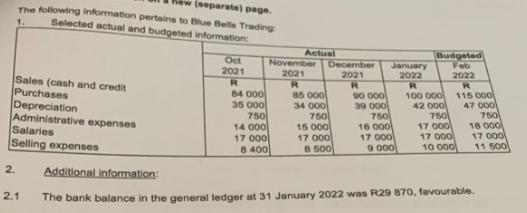

(separate) page. The following information pertains to Blue Bells Trading Selected actual and budgeted information: 1. Sales (cash and credit Purchases Depreciation Administrative expenses

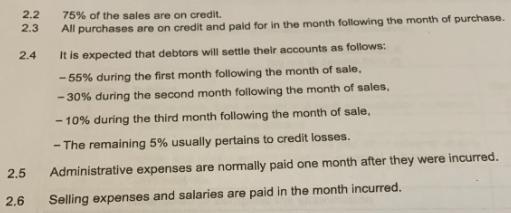

(separate) page. The following information pertains to Blue Bells Trading Selected actual and budgeted information: 1. Sales (cash and credit Purchases Depreciation Administrative expenses Salaries Selling expenses 2. 2.1 Oct 2021 R Actual November December January 2021 2022 2021 R R 84 000 35 000 750 14 000 17 000 8 400 85 000 34 000 750 15 000 17 000 8 500 90 000 39 000 750 16 000 17 000 9 000 Budgeted Feb 2022 R 100 000 42 000 750 17 000 17 000 10 000 R 115 000 47 000 750 18 000 17 000 11 500 Additional information: The bank balance in the general ledger at 31 January 2022 was R29 870, favourable. 2.2 2.3 2.4 2.5 2.6 75% of the sales are on credit. All purchases are on credit and paid for in the month following the month of purchase. It is expected that debtors will settle their accounts as follows: -55% during the first month following the month of sale, -30% during the second month following the month of sales, - 10% during the third month following the month of sale, -The remaining 5% usually pertains to credit losses. Administrative expenses are normally paid one month after they were incurred. Selling expenses and salaries are paid in the month incurred. 2.7 2.8 Rent expenses amount to R10 000 per month. Equipment to the value of R15 000 will be purchased in March. REQUIRED: Prepare the cash budget for Blue Bells Trading for February 2022. NB: Show all calculations. Round all amounts to the nearest rand

Step by Step Solution

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the cash budget for Blue Bells Trading for February 2022 we need to estimate the cash inf...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started