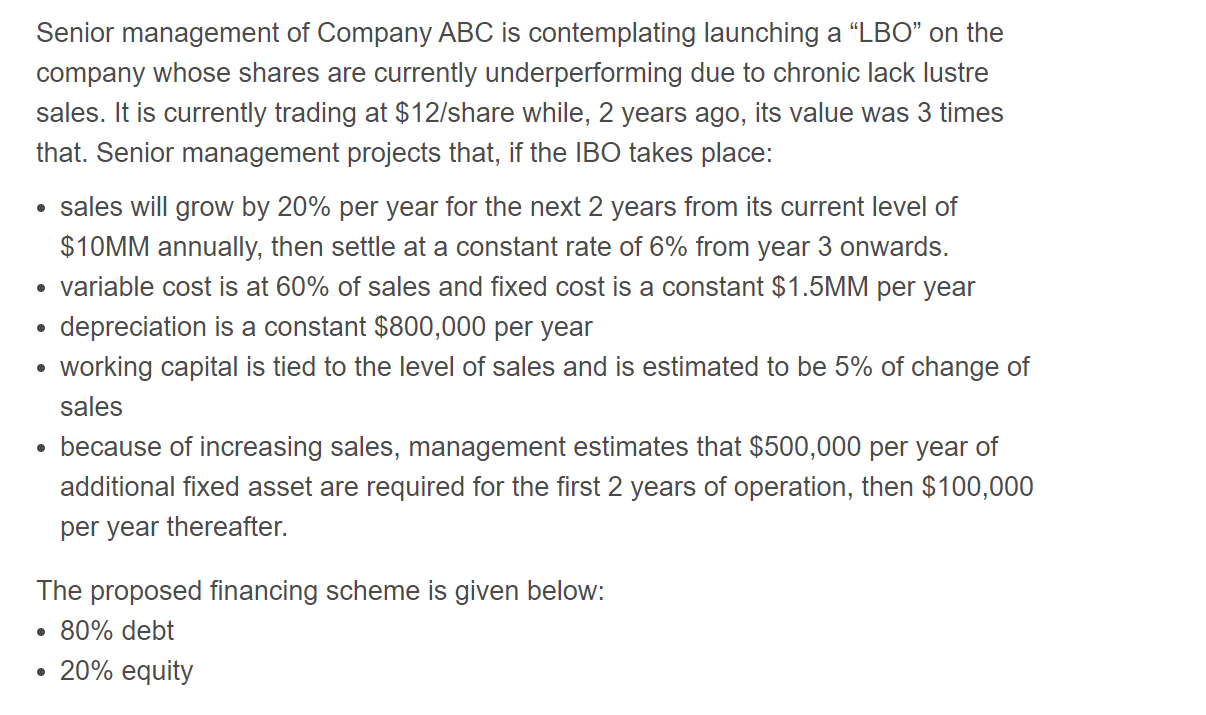

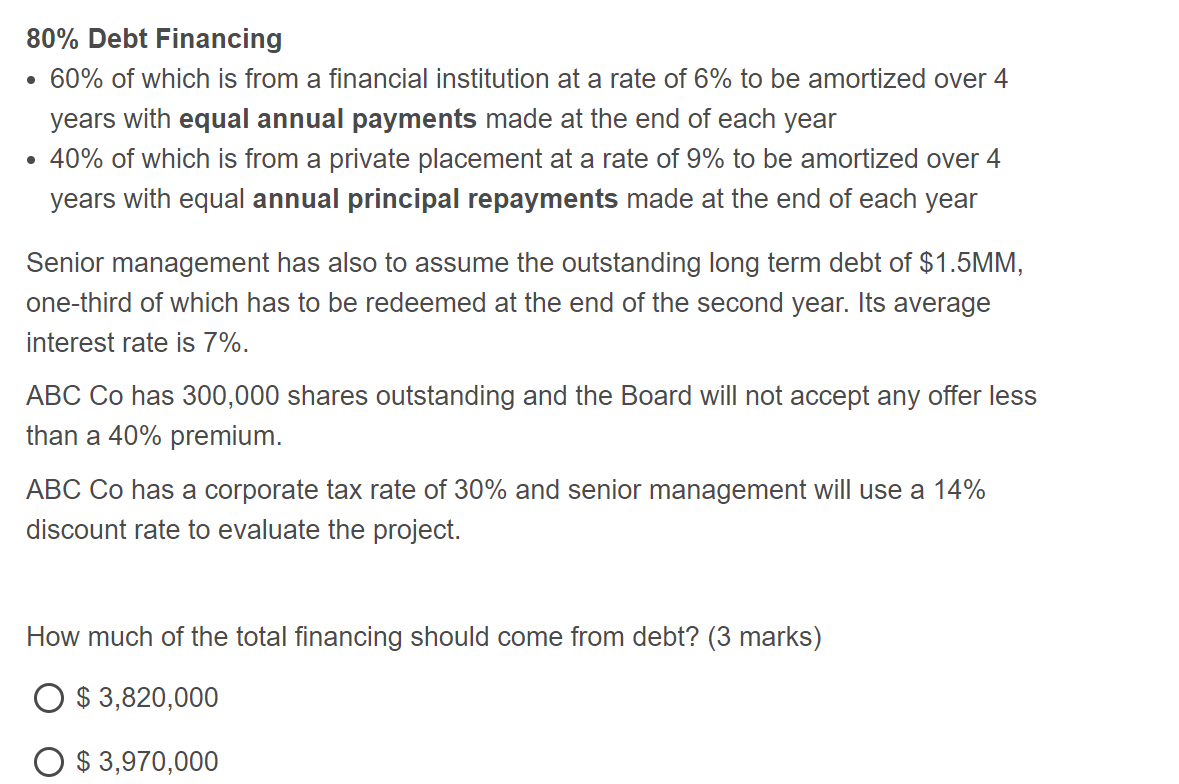

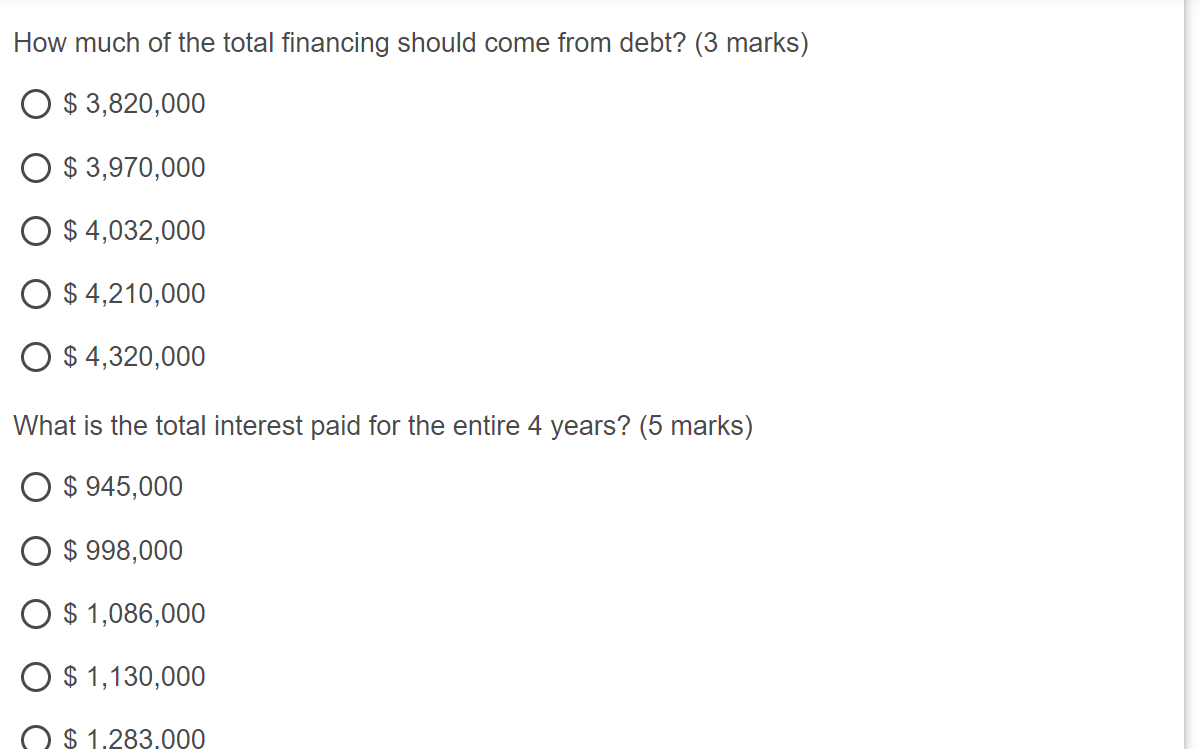

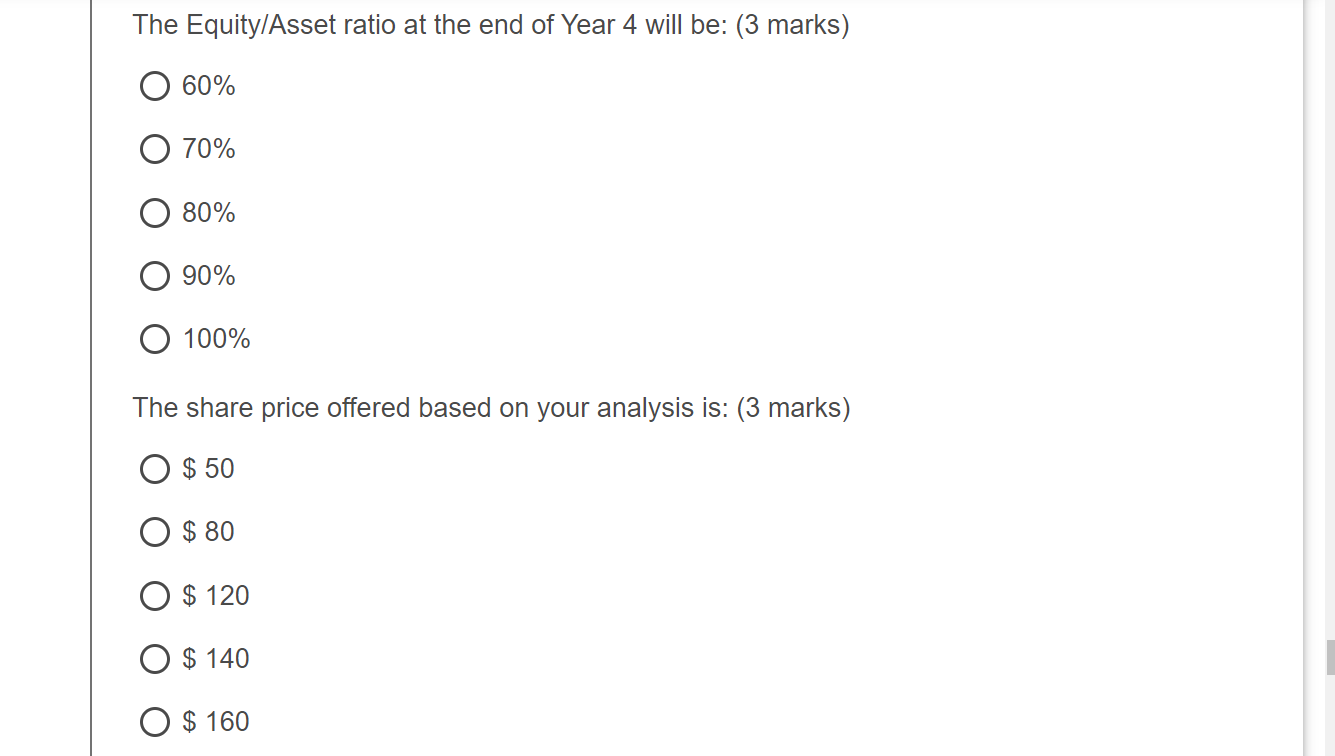

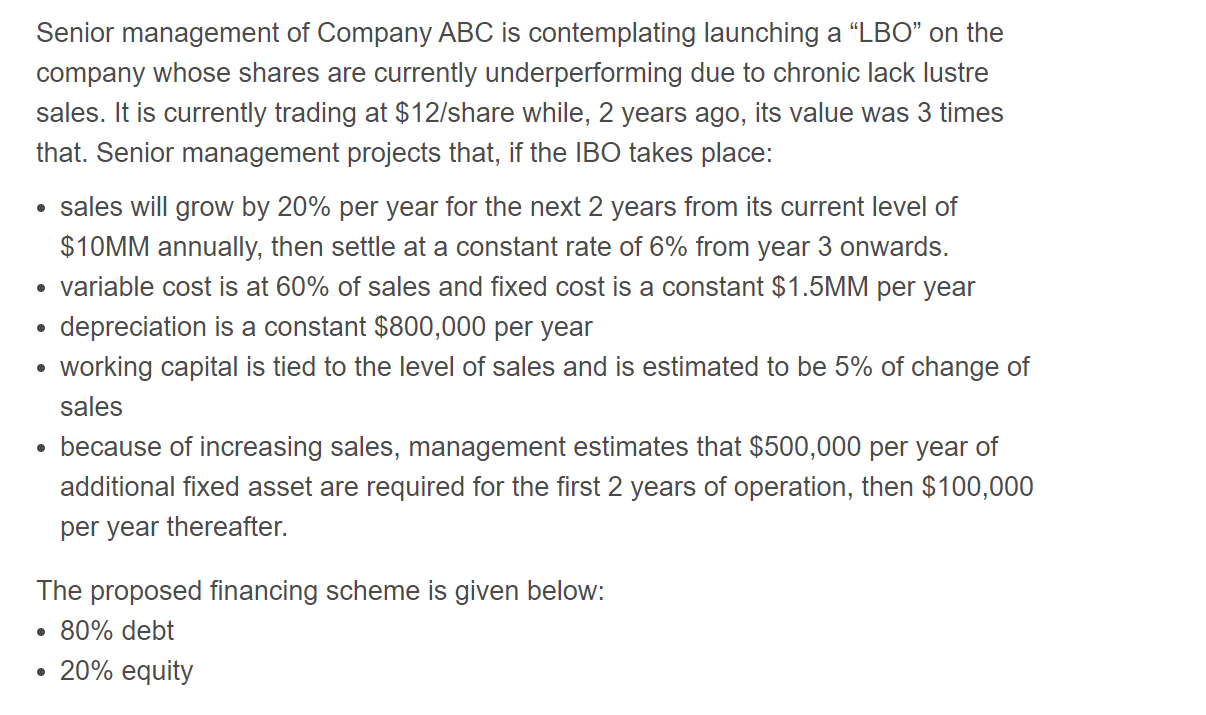

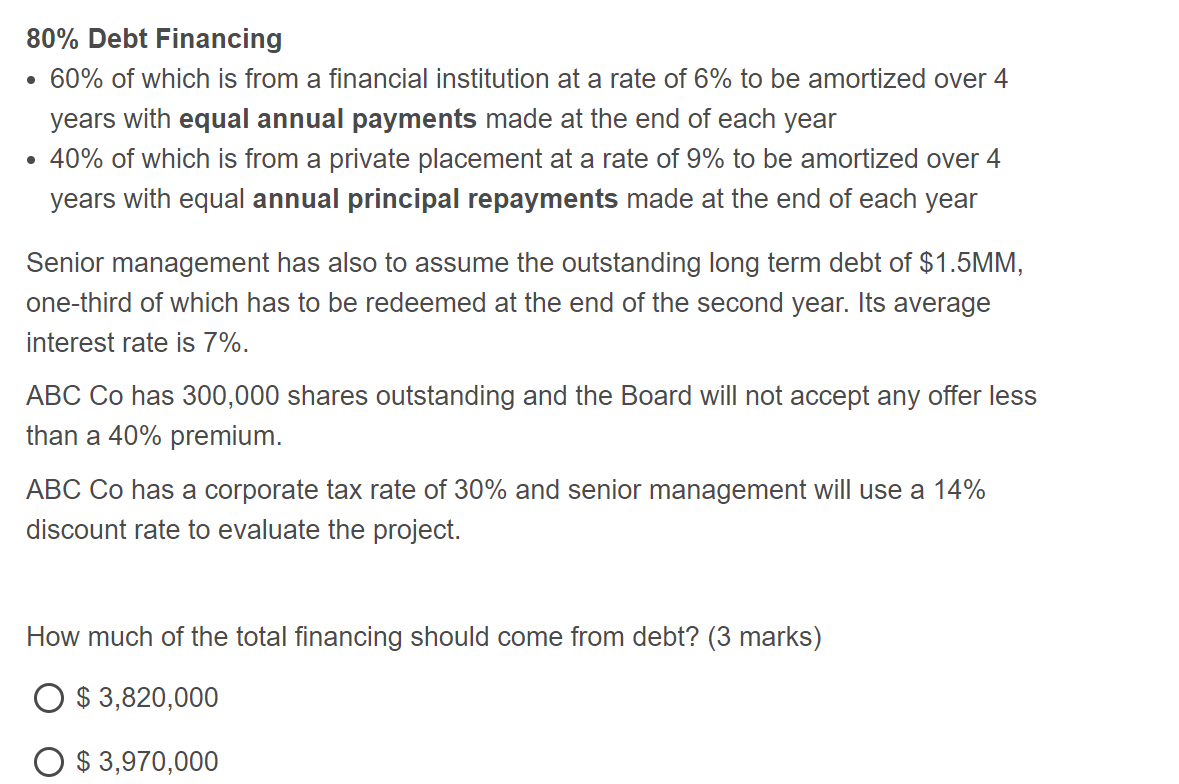

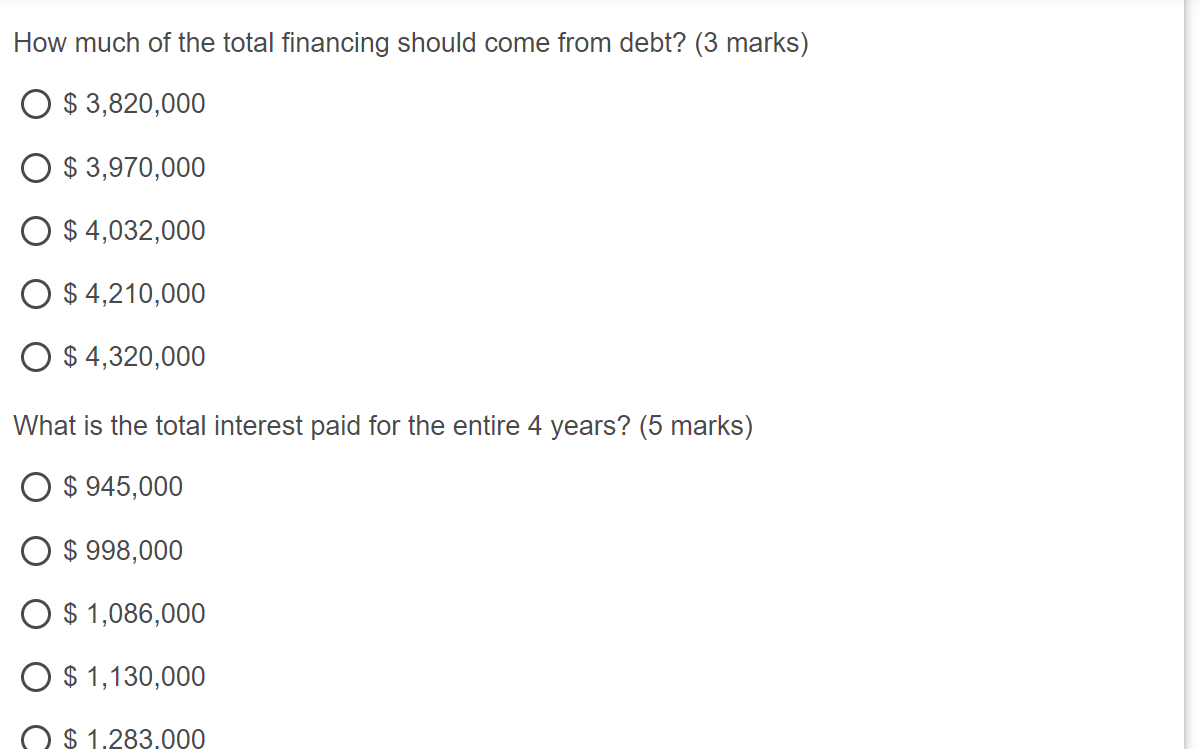

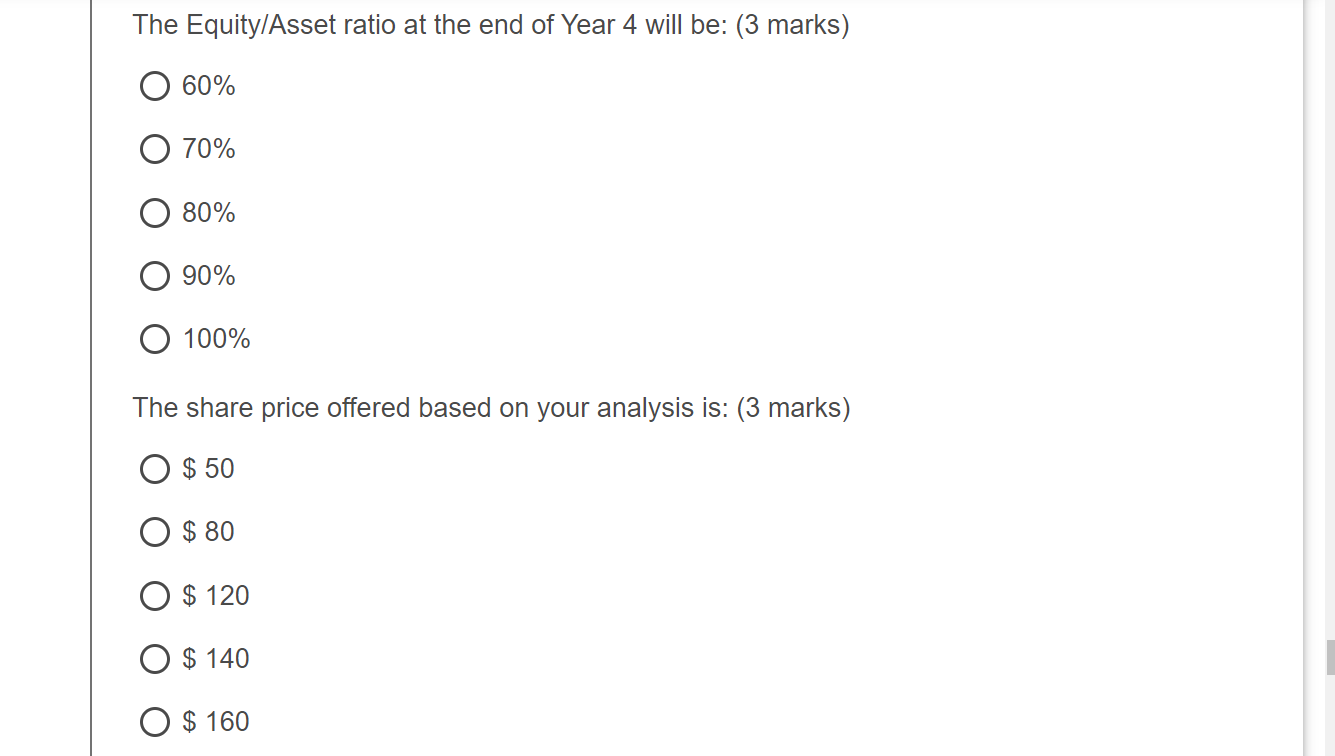

Senior management of Company ABC is contemplating launching a LBO on the company whose shares are currently underperforming due to chronic lack lustre sales. It is currently trading at $12/share while, 2 years ago, its value was 3 times that. Senior management projects that, if the IBO takes place: sales will grow by 20% per year for the next 2 years from its current level of $10MM annually, then settle at a constant rate of 6% from year 3 onwards. variable cost is at 60% of sales and fixed cost is a constant $1.5MM per year depreciation is a constant $800,000 per year working capital is tied to the level of sales and is estimated to be 5% of change of sales because of increasing sales, management estimates that $500,000 per year of additional fixed asset are required for the first 2 years of operation, then $100,000 per year thereafter. The proposed financing scheme is given below: 80% debt 20% equity . 80% Debt Financing 60% of which is from a financial institution at a rate of 6% to be amortized over 4 years with equal annual payments made at the end of each year 40% of which is from a private placement at a rate of 9% to be amortized over 4 years with equal annual principal repayments made at the end of each year Senior management has also to assume the outstanding long term debt of $1.5MM, one-third of which has to be redeemed at the end of the second year. Its average interest rate is 7%. ABC Co has 300,000 shares outstanding and the Board will not accept any offer less than a 40% premium. ABC Co has a corporate tax rate of 30% and senior management will use a 14% discount rate to evaluate the project. How much of the total financing should come from debt? (3 marks) O $ 3,820,000 O $ 3,970,000 How much of the total financing should come from debt? (3 marks) $ 3,820,000 O $ 3,970,000 $ 4,032,000 $ 4,210,000 $ 4,320,000 What is the total interest paid for the entire 4 years? (5 marks) O $ 945,000 O $ 998,000 O $ 1,086,000 $ 1,130,000 $ 1.283.000 The Equity/Asset ratio at the end of Year 4 will be: (3 marks) O 60% O 70% 80% 90% O 100% The share price offered based on your analysis is: (3 marks) O $50 O $ 80 O $ 120 O $ 140 O $ 160 Senior management of Company ABC is contemplating launching a LBO on the company whose shares are currently underperforming due to chronic lack lustre sales. It is currently trading at $12/share while, 2 years ago, its value was 3 times that. Senior management projects that, if the IBO takes place: sales will grow by 20% per year for the next 2 years from its current level of $10MM annually, then settle at a constant rate of 6% from year 3 onwards. variable cost is at 60% of sales and fixed cost is a constant $1.5MM per year depreciation is a constant $800,000 per year working capital is tied to the level of sales and is estimated to be 5% of change of sales because of increasing sales, management estimates that $500,000 per year of additional fixed asset are required for the first 2 years of operation, then $100,000 per year thereafter. The proposed financing scheme is given below: 80% debt 20% equity . 80% Debt Financing 60% of which is from a financial institution at a rate of 6% to be amortized over 4 years with equal annual payments made at the end of each year 40% of which is from a private placement at a rate of 9% to be amortized over 4 years with equal annual principal repayments made at the end of each year Senior management has also to assume the outstanding long term debt of $1.5MM, one-third of which has to be redeemed at the end of the second year. Its average interest rate is 7%. ABC Co has 300,000 shares outstanding and the Board will not accept any offer less than a 40% premium. ABC Co has a corporate tax rate of 30% and senior management will use a 14% discount rate to evaluate the project. How much of the total financing should come from debt? (3 marks) O $ 3,820,000 O $ 3,970,000 How much of the total financing should come from debt? (3 marks) $ 3,820,000 O $ 3,970,000 $ 4,032,000 $ 4,210,000 $ 4,320,000 What is the total interest paid for the entire 4 years? (5 marks) O $ 945,000 O $ 998,000 O $ 1,086,000 $ 1,130,000 $ 1.283.000 The Equity/Asset ratio at the end of Year 4 will be: (3 marks) O 60% O 70% 80% 90% O 100% The share price offered based on your analysis is: (3 marks) O $50 O $ 80 O $ 120 O $ 140 O $ 160