Answered step by step

Verified Expert Solution

Question

1 Approved Answer

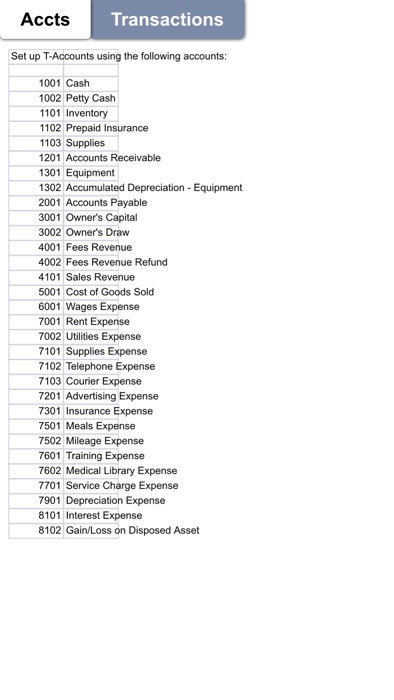

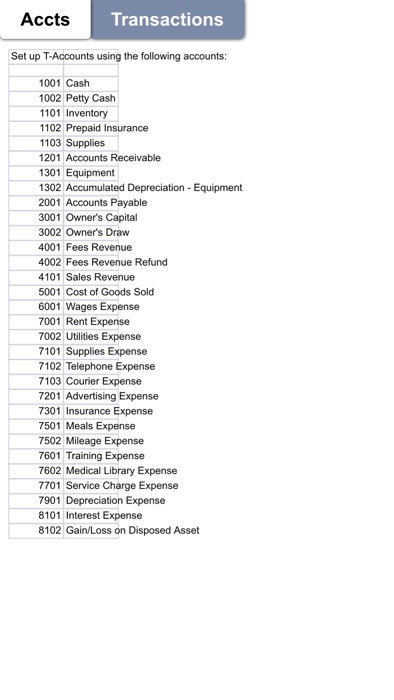

Set up T accounts using the following accounts: 1001 cash, 1002 petty cash, 1101 inventory, 1102 prepaid insurance Accts Transactions Set up T-Accounts using the

Set up T accounts using the following accounts: 1001 cash, 1002 petty cash, 1101 inventory, 1102 prepaid insurance

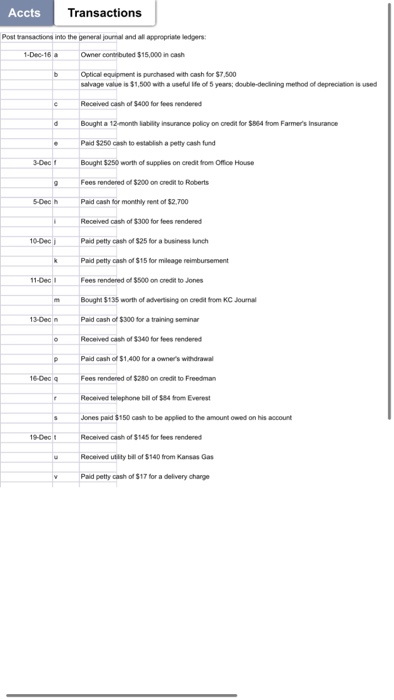

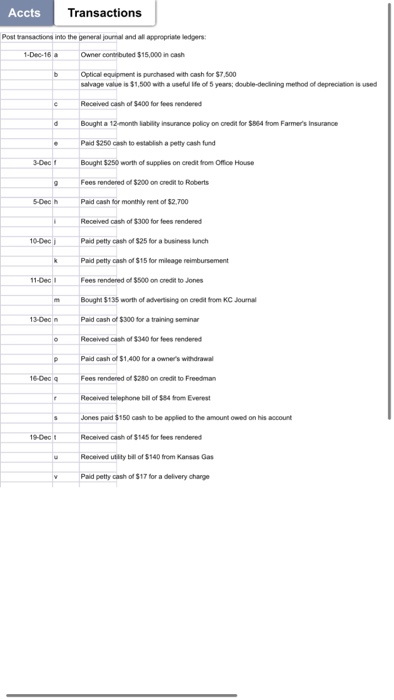

Accts Transactions Set up T-Accounts using the following accounts: 1001 Cash 1002 Petty Cash 1101 Inventory 1102 Prepaid Insurance 1103 Supplies 1201 Accounts Receivable 1301 Equipment 1302 Accumulated Depreciation - Equipment 2001 Accounts Payable 3001 Owner's Capital 3002 Owner's Draw 4001 Fees Revenue 4002 Fees Revenue Refund 4101 Sales Revenue 5001 Cost of Goods Sold 6001 Wages Expense 7001 Rent Expense 7002 Utilities Expense 7101 Supplies Expense 7102 Telephone Expense 7103 Courier Expense 7201 Advertising Expense 7301 Insurance Expense 7501 Meals Expense 7502 Mileage Expense 7601 Training Expense 7602 Medical Library Expense 7701 Service Charge Expense 7901 Depreciation Expense 8101 Interest Expense 8102 Gain/Loss on Disposed Asset Accts Transactions Post transactions into the general journal and all appropriate ledgers: 1-Dec-16 Owner contributed $15,000 in cash Optical equipment is purchased with cash for $7.500 salvage value is $1,500 with a useful ife of years double-declining method of depreciation is used Received cash of $400 for fees rendered Bought a 12-month liability insurance policy on credit for $864 from Farmer's Insurance Paid $250 cash to establish a petty cash fund 3-Dec Bought $250 worth of supplies on credit from Office House Fees rendered of $200 on credit to Roberts 5-Dec Paid cash for monthly rent of $2.700 Received cash of $300 for fees rendered 10 Dec Paid petty cash of $25 for a business lunch Paid petty cash of $15 for mileage reimbursement 11-Dec Fees rendered of $500 on credit to Jones Bought $135 worth of advertising on credit from KC Journal 13 Dec Paid cash of $300 for a training seminar Received cash of $340 for fees rendered Paid cash of $1.400 for a owner's withdrawal Fees rendered of $280 on credit to Freedman Received telephone bill of $84 from Everest Jones paid $150 cash to be applied to the amount owed on his account Received cash of $145 for fees rendered Received tity bel of $140 from Kansas Gas Paid petty cash of $17 for a delivery charge Accts Transactions Set up T-Accounts using the following accounts: 1001 Cash 1002 Petty Cash 1101 Inventory 1102 Prepaid Insurance 1103 Supplies 1201 Accounts Receivable 1301 Equipment 1302 Accumulated Depreciation - Equipment 2001 Accounts Payable 3001 Owner's Capital 3002 Owner's Draw 4001 Fees Revenue 4002 Fees Revenue Refund 4101 Sales Revenue 5001 Cost of Goods Sold 6001 Wages Expense 7001 Rent Expense 7002 Utilities Expense 7101 Supplies Expense 7102 Telephone Expense 7103 Courier Expense 7201 Advertising Expense 7301 Insurance Expense 7501 Meals Expense 7502 Mileage Expense 7601 Training Expense 7602 Medical Library Expense 7701 Service Charge Expense 7901 Depreciation Expense 8101 Interest Expense 8102 Gain/Loss on Disposed Asset Accts Transactions Post transactions into the general journal and all appropriate ledgers: 1-Dec-16 Owner contributed $15,000 in cash Optical equipment is purchased with cash for $7.500 salvage value is $1,500 with a useful ife of years double-declining method of depreciation is used Received cash of $400 for fees rendered Bought a 12-month liability insurance policy on credit for $864 from Farmer's Insurance Paid $250 cash to establish a petty cash fund 3-Dec Bought $250 worth of supplies on credit from Office House Fees rendered of $200 on credit to Roberts 5-Dec Paid cash for monthly rent of $2.700 Received cash of $300 for fees rendered 10 Dec Paid petty cash of $25 for a business lunch Paid petty cash of $15 for mileage reimbursement 11-Dec Fees rendered of $500 on credit to Jones Bought $135 worth of advertising on credit from KC Journal 13 Dec Paid cash of $300 for a training seminar Received cash of $340 for fees rendered Paid cash of $1.400 for a owner's withdrawal Fees rendered of $280 on credit to Freedman Received telephone bill of $84 from Everest Jones paid $150 cash to be applied to the amount owed on his account Received cash of $145 for fees rendered Received tity bel of $140 from Kansas Gas Paid petty cash of $17 for a delivery charge

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started