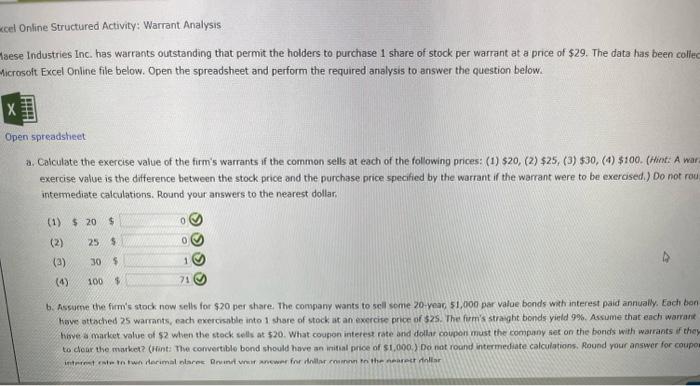

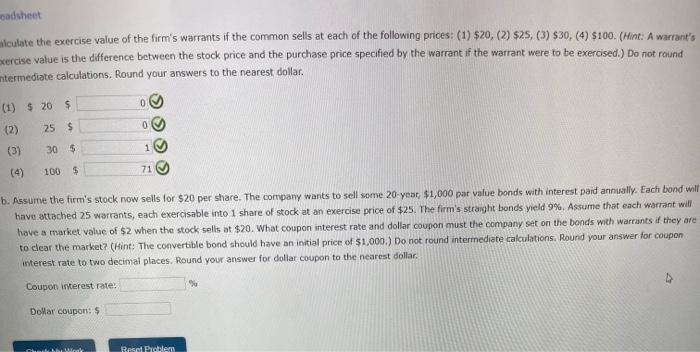

set Online Structured Activity: Warrant Analysis. sese Industries Inc. has warrants outstanding that permit the holders to purchase 1 share of stock per warrant at a price of $29. The data has been coliec icrosolt Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet a. Calculate the exercise value of the firm's warrants if the common sells at each of the following prices: (1) $20, (2) $25, (3) $30, (4) $100. (Hint: A war exercise value is the difference between the stock price and the purchase price specified by the warrant if the warrant were to be exerased.) Do not rou intermediate calculations. Round your answers to the nearest dollar. (1) $20$ (2) 25 i (3) 30$ (4) 100+ 6. Assuene the firm's stock now sells for $20 per share. The company wants to sell some 20-year, 51,000 par value bendls wath interest paid annually, Each bon Hove ottached 25 warrants, each exercisible into 1 share of stock at an exercike price of 525 . The furmis straght bonds yield 9%, Assume that each warrant hiwe a market value of $2 when the stock sells at $20. What coupon interes rate ond dollar coupon must the company set on the bonds with warrants if they to dour the makket? (Hint: the comvertible bond should hove an initial price of $1,000 ) Do not round intermediate calculations, Round vour answer for coupo Iculate the exercise value of the firm's warrants if the common sells at each of the following prices: (1) $20,(2)$25,(3)$30, (4) $100. (Hint: A warrant's cercise value is the difference between the stock price and the purchase price specified by the warrant if the warrant were to be exercised.) Do not round termediate calculations. Round your answers to the nearest dollar. (1) 520$ (2) 255 (3) 305 (4) 100$ . Assume the firm's stock now sells for $20 per share. The company wants to sell some 20-yeat, $1,000 par value bonds with interest paid annually. Each bond will have attached 25 warrants, each exercisable into 1 share of stock at an exercise price of $25. The firm's straight bonds yield 9%. Assume that each warrant will have a market value of $2 when the stock sells at $20. What coupon interest rate and dollar coupon must the company set on the bonds with warrants if they are to clear the market? (Hint: The convertible bond should have an initial price of \$1,000.) Do not round intermediate calculations. Round your answer for coupon interest rate to two decimal places. Round your answer for dollar coupon to the nearest dollar. Coupon interest rate: Dollar coupon: $