Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SERVCO is a corp which receives service fee income from independent party - $20,000 in 2020. That's all SERVCO has from income side. SERVCO

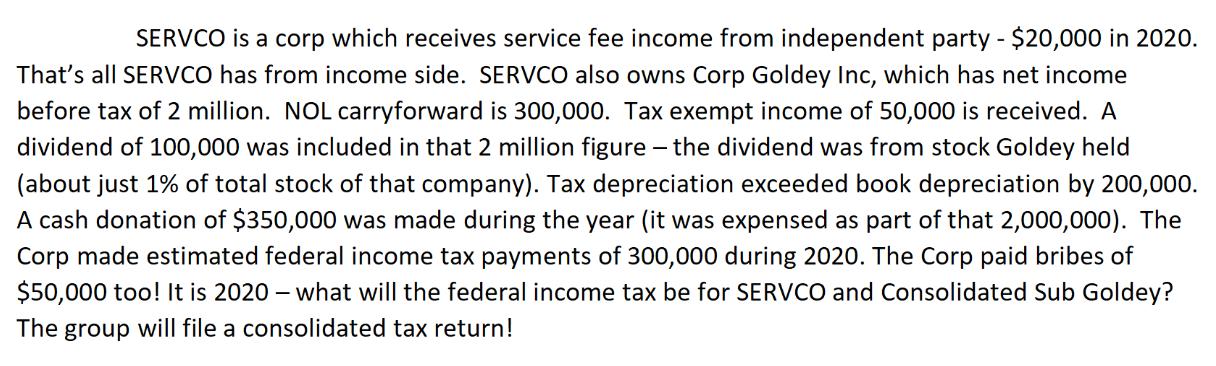

SERVCO is a corp which receives service fee income from independent party - $20,000 in 2020. That's all SERVCO has from income side. SERVCO also owns Corp Goldey Inc, which has net income before tax of 2 million. NOL carryforward is 300,000. Tax exempt income of 50,000 is received. A dividend of 100,000 was included in that 2 million figure - the dividend was from stock Goldey held (about just 1% of total stock of that company). Tax depreciation exceeded book depreciation by 200,000. A cash donation of $350,000 was made during the year (it was expensed as part of that 2,000,000). The Corp made estimated federal income tax payments of 300,000 during 2020. The Corp paid bribes of $50,000 too! It is 2020 - what will the federal income tax be for SERVCO and Consolidated Sub Goldey? The group will file a consolidated tax return!

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Solution To determine the federal income tax for SERVCO and Consolidated Sub Goldey we need to first ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started