Answered step by step

Verified Expert Solution

Question

1 Approved Answer

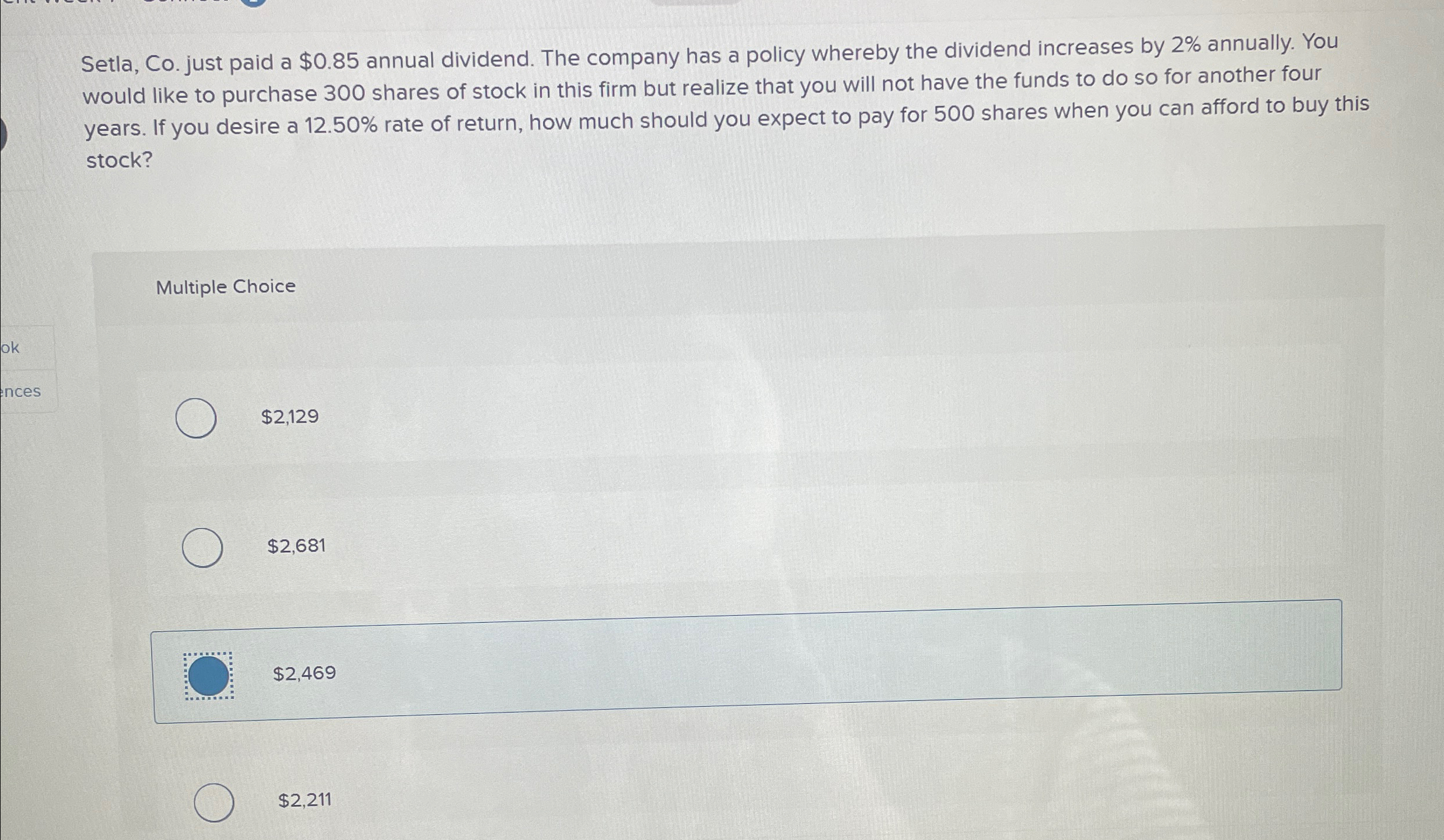

Setla, Co . just paid a $ 0 . 8 5 annual dividend. The company has a policy whereby the dividend increases by 2 %

Setla, Co just paid a $ annual dividend. The company has a policy whereby the dividend increases by annually. You would like to purchase shares of stock in this firm but realize that you will not have the funds to do so for another four years. If you desire a rate of return, how much should you expect to pay for shares when you can afford to buy this stock?

Multiple Choice

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started