Answered step by step

Verified Expert Solution

Question

1 Approved Answer

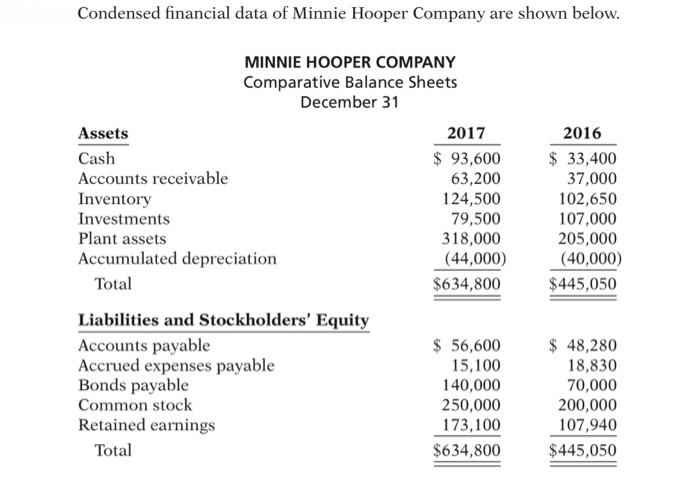

Condensed financial data of Minnie Hooper Company are shown below. MINNIE HOOPER COMPANY Comparative Balance Sheets December 31 Assets Cash Accounts receivable Inventory Investments

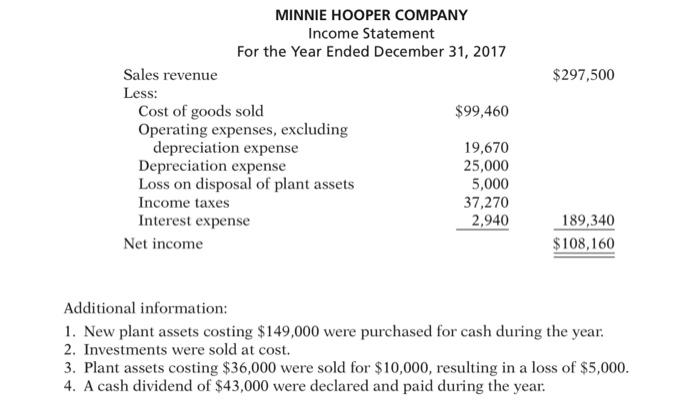

Condensed financial data of Minnie Hooper Company are shown below. MINNIE HOOPER COMPANY Comparative Balance Sheets December 31 Assets Cash Accounts receivable Inventory Investments Plant assets Accumulated depreciation Total Liabilities and Stockholders' Equity Accounts payable Accrued expenses payable Bonds payable Common stock Retained earnings Total 2017 $ 93,600 63,200 124,500 79,500 318,000 (44,000) $634,800 $ 56,600 15,100 140,000 250,000 173,100 $634,800 2016 $ 33,400 37,000 102,650 107,000 205,000 (40,000) $445,050 $ 48,280 18,830 70,000 200,000 107,940 $445,050 Sales revenue Less: MINNIE HOOPER COMPANY Income Statement For the Year Ended December 31, 2017 Cost of goods sold Operating expenses, excluding depreciation expense Depreciation expense Loss on disposal of plant assets Income taxes Interest expense Net income $99,460 19,670 25,000 5,000 37,270 2,940 $297,500 189,340 $108,160 Additional information: 1. New plant assets costing $149,000 were purchased for cash during the year. 2. Investments were sold at cost. 3. Plant assets costing $36,000 were sold for $10,000, resulting in a loss of $5,000. 4. A cash dividend of $43,000 were declared and paid during the year.

Step by Step Solution

★★★★★

3.51 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Answer ANSWER Statement of cash flow Cash flow from operating activities Net in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started