Question

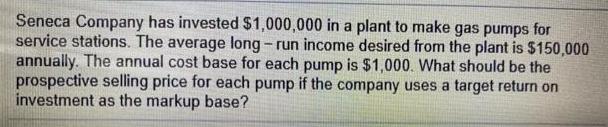

Seneca Company has invested $1,000,000 in a plant to make gas pumps for service stations. The average long - run income desired from the

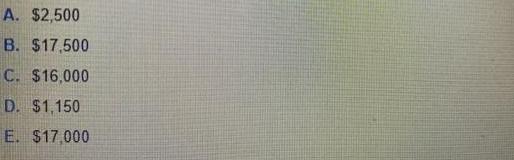

Seneca Company has invested $1,000,000 in a plant to make gas pumps for service stations. The average long - run income desired from the plant is $150,000 annually. The annual cost base for each pump is $1,000. What should be the prospective selling price for each pump if the company uses a target return on investment as the markup base? A. $2,500 B. $17,500 C. $16,000 D. $1,150 E. $17,000

Step by Step Solution

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Microeconomics

Authors: Dean Karlan, Jonathan Morduch

1st edition

978-0077332587, 007733258X, 978-0077332648, 77332644, 978-1259163531

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App