Answered step by step

Verified Expert Solution

Question

1 Approved Answer

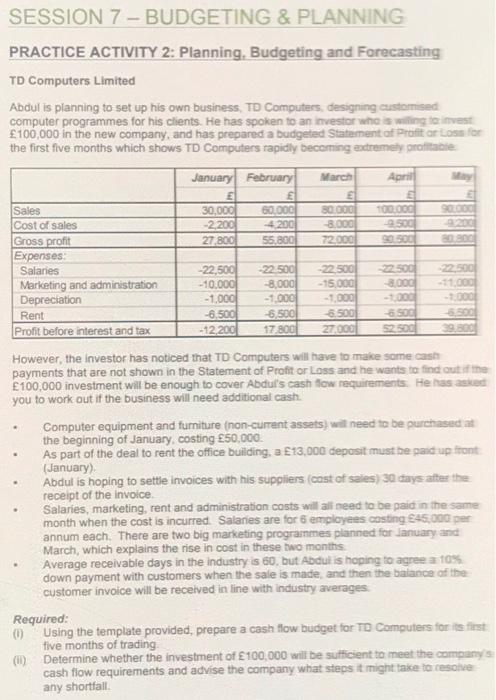

SESSION 7- BUDGETING & PLANNING PRACTICE ACTIVITY 2: Planning, Budgeting and Forecasting TD Computers Limited Abdul is planning to set up his own business, TD

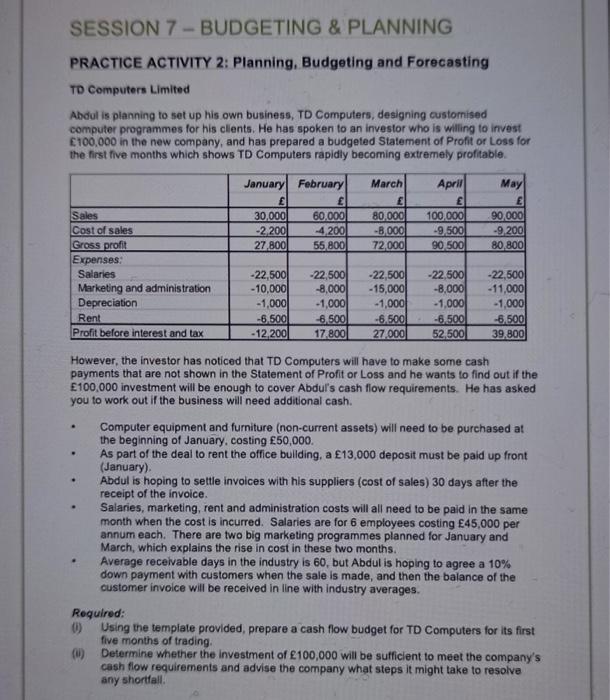

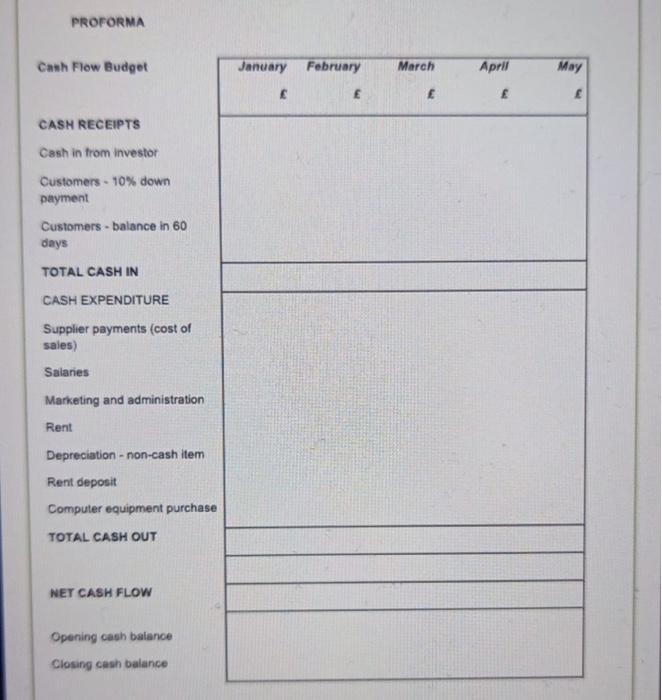

SESSION 7- BUDGETING & PLANNING PRACTICE ACTIVITY 2: Planning, Budgeting and Forecasting TD Computers Limited Abdul is planning to set up his own business, TD Computers, designing customised computer programmes for his clients. He has spoken to an investor who is willing to invest 100,000 in the new company, and has prepared a budgeted Statement of Profit or Loss for the first five months which shows TD Computers rapidly becoming extremely profitable. Sales Cost of sales Gross profit Expenses: Salaries Marketing and administration Depreciation Rent Profit before interest and tax January 30,000 -2,200 27,800 -22,500 10,000 -1,000 -6,500 -12,200 February March 60,000 -4,200 55,800 80,000 -8.000 72,000 -22,500 -22,500 -8,000 -15.000 -1,000 -1,000 -6,500 -6,500 17,800 27.000 April 1 100,000 -9,500 90.500 -22,500 -8,000 -1,000 -6,500 52,500 May 90,000 -9,200 80,800 However, the investor has noticed that TD Computers will have to make some cash payments that are not shown in the Statement of Profit or Loss and he wants to find out if the 100,000 investment will be enough to cover Abdul's cash flow requirements. He has asked you to work out if the business will need additional cash. -22.500 -11,000 -1,000 -6,500 39,800 Computer equipment and furniture (non-current assets) will need to be purchased at the beginning of January, costing 50,000. As part of the deal to rent the office building, a 13,000 deposit must be paid up front (January). Abdul is hoping to settle invoices with his suppliers (cast of sales) 30 days after the receipt of the invoice. Salaries, marketing, rent and administration costs will all need to be paid in the same month when the cost is incurred. Salaries are for 6 employees casting 45,000 per annum each. There are two big marketing programmes planned for January and March, which explains the rise in cost in these two months. Average receivable days in the industry is 60, but Abdul is hoping to agree a 10% down payment with customers when the sale is made, and then the balance of the customer invoice will be received in line with industry averages. Required: (0) Using the template provided, prepare a cash flow budget for TD Computers for its first five months of trading. Determine whether the investment of 100,000 will be sufficient to meet the company's cash flow requirements and advise the company what steps it might take to resolve any shortfall.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started