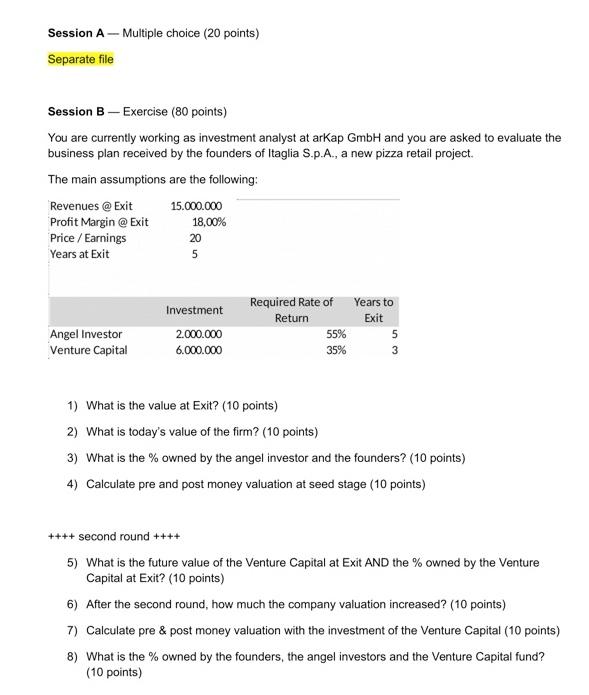

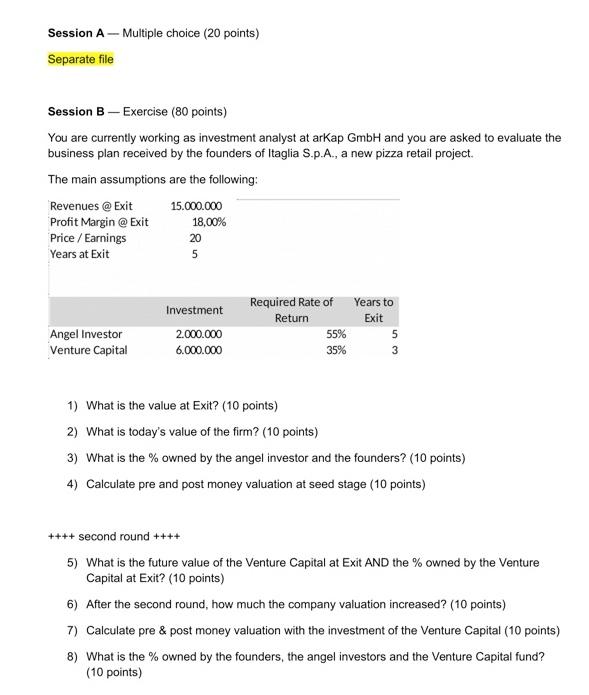

Session A - Multiple choice (20 points) Separate file Session B - Exercise (80 points) You are currently working as investment analyst at arkap GmbH and you are asked to evaluate the business plan received by the founders of Itaglia S.p.A., a new pizza retail project. The main assumptions are the following: Revenues @ Exit 15.000.000 Profit Margin @ Exit 18,00% Price / Earnings 20 Years at Exit 5 Required Rate of Return Investment 2.000.000 6.000.000 Years to Exit 5 3 Angel Investor Venture Capital 55% 35% 1) What is the value at Exit? (10 points) 2) What is today's value of the firm? (10 points) 3) What is the % owned by the angel investor and the founders? (10 points) 4) Calculate pre and post money valuation at seed stage (10 points) ++++ second round ++++ 5) What is the future value of the Venture Capital at Exit AND the % owned by the Venture Capital at Exit? (10 points) 6) After the second round, how much the company valuation increased? (10 points) 7) Calculate pre & post money valuation with the investment of the Venture Capital (10 points) 8) What is the % owned by the founders, the angel investors and the Venture Capital fund? (10 points) Session A - Multiple choice (20 points) Separate file Session B - Exercise (80 points) You are currently working as investment analyst at arkap GmbH and you are asked to evaluate the business plan received by the founders of Itaglia S.p.A., a new pizza retail project. The main assumptions are the following: Revenues @ Exit 15.000.000 Profit Margin @ Exit 18,00% Price / Earnings 20 Years at Exit 5 Required Rate of Return Investment 2.000.000 6.000.000 Years to Exit 5 3 Angel Investor Venture Capital 55% 35% 1) What is the value at Exit? (10 points) 2) What is today's value of the firm? (10 points) 3) What is the % owned by the angel investor and the founders? (10 points) 4) Calculate pre and post money valuation at seed stage (10 points) ++++ second round ++++ 5) What is the future value of the Venture Capital at Exit AND the % owned by the Venture Capital at Exit? (10 points) 6) After the second round, how much the company valuation increased? (10 points) 7) Calculate pre & post money valuation with the investment of the Venture Capital (10 points) 8) What is the % owned by the founders, the angel investors and the Venture Capital fund? (10 points)