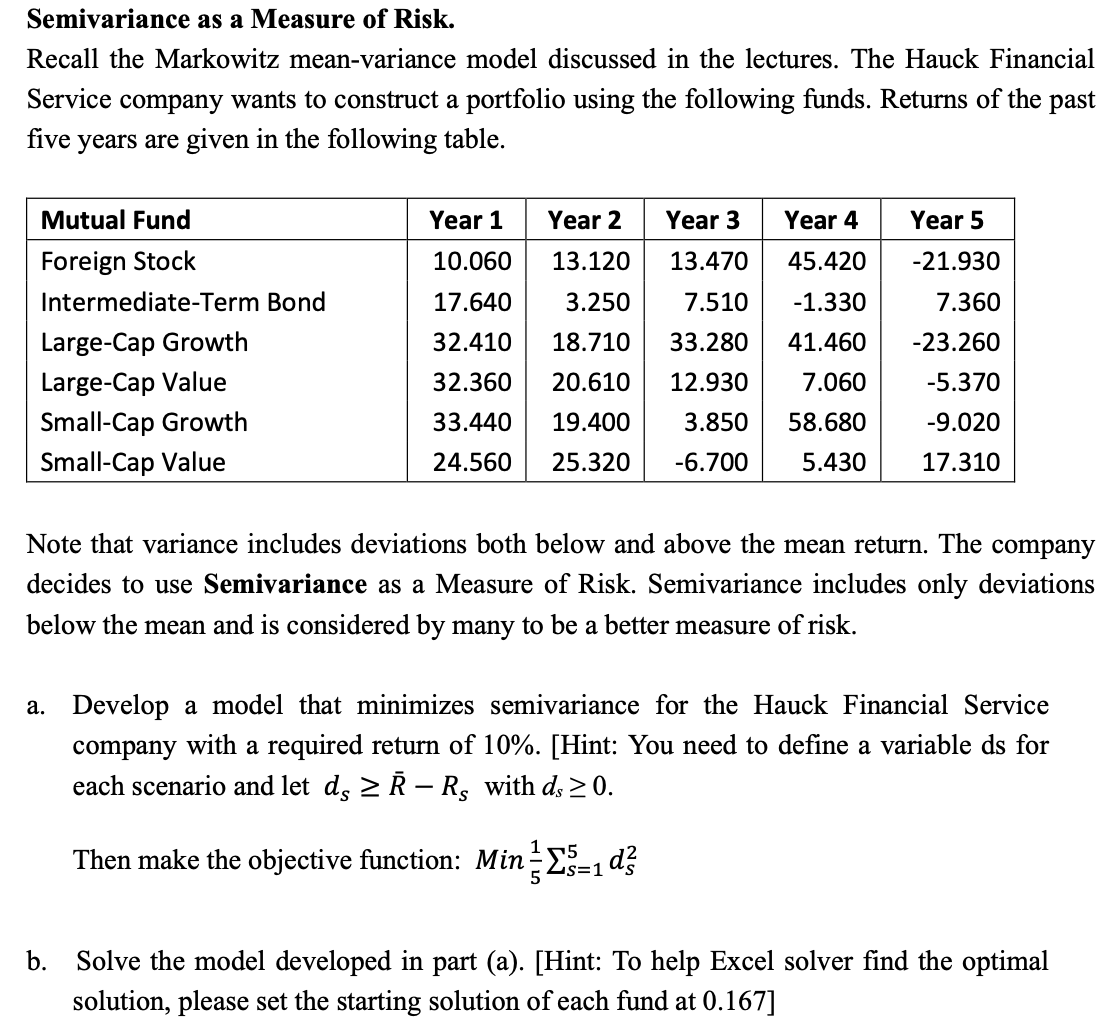

Semivariance as a Measure of Risk. Recall the Markowitz mean-variance model discussed in the lectures. The Hauck Financial Service company wants to construct a portfolio using the following funds. Returns of the past five years are given in the following table. Note that variance includes deviations both below and above the mean return. The company decides to use Semivariance as a Measure of Risk. Semivariance includes only deviations below the mean and is considered by many to be a better measure of risk. a. Develop a model that minimizes semivariance for the Hauck Financial Service company with a required return of 10%. [Hint: You need to define a variable ds for each scenario and let dsRRs with ds0. Then make the objective function: Min51s=15ds2 b. Solve the model developed in part (a). [Hint: To help Excel solver find the optimal solution, please set the starting solution of each fund at 0.167 ]

Semivariance as a Measure of Risk. Recall the Markowitz mean-variance model discussed in the lectures. The Hauck Financial Service company wants to construct a portfolio using the following funds. Returns of the past five years are given in the following table. Note that variance includes deviations both below and above the mean return. The company decides to use Semivariance as a Measure of Risk. Semivariance includes only deviations below the mean and is considered by many to be a better measure of risk. a. Develop a model that minimizes semivariance for the Hauck Financial Service company with a required return of 10%. [Hint: You need to define a variable ds for each scenario and let dsRRs with ds0. Then make the objective function: Min51s=15ds2 b. Solve the model developed in part (a). [Hint: To help Excel solver find the optimal solution, please set the starting solution of each fund at 0.167 ] Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started