Service Price per hour provided: $97.75 Sales Price per unit of inventory sold: $75.25 Cost per unit of inventory sold: $33.75

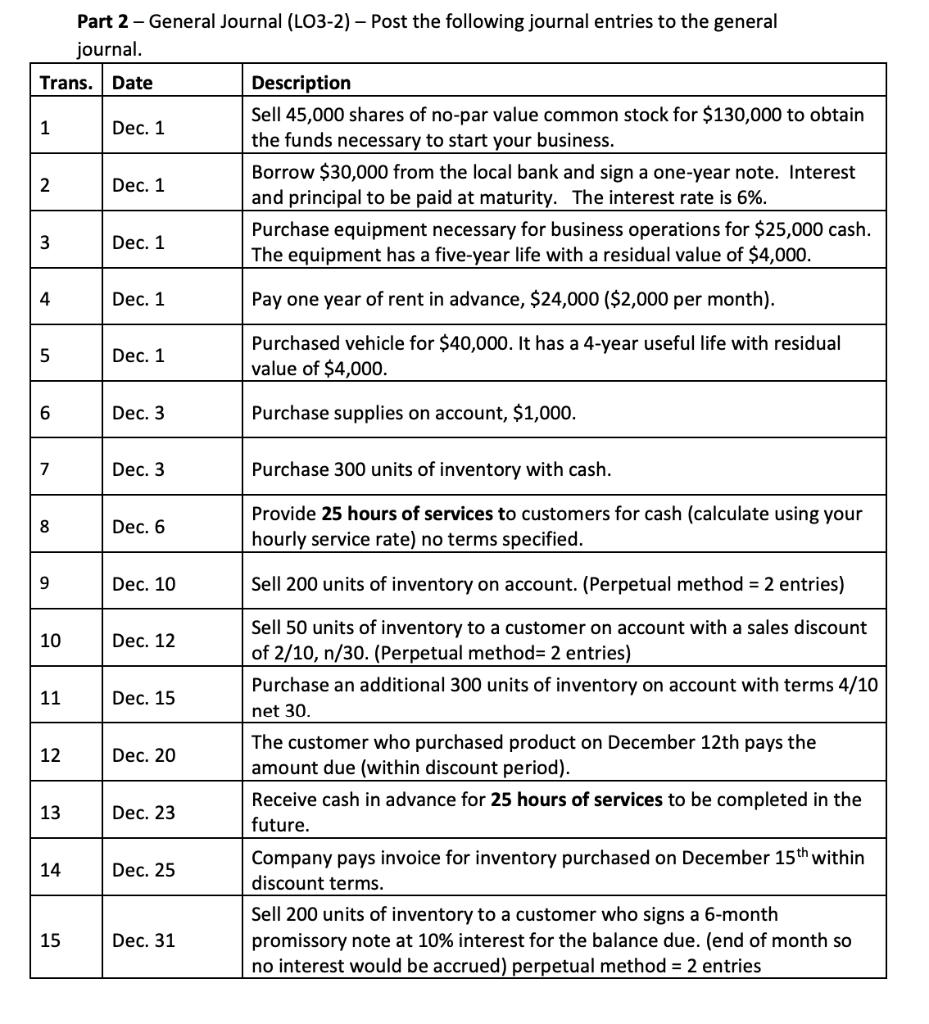

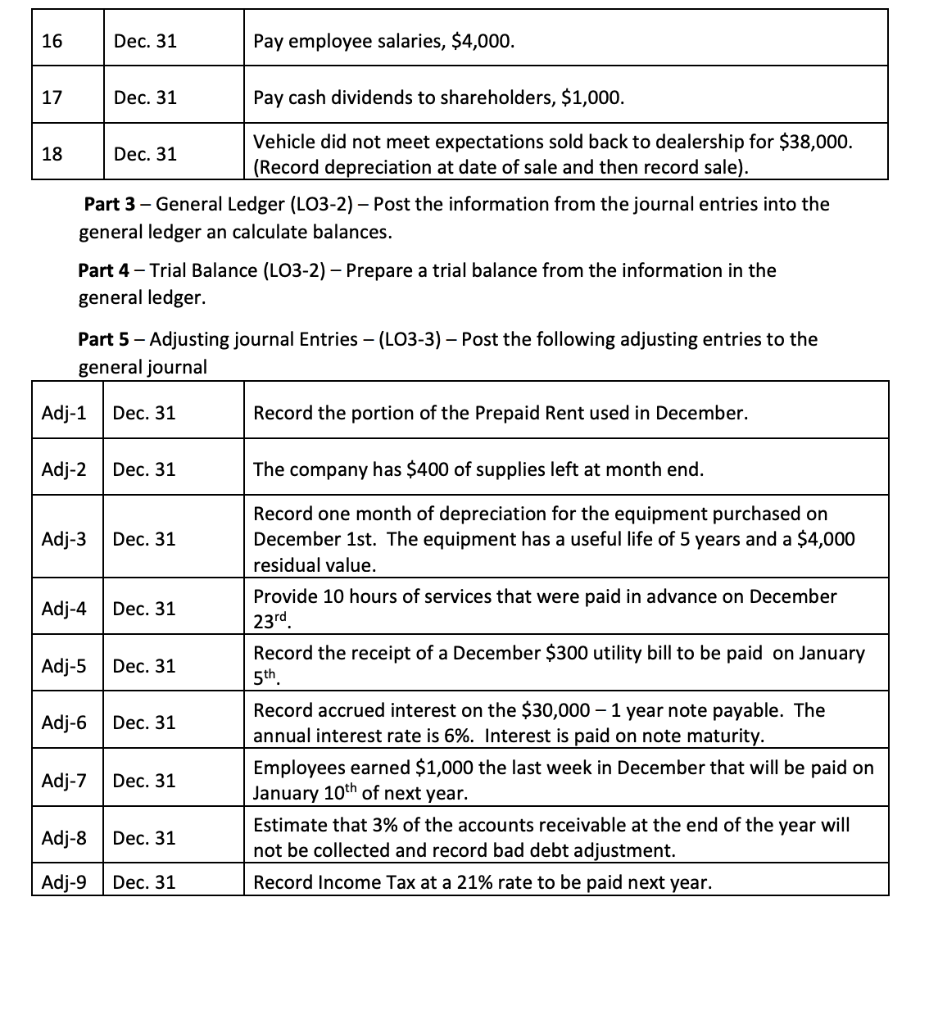

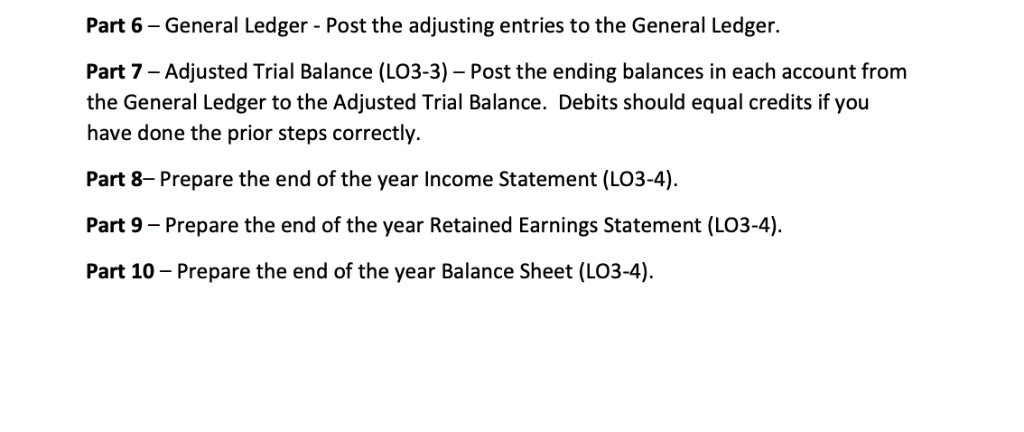

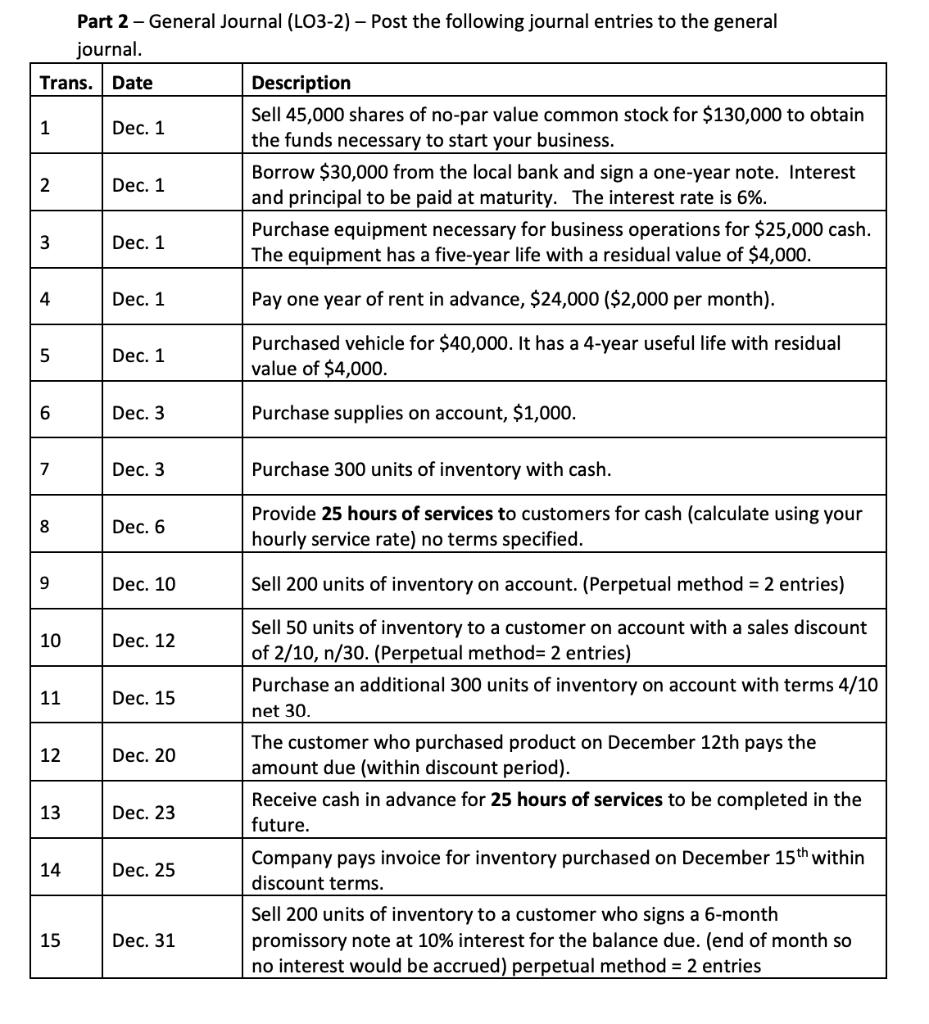

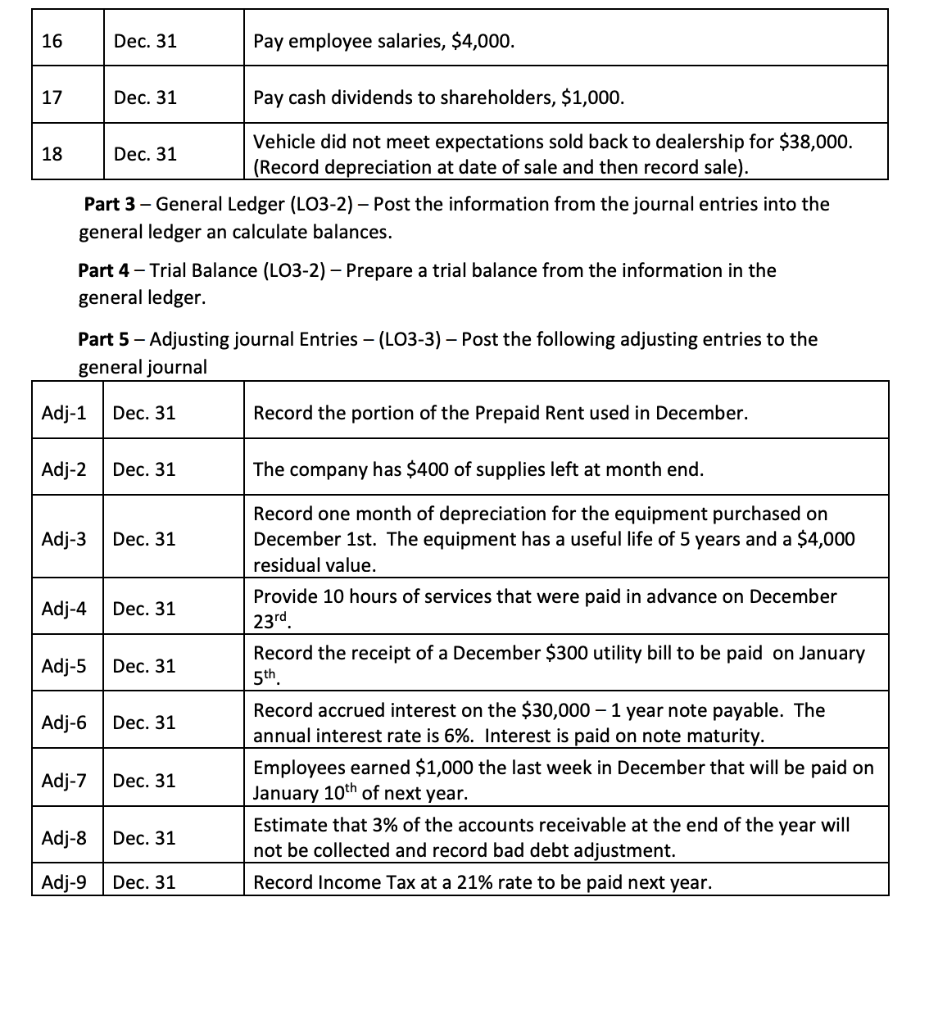

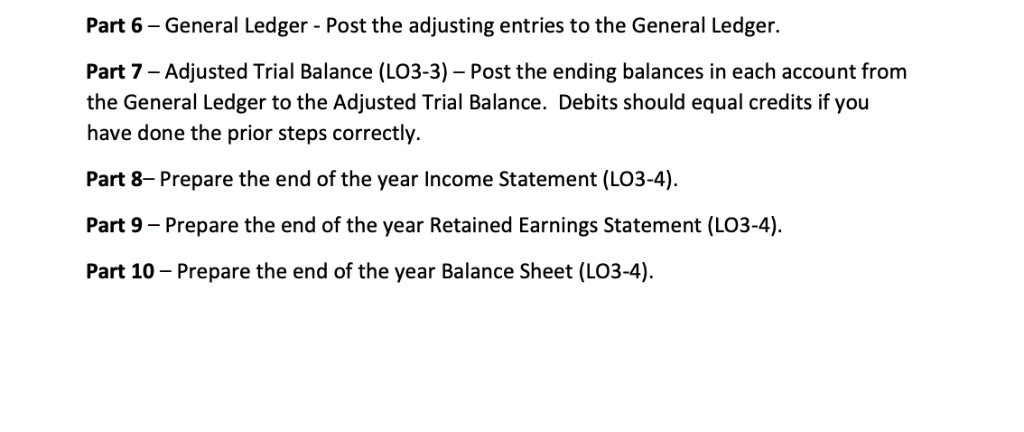

Part 2 - General Journal (LO3-2) Post the following journal entries to the general journal. Trans. Date Description Sell 45,000 shares of no-par value common stock for $130,000 to obtain Dec. 1 the funds necessary to start your business. Borrow $30,000 from the local bank and sign a one-year note. Interest Dec. 1 and principal to be paid at maturity. The interest rate is 6%. Purchase equipment necessary for business operations for $25,000 cash. Dec. 1 The equipment has a five-year life with a residual value of $4,000. Dec. 1 Pay one year of rent in advance, $24,000 ($2,000 per month). Dec. 1 Purchased vehicle for $40,000. It has a 4-year useful life with residual value of $4,000. Dec. 3 Purchase supplies on account, $1,000. 7 Dec. 3 Purchase 300 units of inventory with cash. Dec. 6 Provide 25 hours of services to customers for cash (calculate using your hourly service rate) no terms specified. Dec. 10 Sell 200 units of inventory on account. (Perpetual method = 2 entries) Dec. 12 Dec. 15 Dec. 20 Sell 50 units of inventory to a customer on account with a sales discount of 2/10, n/30. (Perpetual method= 2 entries) Purchase an additional 300 units of inventory on account with terms 4/10 net 30. The customer who purchased product on December 12th pays the amount due (within discount period). Receive cash in advance for 25 hours of services to be completed in the future. Company pays invoice for inventory purchased on December 15th within discount terms. Sell 200 units of inventory to a customer who signs a 6-month promissory note at 10% interest for the balance due. (end of month so no interest would be accrued) perpetual method = 2 entries Dec. 23 14 Dec. 25 Dec. 31 Dec. 31 Pay employee salaries, $4,000. 17 Dec. 31 Pay cash dividends to shareholders, $1,000. Dec. 31 Vehicle did not meet expectations sold back to dealership for $38,000. (Record depreciation at date of sale and then record sale). Part 3 - General Ledger (LO3-2) - Post the information from the journal entries into the general ledger an calculate balances. Part 4 - Trial Balance (L03-2) - Prepare a trial balance from the information in the general ledger. Part 5 - Adjusting journal Entries - (LO3-3) - Post the following adjusting entries to the general journal Adj-1 Dec. 31 Record the portion of the Prepaid Rent used in December. Adj-2 Dec. 31 The company has $400 of supplies left at month end. Adj-3 Dec. 31 Record one month of depreciation for the equipment purchased on December 1st. The equipment has a useful life of 5 years and a $4,000 residual value. Provide 10 hours of services that were paid in advance on December 23rd Record the receipt of a December $300 utility bill to be paid on January Adj-4 Dec. 31 Adj-5 Dec. 31 5th. Adj-6 Dec. 31 Adj-7 Dec. 31 Record accrued interest on the $30,000 - 1 year note payable. The annual interest rate is 6%. Interest is paid on note maturity. Employees earned $1,000 the last week in December that will be paid on January 10th of next year. Estimate that 3% of the accounts receivable at the end of the year will not be collected and record bad debt adjustment. Record Income Tax at a 21% rate to be paid next year. Adj-8 Dec. 31 Adj-9 Dec. 31 Part 6 - General Ledger - Post the adjusting entries to the General Ledger. Part 7 - Adjusted Trial Balance (LO3-3) - Post the ending balances in each account from the General Ledger to the Adjusted Trial Balance. Debits should equal credits if you have done the prior steps correctly. Part 8- Prepare the end of the year Income Statement (LO3-4). Part 9 - Prepare the end of the year Retained Earnings Statement (LO3-4). Part 10 - Prepare the end of the year Balance Sheet (LO3-4)