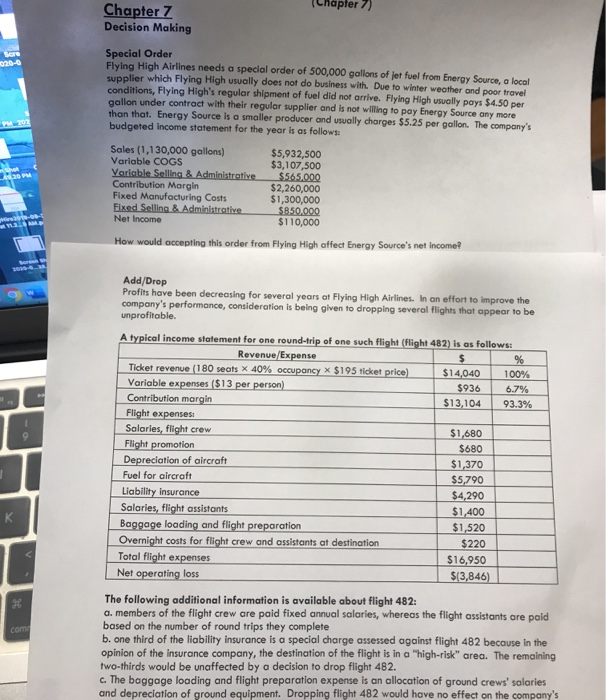

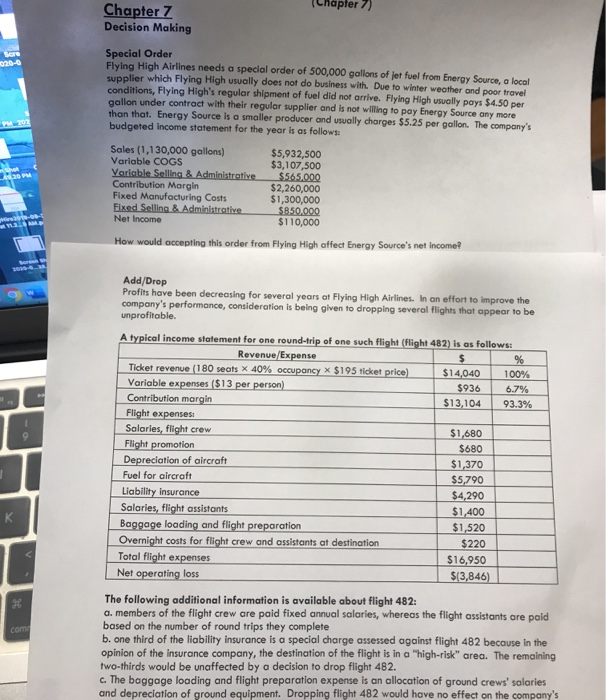

Sere Chapter 72 Chapter 7 Decision Making Special Order Flying High Airlines needs a special order of 500,000 gallons of jet fuel from Energy Source, a local supplier which Flying High usually does not do business with. Due to winter weather and poor travel conditions, Flying High's regular shipment of fuel did not arrive. Flying High usually pays $4.50 per gallon under contract with their regular supplier and is not willing to pay Energy Source any more than that. Energy Source is a smaller producer and usually charges $5.25 per gallon. The company's budgeted income statement for the year is as follows: 70 Sales (1,130,000 gallons) $5,932,500 Variable COGS $3,107,500 Variable Selling & Administrative $565.000 Contribution Margin $2,260,000 Fixed Manufacturing Costs $1,300,000 Fixed Selling & Administrative $850,000 Net Income $110,000 How would accepting this order from Flying High affect Energy Source's net income? Add/Drop Profits have been decreasing for several years at Flying High Airlines. In an effort to improve the company's performance, consideration is being given to dropping several flights that appear to be unprofitable. A typical income statement for one round-trip of one such flight (flight 482) is as follows: Revenue/Expense $ % Ticket revenue (180 seats x 40% occupancy X $195 ticket price) $14,040 100% Variable expenses ($13 per person) $936 6.7% Contribution margin $13,104 93.3% Flight expenses Salaries, flight crew $1,680 Flight promotion $680 Depreciation of aircraft $1,370 Fuel for aircraft $5,790 Liability insurance $4,290 Salaries, flight assistants $1,400 Baggage loading and flight preparation $1,520 Overnight costs for flight crew and assistants at destination $220 Total flight expenses $16.950 Net operating loss $(3,846) The following additional information is available about flight 482: a. members of the flight crew are paid fixed annual salaries, whereas the flight assistants are paid based on the number of round trips they complete b. one third of the liability insurance is a special charge assessed against flight 482 because in the opinion of the insurance company, the destination of the flight is in a "high-risk" area. The remaining two-thirds would be unaffected by a decision to drop flight 482. c. The baggage loading and flight preparation expense is an allocation of ground crews' salaries and depreciation of ground equipment. Dropping flight 482 would have no effect on the company's K 96 come Sere Chapter 72 Chapter 7 Decision Making Special Order Flying High Airlines needs a special order of 500,000 gallons of jet fuel from Energy Source, a local supplier which Flying High usually does not do business with. Due to winter weather and poor travel conditions, Flying High's regular shipment of fuel did not arrive. Flying High usually pays $4.50 per gallon under contract with their regular supplier and is not willing to pay Energy Source any more than that. Energy Source is a smaller producer and usually charges $5.25 per gallon. The company's budgeted income statement for the year is as follows: 70 Sales (1,130,000 gallons) $5,932,500 Variable COGS $3,107,500 Variable Selling & Administrative $565.000 Contribution Margin $2,260,000 Fixed Manufacturing Costs $1,300,000 Fixed Selling & Administrative $850,000 Net Income $110,000 How would accepting this order from Flying High affect Energy Source's net income? Add/Drop Profits have been decreasing for several years at Flying High Airlines. In an effort to improve the company's performance, consideration is being given to dropping several flights that appear to be unprofitable. A typical income statement for one round-trip of one such flight (flight 482) is as follows: Revenue/Expense $ % Ticket revenue (180 seats x 40% occupancy X $195 ticket price) $14,040 100% Variable expenses ($13 per person) $936 6.7% Contribution margin $13,104 93.3% Flight expenses Salaries, flight crew $1,680 Flight promotion $680 Depreciation of aircraft $1,370 Fuel for aircraft $5,790 Liability insurance $4,290 Salaries, flight assistants $1,400 Baggage loading and flight preparation $1,520 Overnight costs for flight crew and assistants at destination $220 Total flight expenses $16.950 Net operating loss $(3,846) The following additional information is available about flight 482: a. members of the flight crew are paid fixed annual salaries, whereas the flight assistants are paid based on the number of round trips they complete b. one third of the liability insurance is a special charge assessed against flight 482 because in the opinion of the insurance company, the destination of the flight is in a "high-risk" area. The remaining two-thirds would be unaffected by a decision to drop flight 482. c. The baggage loading and flight preparation expense is an allocation of ground crews' salaries and depreciation of ground equipment. Dropping flight 482 would have no effect on the company's K 96 come