send the full answer

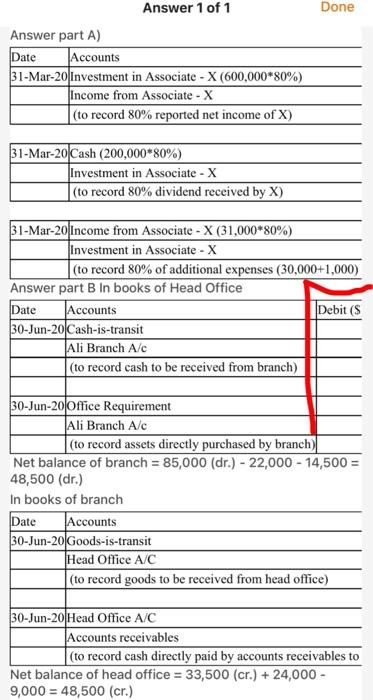

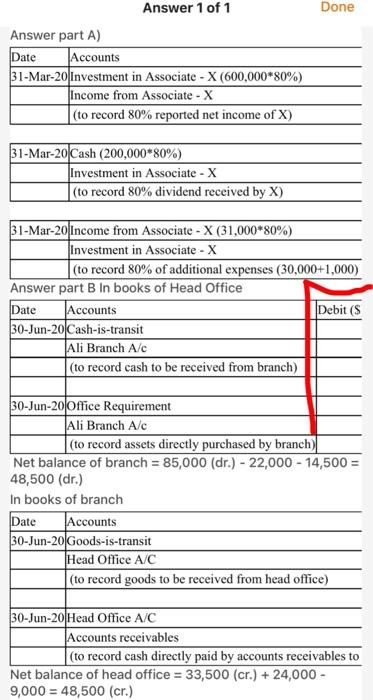

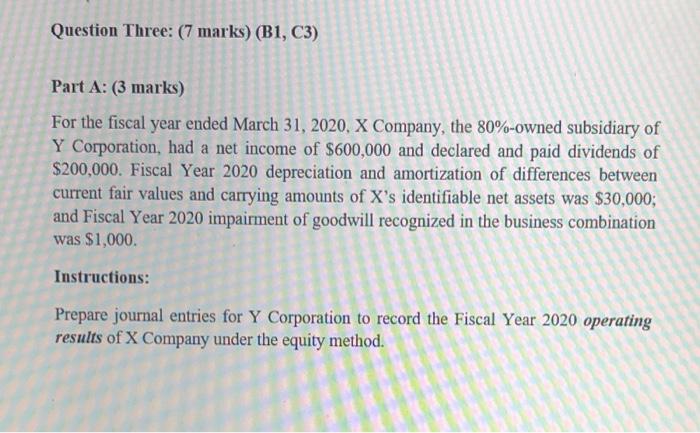

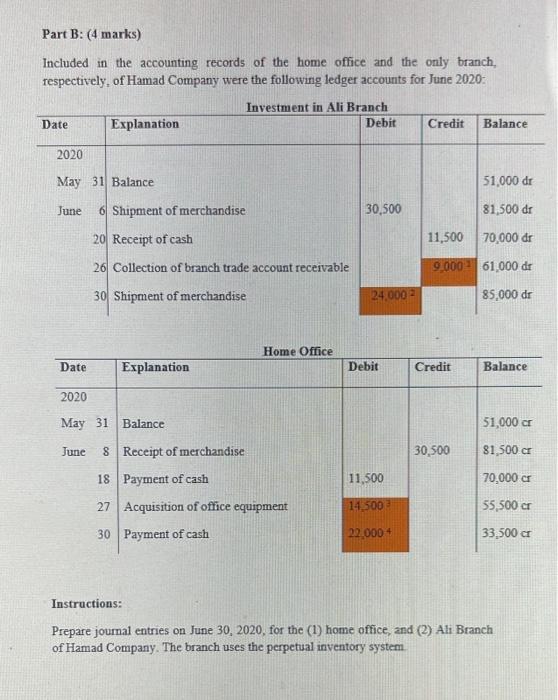

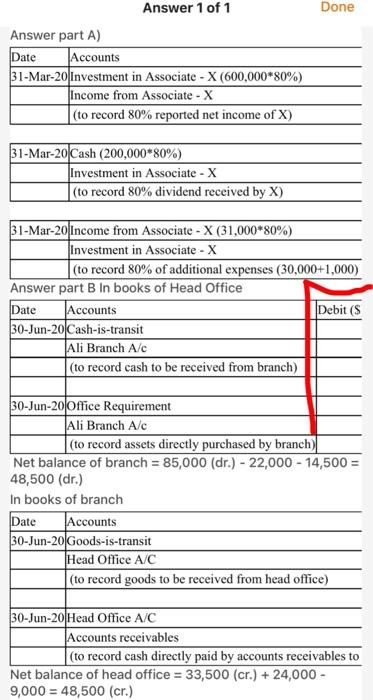

Done Answer 1 of 1 Answer part A) Date Accounts 31-Mar-20 Investment in Associate - X (600,000*80%) Income from Associate - X (to record 80% reported net income of X) 31-Mar-20 Cash (200,000*80%) Investment in Associate - X (to record 80% dividend received by X) 31-Mar-20Income from Associate - X (31,000*80%) Investment in Associate - X (to record 80% of additional expenses (30,000+1,000) Answer part B in books of Head Office Date Accounts Debit (S 30-Jun-20 Cash-is-transit Ali Branch Alc (to record cash to be received from branch) 30-Jun-20Office Requirement Ali Branch Alc (to record assets directly purchased by branch) Net balance of branch = 85,000 (dr.) - 22,000 - 14,500 = 48,500 (dr.) In books of branch Date Accounts 30-Jun-20 Goods-is-transit Head Office A/C (to record goods to be received from head office) 30-Jun-20 Head Office A/C Accounts receivables (to record cash directly paid by accounts receivables to Net balance of head office = 33,500 (cr.) + 24,000 - 9,000 = 48,500 (cr.) Question Three: (7 marks) (B1, C3) Part A: (3 marks) For the fiscal year ended March 31, 2020, X Company, the 80%-owned subsidiary of Y Corporation, had a net income of $600,000 and declared and paid dividends of $200,000. Fiscal Year 2020 depreciation and amortization of differences between current fair values and carrying amounts of X's identifiable net assets was $30,000; and Fiscal Year 2020 impairment of goodwill recognized in the business combination was $1,000 Instructions: Prepare journal entries for Y Corporation to record the Fiscal Year 2020 operating results of X Company under the equity method. Part B: (4 marks) Included in the accounting records of the home office and the only branch, respectively, of Hamad Company were the following ledger accounts for June 2020: Investment in Ali Branch Debit Date Explanation Credit Balance 2020 May 31 Balance 51,000 dr June 30,500 81,500 dr 6 Shipment of merchandise 20 Receipt of cash 11,500 70,000 dr 26 Collection of branch trade account receivable 9.000 61.000 de 30 Shipment of merchandise 24.000 85,000 dr Home Office Date Explanation Debit Credit Balance 2020 May 31 Balance 51,000 ar June 8 Receipt of merchandise 30,500 81,500 cr 18 Payment of cash 11,500 70,000 cr 27 Acquisition of office equipment 14,500 55,500 ar 30 Payment of cash 02.000+ 33,500 ar Instructions: Prepare journal entries on June 30, 2020, for the (1) home office, and (2) Ali Branch of Hamad Company. The branch uses the perpetual inventory system