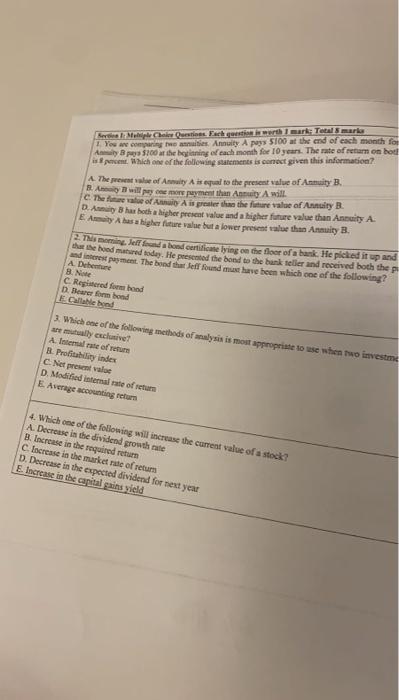

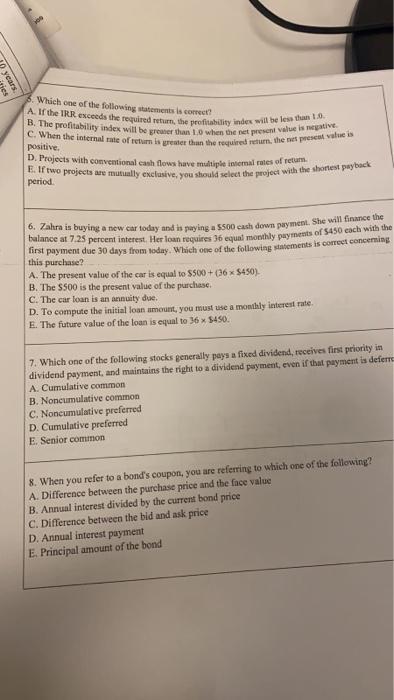

Serie: Mer Fachwerth 1 mark Total mark 1 Yes we competes Annuity A pass 5100 at the end of each month for Los 100 at the beginning of each month for 10 years. The rate of return on hod pace. Which one of the following statements is connect given this information? A. The present of Annuity Aisal to the present value of Asmat B. By will pay or payment than Annuity Awill C. The fare value of A is greater than the future value of Any B. D. Any has both a higher present value and a higher future value than Aity A Ey A has a higher future valer but a lower present value than Asty 2. This memin, Jeff band certificate lying on the floor of a bank. He picked it up and the bond mature today. He presented the bond to the bank teller and received both the p and interessent. The bond that Jeff found must have been which coe of the following? A Deere 8. Note C Regismered for hond D. Beserform bond Ee bad 3. Which one of the following methods of analysis is most appropriate to use when two investme mutually exclusive? A. Internal rate of retum R. Profitability index C. Net prevale D. Modified internal rate of return E. Average accounting return 4. Which one of the following will increase the current value of a stock? A Decrease in the dividend growth rate B. Increase in the required return C Increase in the market rate of return D. Decrease in the expected dividend for next year Elecrease in the capital gains yield cars 3. Which one of the following statements is correct? A if the IRR exceeds the required return, the profitability index will be less that B. The profitability index will be goner than to when the net present value is negative C. When the internal me ofruger than the required turn the prescue is positive D. Projects with conventional cash flows have multiple intemni rates of retum E. If two projects are mutually exclusive, you should select the project with the shortest payback period 6. Zahra in buying a new car today and is paying a 5500 cash down payment. She will finance the balance at 7.25 percent interest. Her loun requires 36 equal monthly payments of 5450 each with the first payment due 30 days from today. Which one of the following statements is correct concerning this purchase? A. The present value of the car is equal to $500 + 36 XS450) B. The $500 is the present value of the purchase C. The car loan is an annuity due D. To compute the initial loan amount, you must use a monthly interest rate E. The future value of the loan is equal to 36 $450. 7. Which one of the following stocks generally pays a fixed dividend, receives first priority in dividend payment, and maintains the right to a dividend payment, even if that payment is deferre a A. Cumulative common B. Noncumulative common C. Noncumulative preferred D. Cumulative preferred E. Senior common 8. When you refer to a bond's coupon, you are referring to which one of the following? A. Difference between the purchase price and the face value B. Annual interest divided by the current bond price C. Difference between the bid and ask price D. Annual interest payment E. Principal amount of the bond Serie: Mer Fachwerth 1 mark Total mark 1 Yes we competes Annuity A pass 5100 at the end of each month for Los 100 at the beginning of each month for 10 years. The rate of return on hod pace. Which one of the following statements is connect given this information? A. The present of Annuity Aisal to the present value of Asmat B. By will pay or payment than Annuity Awill C. The fare value of A is greater than the future value of Any B. D. Any has both a higher present value and a higher future value than Aity A Ey A has a higher future valer but a lower present value than Asty 2. This memin, Jeff band certificate lying on the floor of a bank. He picked it up and the bond mature today. He presented the bond to the bank teller and received both the p and interessent. The bond that Jeff found must have been which coe of the following? A Deere 8. Note C Regismered for hond D. Beserform bond Ee bad 3. Which one of the following methods of analysis is most appropriate to use when two investme mutually exclusive? A. Internal rate of retum R. Profitability index C. Net prevale D. Modified internal rate of return E. Average accounting return 4. Which one of the following will increase the current value of a stock? A Decrease in the dividend growth rate B. Increase in the required return C Increase in the market rate of return D. Decrease in the expected dividend for next year Elecrease in the capital gains yield cars 3. Which one of the following statements is correct? A if the IRR exceeds the required return, the profitability index will be less that B. The profitability index will be goner than to when the net present value is negative C. When the internal me ofruger than the required turn the prescue is positive D. Projects with conventional cash flows have multiple intemni rates of retum E. If two projects are mutually exclusive, you should select the project with the shortest payback period 6. Zahra in buying a new car today and is paying a 5500 cash down payment. She will finance the balance at 7.25 percent interest. Her loun requires 36 equal monthly payments of 5450 each with the first payment due 30 days from today. Which one of the following statements is correct concerning this purchase? A. The present value of the car is equal to $500 + 36 XS450) B. The $500 is the present value of the purchase C. The car loan is an annuity due D. To compute the initial loan amount, you must use a monthly interest rate E. The future value of the loan is equal to 36 $450. 7. Which one of the following stocks generally pays a fixed dividend, receives first priority in dividend payment, and maintains the right to a dividend payment, even if that payment is deferre a A. Cumulative common B. Noncumulative common C. Noncumulative preferred D. Cumulative preferred E. Senior common 8. When you refer to a bond's coupon, you are referring to which one of the following? A. Difference between the purchase price and the face value B. Annual interest divided by the current bond price C. Difference between the bid and ask price D. Annual interest payment E. Principal amount of the bond