Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sensitivity Analysis Instructions Read the assignment scenario in Blackboard and complete the following in the space provided below. Conduct Sensitivity Analysis using the following

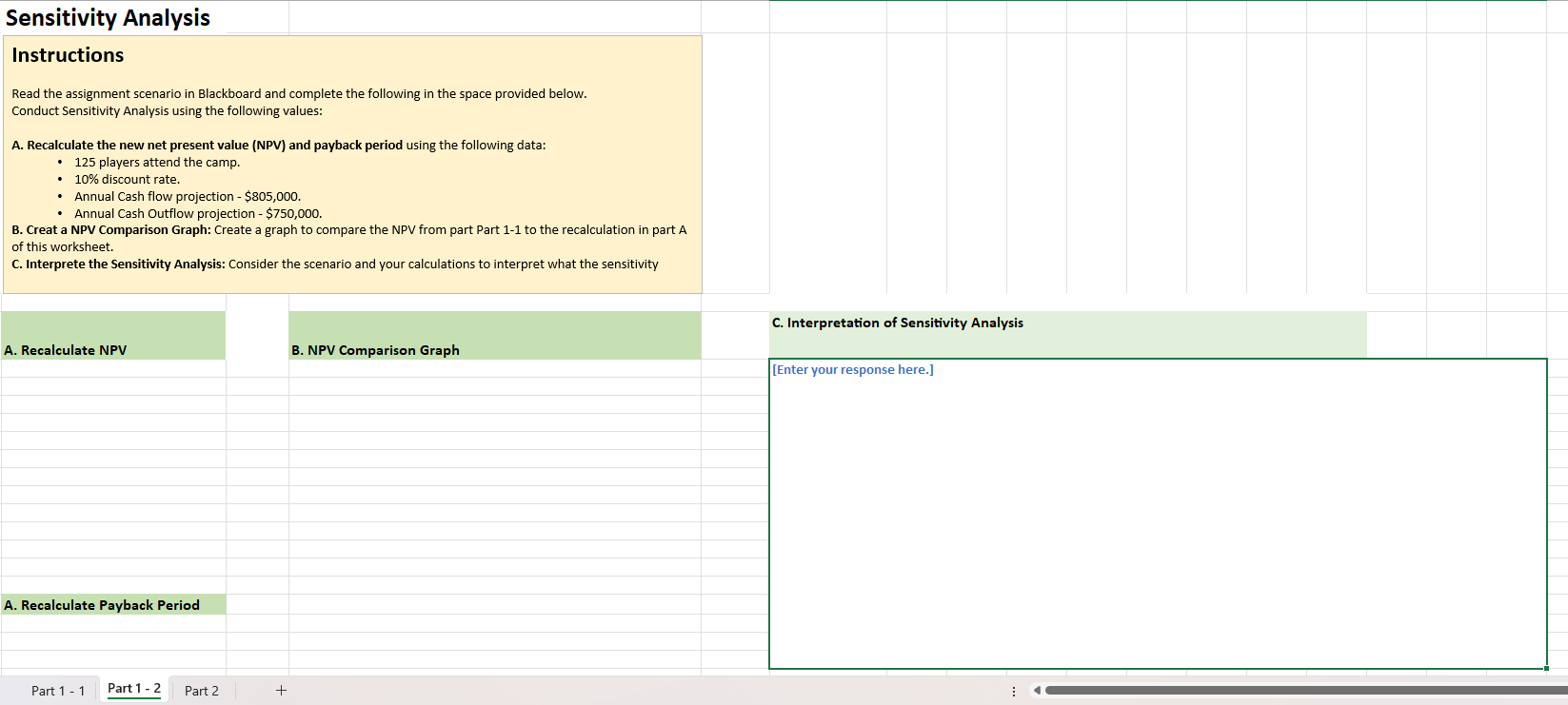

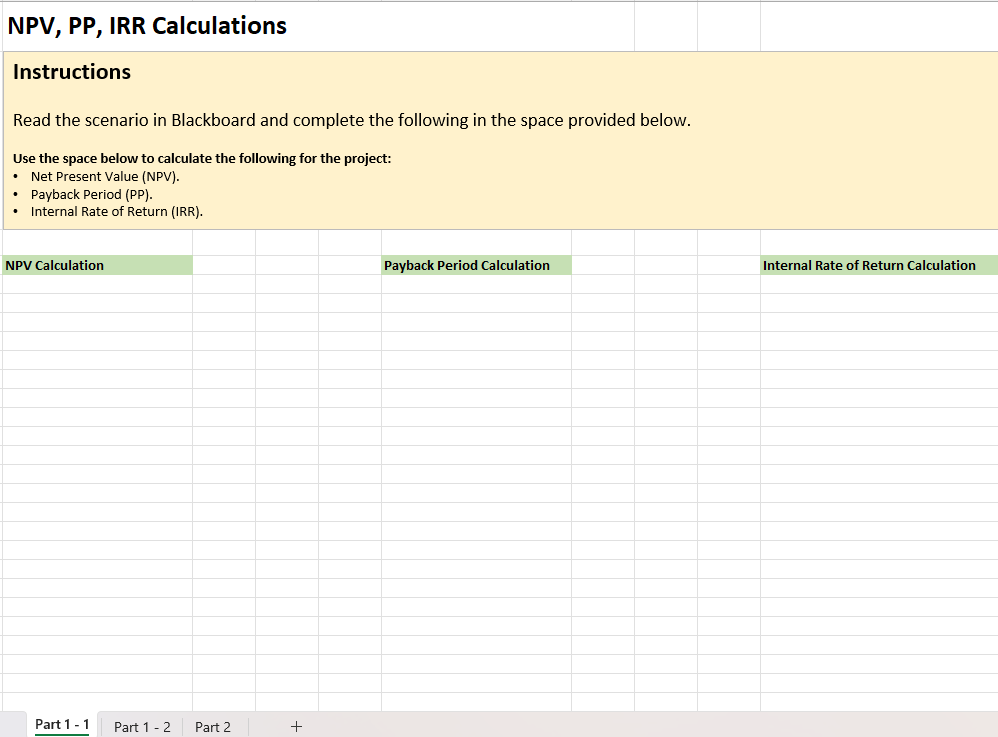

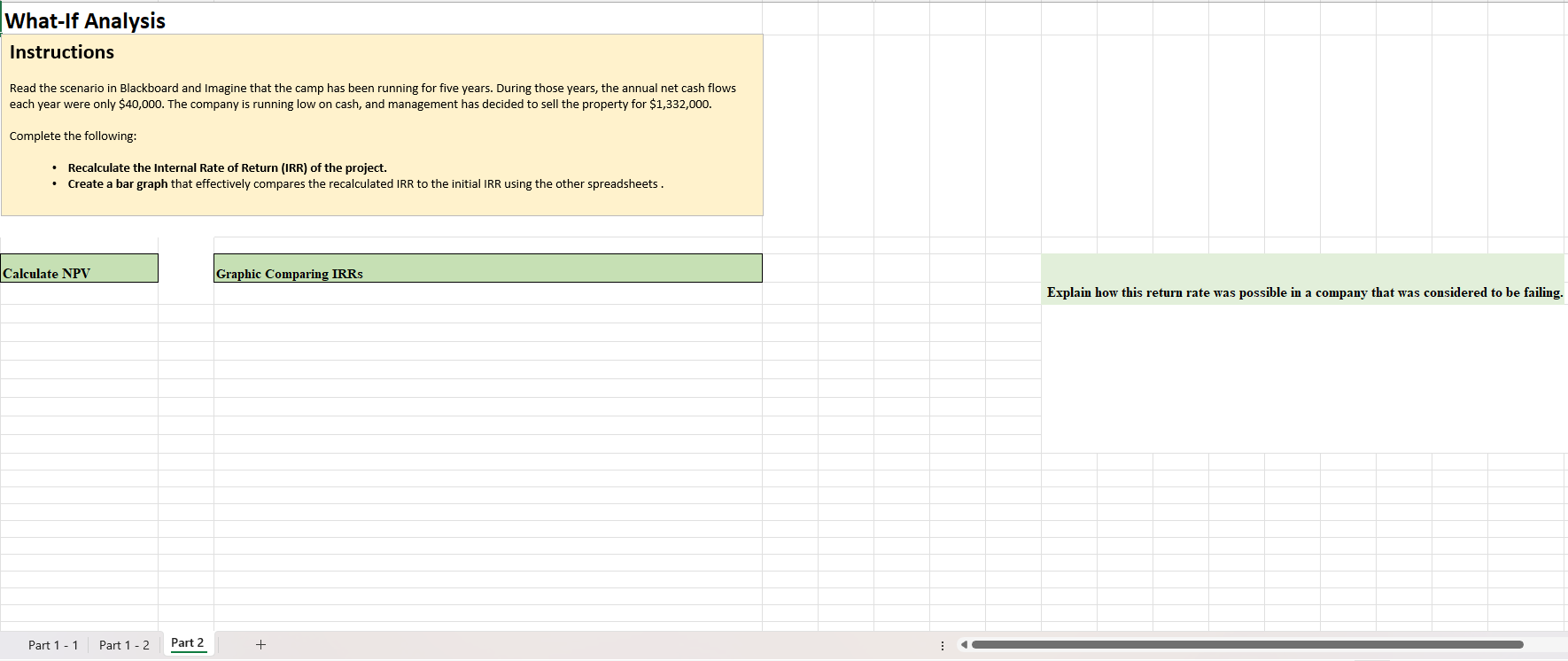

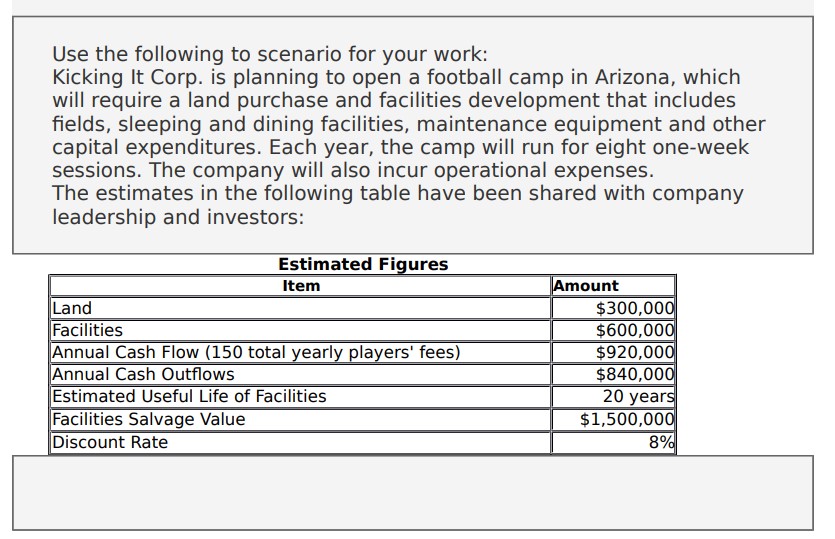

Sensitivity Analysis Instructions Read the assignment scenario in Blackboard and complete the following in the space provided below. Conduct Sensitivity Analysis using the following values: A. Recalculate the new net present value (NPV) and payback period using the following data: 125 players attend the camp. 10% discount rate. Annual Cash flow projection - $805,000. Annual Cash Outflow projection - $750,000. B. Creat a NPV Comparison Graph: Create a graph to compare the NPV from part Part 1-1 to the recalculation in part A of this worksheet. C. Interprete the Sensitivity Analysis: Consider the scenario and your calculations to interpret what the sensitivity A. Recalculate NPV A. Recalculate Payback Period Part 1 - 1 Part 1 - 2 Part 2 + B. NPV Comparison Graph C. Interpretation of Sensitivity Analysis [Enter your response here.] NPV, PP, IRR Calculations Instructions Read the scenario in Blackboard and complete the following in the space provided below. Use the space below to calculate the following for the project: Net Present Value (NPV). Payback Period (PP). Internal Rate of Return (IRR). NPV Calculation Part 1 - 1 Part 1 - 2 Part 2 + Payback Period Calculation Internal Rate of Return Calculation What-If Analysis Instructions Read the scenario in Blackboard and Imagine that the camp has been running for five years. During those years, the annual net cash flows each year were only $40,000. The company is running low on cash, and management has decided to sell the property for $1,332,000. Complete the following: Recalculate the Internal Rate of Return (IRR) of the project. Create a bar graph that effectively compares the recalculated IRR to the initial IRR using the other spreadsheets. Calculate NPV Graphic Comparing IRRS Part 1 - 1 Part 1 - 2 Part 2 + Explain how this return rate was possible in a company that was considered to be failing. Use the following to scenario for your work: Kicking It Corp. is planning to open a football camp in Arizona, which will require a land purchase and facilities development that includes fields, sleeping and dining facilities, maintenance equipment and other capital expenditures. Each year, the camp will run for eight one-week sessions. The company will also incur operational expenses. The estimates in the following table have been shared with company leadership and investors: Land Facilities Estimated Figures Item Annual Cash Flow (150 total yearly players' fees) Annual Cash Outflows Estimated Useful Life of Facilities Facilities Salvage Value Discount Rate Amount $300,000 $600,000 $920,000 $840,000 20 years $1,500,000 8% WEEK 4 ASSIGNMENT - PLANNING FOR CAPITAL INVESTMENTS Week 4 Assignment - Planning for Capital Investments Overview Determining the viability of a long-term capital investment is a fundamental aspect of corporate accounting. In this assignment, you use Excel to make and interpret specified calculations for a capital investment analysis that includes sensitivity and what-if analyses for a proposed football training facility. Instructions Read the following scenario and use the Week 4 Assignment Template [XLSX] to complete this assignment. Specific directions are included in the template. Make sure to complete all tabs for Parts 1 and 2 and follow the directions given in each. Note that you must add functionality to the appropriate spreadsheets to make the proper calculations. Scenario

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started