Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sesi 2. Question to be discussed Are the trained staff assets of Open Safari? (Note: Open Safari has incurred significant staff training costs and some

Sesi 2. Question to be discussed

- Are the trained staff assets of Open Safari? (Note: Open Safari has incurred significant staff training costs and some staff possess specialised skills that are essential for Open Safari’s operations.)

- Which Standards apply when accounting for the acquisition of Freelands and the assets constructed thereon?

- What judgements and estimates are made to measure the cost of the property, plant and equipment (PPE)—staff housing, lodge, balloons, helicopter—at initial recognition?

- Would Open Safari depreciate any of its PPE (amortise any of its intangible assets) during 20X0–20X2? If so, when would depreciation of each item of PPE start?

- Other depreciation/amortisation issues (discuss judgements and estimates to be made in respect of each item of PPE even if depreciation of the item will start only in 20X3):

- How to determine whether components of that item must be depreciated separately?

- How to determine which depreciation method must be used?

- How to determine the residual value?

- How to determine the useful life?

- What additional judgements and estimates would be made for any class of PPE for which Open Safari follows an accounting policy of revaluing?

- Is the website an asset of Open Safari?

- Do the expenditures on advertising and promotion activities (for example, attending the trade fair) generate an asset as defined for Open Safari (ignore recognition requirements)?

- Are the unused chemicals, chemical spraying equipment and machetes assets of Open Safari?

- Is the initial operating loss an asset of Open Safari?

- Which Standards apply when accounting for the elements (for example, assets) identified from the information provided for Open Safari in 20X3?

- Which, if any, of the assets identified in 20X3 does IFRS prohibit Open Safari from recognising as an asset (and why)?

- What is the ‘unit of account’ for the assets recognised by Open Safari for the first time in 20X3?

- What judgements and estimates are made to measure the cost of the website at initial recognition?

- Which assets would Open Safari depreciate/amortise for the first time in 20X3? When would depreciation/amortisation start?

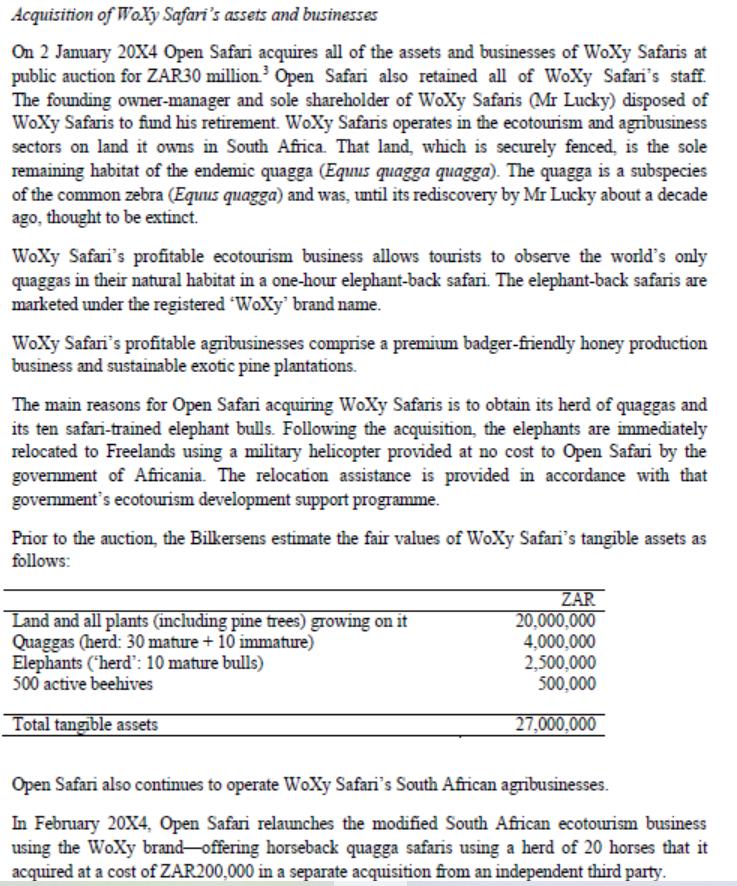

- Identify the assets acquired by Open Safari at the date of acquisition of WoXy Safaris?

- Assuming that goodwill arises in the accounting for the acquisition of WoXy Safari: is the goodwill an asset of Open Safari?

- Which Standards apply when accounting for the elements (for example, assets) identified from the information provided for Open Safari in 20X4?

- Which, if any, of the assets identified in 20X4 does IFRS prohibit Open Safari from recognising as an asset (and why)?

- Which assets would Open Safari depreciate/amortise for the first time in 20X4? When would depreciation/amortisation start?

- Other depreciation/amortisation issues (discuss judgements and estimates to be made in respect of each item of PPE even if the depreciation of the item will start only in 20X4):

- How to determine whether components of that item must be depreciated separately?

- How to determine which depreciation method must be used?

- How to determine the residual value?

- How to determine the useful life?

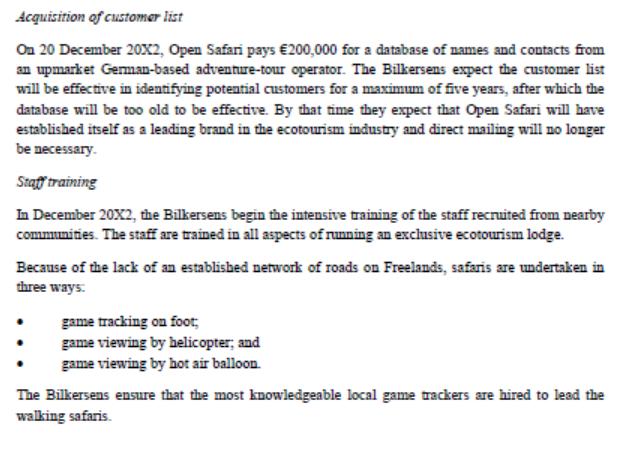

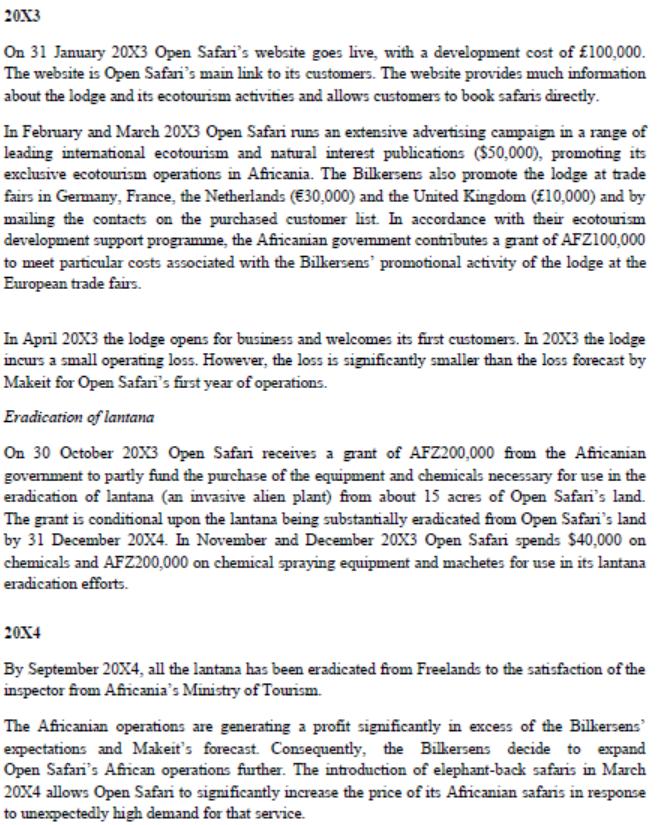

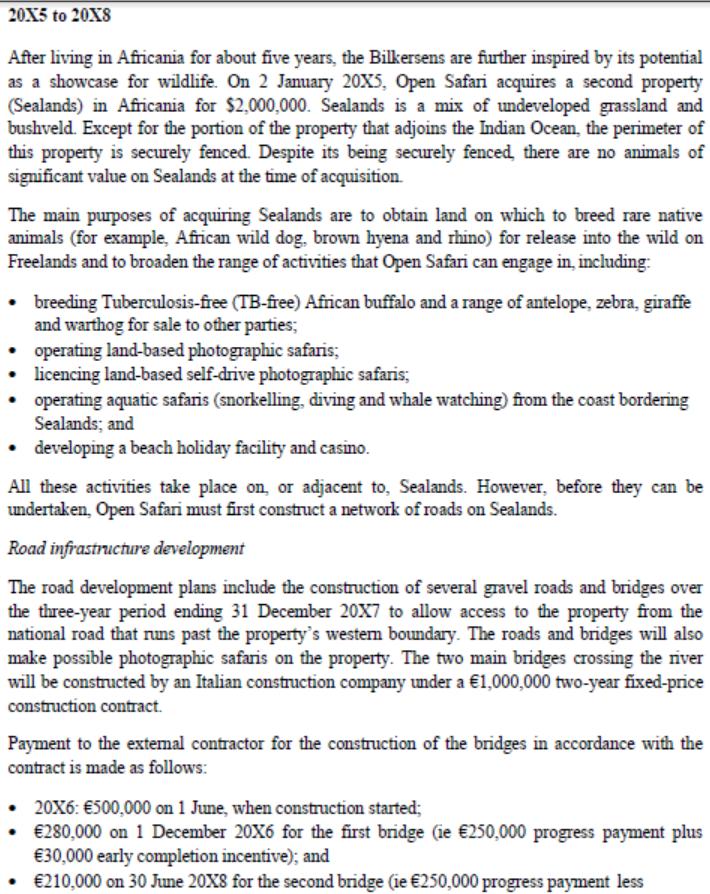

The Open Country Safari Company Case Study Michael JC Wells, Director, IFRS Education Initiative, IFRS Foundation Ann Tarca, former Academic Fellow, IFRS Education Initiative, IFRS Foundation and Professor of Accounting, Business School, University of Western Australia This material has benefited greatly from the feedback and comments from people attending a series of workshops on the Framework-based approach to teaching International Financial Reporting Standards (IFRS) organised by the IFRS Foundation and others and from peer review by a number of anonymous reviewers. Background Makeit PLC is a company listed on the London Stock Exchange. The company has operated successfully in the manufacturing sector for more than twenty years and for many years has prepared its financial statements in accordance with International Financial Reporting Standards (IFRS). Although Makeit presents its financial statements in British Pounds (), its functional currency is the Euro (). In 20X0 Makeit's board of directors decide to expand Makeit's operations into new types of business and into a geographical location in which it currently does not operate-Sub-Saharan Africa. Accordingly, management selects a number of activities in Southern Africa to be carried out as part of a ten-year diversification plan. The company appoints James and Judith Bilkersen to manage its African operations, under the brand name The Open Country Safari Company (Open Safan). The Bilkersens have over fifteen years' experience in the hospitality industry in Africa and they share a passion for conserving wildlife and natural habitats. Makeit intends to operate a safari lodge and other African operations indefinitely. Open Safari prepares financial statements in compliance with IFRS. Events in 20X0-20X2 On 2 January 20X0, Makeit incorporates a wholly-owned separate legal entity, Open Safari, in the Republic of Africania (Africania) by contributing 10,000,000 to form Open Safari's permanent capital. On 3 January 20X0, Open Safari obtains an 8,000,000 loan facility from a British bank. The loan is denominated in British pounds (). The loan agreement obligates the bank to transfer 8,000,000 to Open Safari on 3 January 20X0 and Open Safari to transfer to the bank ten years later 13,031,157 on 2 January 20Y0 (in full and final settlement of the loan). Makeit guarantees all payments to the bank in the event that Open Safari defaults.

Step by Step Solution

★★★★★

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Are the trained staff assets of Open Safari Note Open Safari has incurred significant staff training costs and some staff possess specialised skills that are essential for Open Safaris operations In a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started