Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sesco Bhd. (Sesco) manufactures electronic components for the domestic market. Covid-19 has impacted many businesses. The Board of Directors is of the opinion that

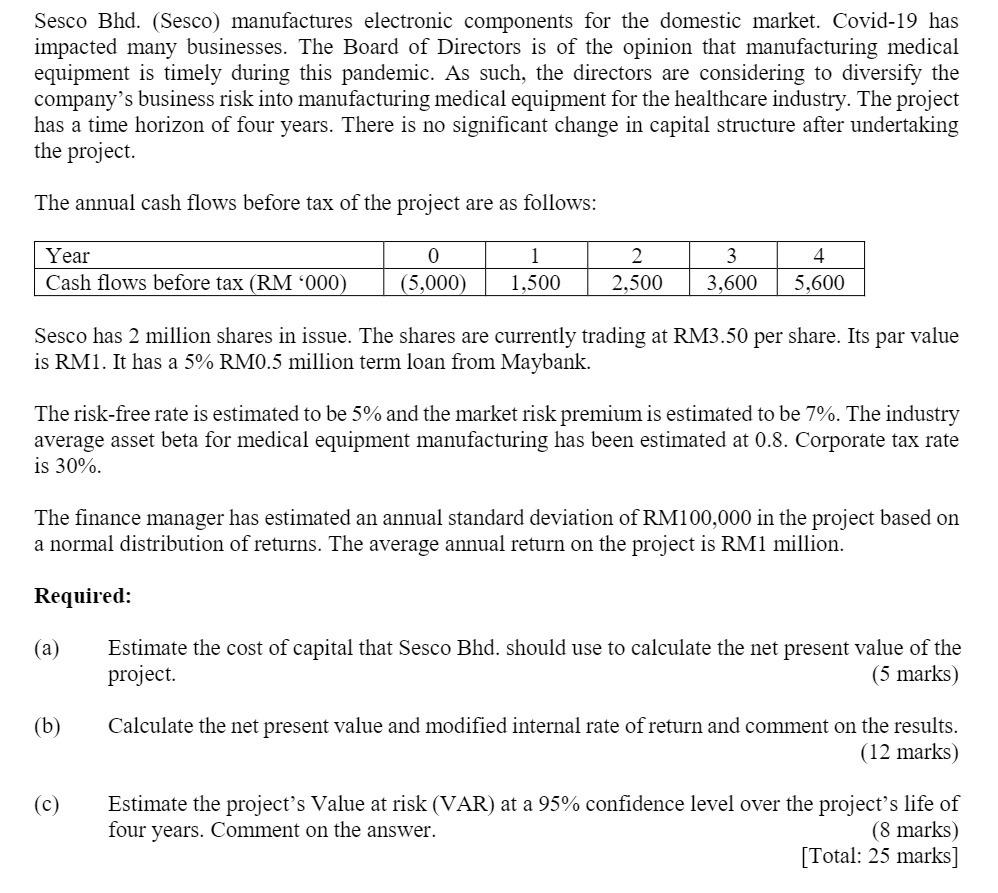

Sesco Bhd. (Sesco) manufactures electronic components for the domestic market. Covid-19 has impacted many businesses. The Board of Directors is of the opinion that manufacturing medical equipment is timely during this pandemic. As such, the directors are considering to diversify the company's business risk into manufacturing medical equipment for the healthcare industry. The project has a time horizon of four years. There is no significant change in capital structure after undertaking the project. The annual cash flows before tax of the project are as follows: Year Cash flows before tax (RM '000) 0 (5,000) (a) 1,500 (b) 2 2,500 Sesco has 2 million shares in issue. The shares are currently trading at RM3.50 per share. Its par value is RM1. It has a 5% RM0.5 million term loan from Maybank. (c) 3 3,600 The risk-free rate is estimated to be 5% and the market risk premium is estimated to be 7%. The industry average asset beta for medical equipment manufacturing has been estimated at 0.8. Corporate tax rate is 30%. 4 5,600 The finance manager has estimated an annual standard deviation of RM100,000 in the project based on a normal distribution of returns. The average annual return on the project is RM1 million. Required: Estimate the cost of capital that Sesco Bhd. should use to calculate the net present value of the project. (5 marks) Calculate the net present value and modified internal rate of return and comment on the results. (12 marks) Estimate the project's Value at risk (VAR) at a 95% confidence level over the project's life of four years. Comment on the answer. (8 marks) [Total: 25 marks]

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Lets break down your questions step by step a Estimate the cost of capital that Sesco Bhd should use to calculate the net present value of the project 5 marks The cost of capital is the required rate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started