Answered step by step

Verified Expert Solution

Question

1 Approved Answer

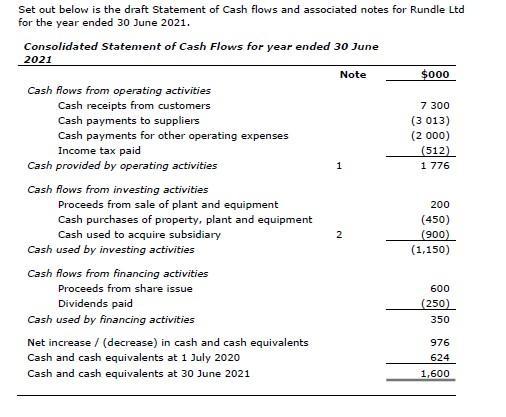

Set out below is the draft Statement of Cash flows and associated notes for Rundle Ltd for the year ended 30 June 2021. Consolidated

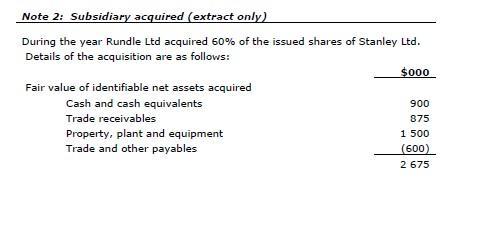

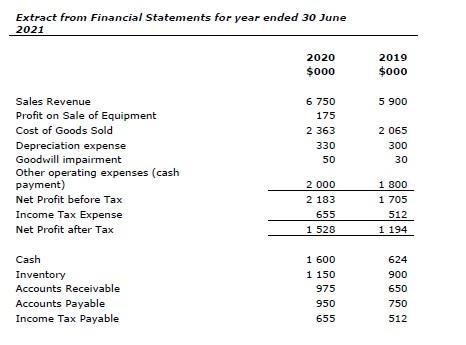

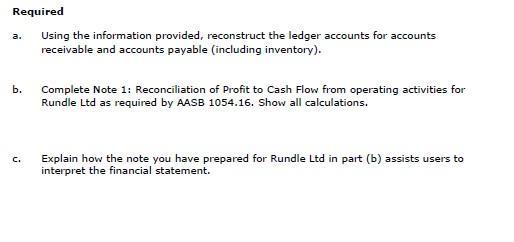

Set out below is the draft Statement of Cash flows and associated notes for Rundle Ltd for the year ended 30 June 2021. Consolidated Statement of Cash Flows for year ended 30 June 2021 Note $00 Cash flows from operating activities Cash receipts from customers Cash payments to suppliers Cash payments for other operating expenses Income tax paid 7 300 (3 013) (2 000) (512) 1 776 Cash provided by operating activities 1 Cash flows from investing activities Proceeds from sale of plant and equipment 200 Cash purchases of property, plant and equipment Cash used to acquire subsidiary (450) (900) (1,150) Cash used by investing activities Cash flows from financing activities Proceeds from share issue 600 Dividends paid (250) Cash used by financing activities 350 Net increase / (decrease) in cash and cash equivalents Cash and cash equivalents at 1 July 2020 976 624 Cash and cash equivalents at 30 June 2021 1,600 Note 2: Subsidiary acquired (extract only) During the year Rundle Ltd acquired 60% of the issued shares of Stanley Ltd. Details of the acquisition are as follows: $000 Fair value of identifiable net assets acquired Cash and cash equivalents 900 Trade receivables 875 1 500 Property, plant and equipment Trade and other payables (600) 2 675 Extract from Financial Statements for year ended 30 June 2021 2020 2019 $000 $000 Sales Revenue 6 750 5 900 Profit on Sale of Equipment 175 Cost of Goods Sold 2 363 2 065 Depreciation expense 330 300 Goodwill impairment Other operating expenses (cash payment) 50 30 1 800 1 705 2 000 Net Profit before Tax 2 183 Income Tax Expense 655 1 528 512 Net Profit after Tax 1 194 Cash 1 600 1 150 624 Inventory 900 Accounts Receivable 975 650 Accounts Payable 950 750 Income Tax Payable 655 512 Required Using the information provided, reconstruct the ledger accounts for accounts receivable and accounts payable (including inventory). a. b. Complete Note 1: Reconciliation of Profit to Cash Flow from operating activities for Rundle Ltd as required by AASB 1054.16. Show all calculations. Explain how the note you have prepared for Rundle Ltd in part (b) assists users to interpret the financial statement. C.

Step by Step Solution

★★★★★

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 a The ledger for accounts receivable in 000 Date Particulars Debit Credit Balance 1 July 2020 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started