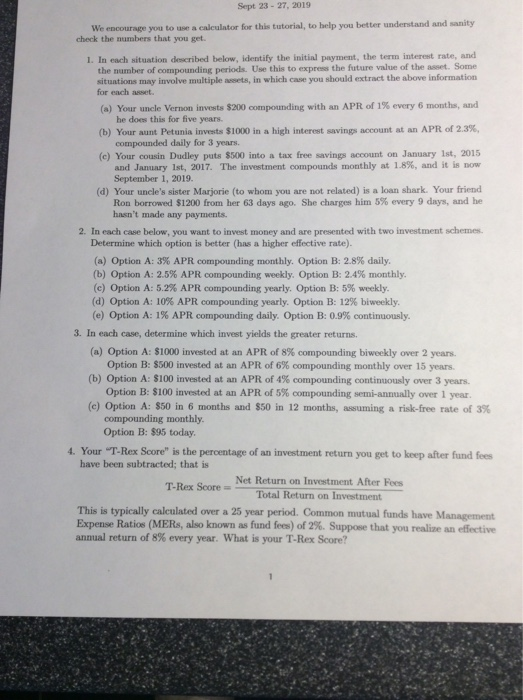

Sept 23 - 27, 2019 We encourage you to use a calculator for this tutorial, to help you better understand and sanity check the numbers that you get. 1. In each situation described below, identify the initial payment, the term interest rate, and the number of compounding periods. Use this to express the future value of the wet. Some situations may involve multiple assets, in which case you should extract the above information for each weet. (a) Your uncle Vernon invests $200 compounding with an APR of 1% every 6 months, and he does this for five years. (b) Your aunt Petunia invests $1000 in a high interest savings account at an APR of 2.3%, compounded daily for 3 years (c) Your cousin Dudley puts $500 into a tax free savings account on January 1st, 2015 and January 1st, 2017. The investment compounds monthly at 1.8%, and it is now September 1, 2019. (d) Your uncle's sister Marjorie (to whom you are not related) is a loan shark. Your friend Ron borrowed $1200 from her 63 days ago. She charges him 5% every 9 days, and he hasn't made any payments. 2. In each case below, you want to invest money and are presented with two investment schemes. Determine which option is better has a higher effective rate). (a) Option A: 3% APR compounding monthly. Option B: 2.8% daily. (b) Option A: 2.5% APR compounding weekly. Option B: 2.4% monthly. (c) Option A: 5.2% APR compounding yearly. Option B: 5% weekly. (d) Option A: 10% APR compounding yearly. Option B: 12% biweekly. (e) Option A: 1% APR compounding daily. Option B: 0.9% continuously. 3. In each case, determine which invest yields the greater returns. (a) Option A: $1000 invested at an APR of 8% compounding biweekly over 2 years. Option B: $500 invested at an APR of 6% compounding monthly over 15 years (b) Option A: $100 invested at an APR of 4% compounding continuously over 3 years. Option B: $100 invested at an APR of 5% compounding semi-annually over 1 year (c) Option A: 850 in 6 months and $50 in 12 months, assuming a risk-free rate of 3% compounding monthly. Option B: $95 today, 4. Your "T-Rex Score" is the percentage of an investment return you get to keep after fund fees have been subtracted; that is Net Return on Investment After Fees T-Rex Score = Total Return on Investment This is typically calculated over a 25 year period. Common mutual funds have Management Expense Ratios (MERs, also known as fund fees) of 2%. Suppose that you realize an effective annual return of 8% every year. What is your T-Rex Score