Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Senior management at ACME faces four potential investment opportunities. ACME is currently operating in a capital-constrained environment. Rank the four investment projects according to NPV,

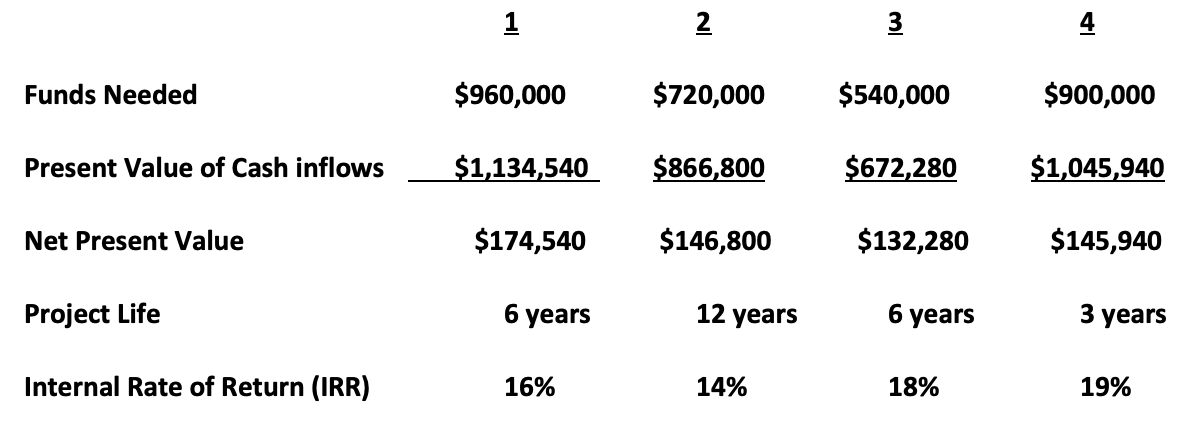

Senior management at ACME faces four potential investment opportunities. ACME is currently operating in a "capital-constrained" environment. Rank the four investment projects according to NPV, IRR and profitability index. Which criteria do you use to make your recommendation and why? EXPLAIN.

2 3 Funds Needed $960,000 $720,000 $540,000 $900,000 Present Value of Cash inflows $1,134,540 $866,800 $672,280 $1,045,940 Net Present Value $174,540 $146,800 $132,280 $145,940 Project Life 6 years 12 years 6 years 3 years Internal Rate of Return (IRR) 16% 14% 18% 19%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To rank the four investment projects according to NPV IRR and profitability index we will consider each criterion individually 1 Net Present Value NPV ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started