Question

Senior management at Harriot Industries, an Italian-based fashion house and cosmetics company, have been engaged in a debate around the best key financial measure relevant

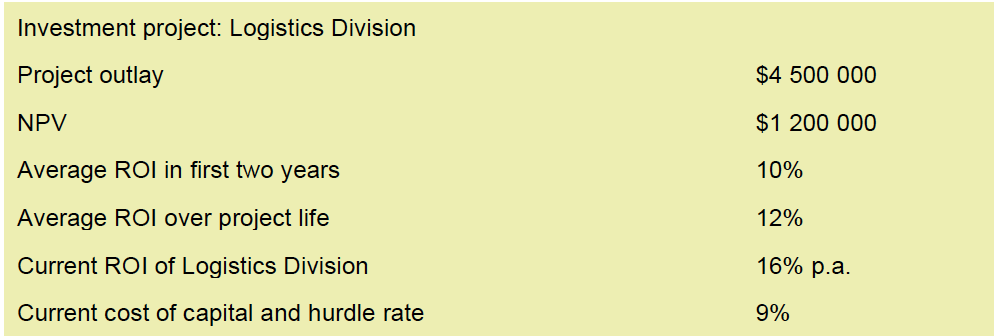

Senior management at Harriot Industries, an Italian-based fashion house and cosmetics company, have been engaged in a debate around the best key financial measure relevant to evaluate the performance of senior executives and divisional managers. Currently, the performance of senior managers and divisional managers is based on return on investment (ROI), which forms the basis of the bonus payments, provided ROI increases are achieved each year. The main source of tension seems to be that some of the accounting staff are pushing for the use of economic value added (EVA) or, at the very least, residual income (RI) to be used at both the senior executive and divisional levels. You have been asked to contribute some views. On a recent visit to the head office of Harriot Industries you were able to access details on a printout from a digital whiteboard that represented a discussion about performance measures and a potential investment project in the Logistics Division. Some of this material is provided below.

Required

Using the information provided in the table, demonstrate the key arguments that might be put forward to support the view that the sole use of return on investment (ROI) may be inappropriate, particularly at the divisional level.

Investment project: Logistics Division $4 500 000 Project outlay NPV $1 200 000 Average ROI in first two years 10% Average ROI over project life 12% 16% p.a. Current ROI of Logistics Division Current cost of capital and hurdle rate 9%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started