Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Seven months ago, a customer signed a $86,500, 7-month, 5% promissory note. On maturity, the customer must repay the amount borrowed with accrued interest. Today

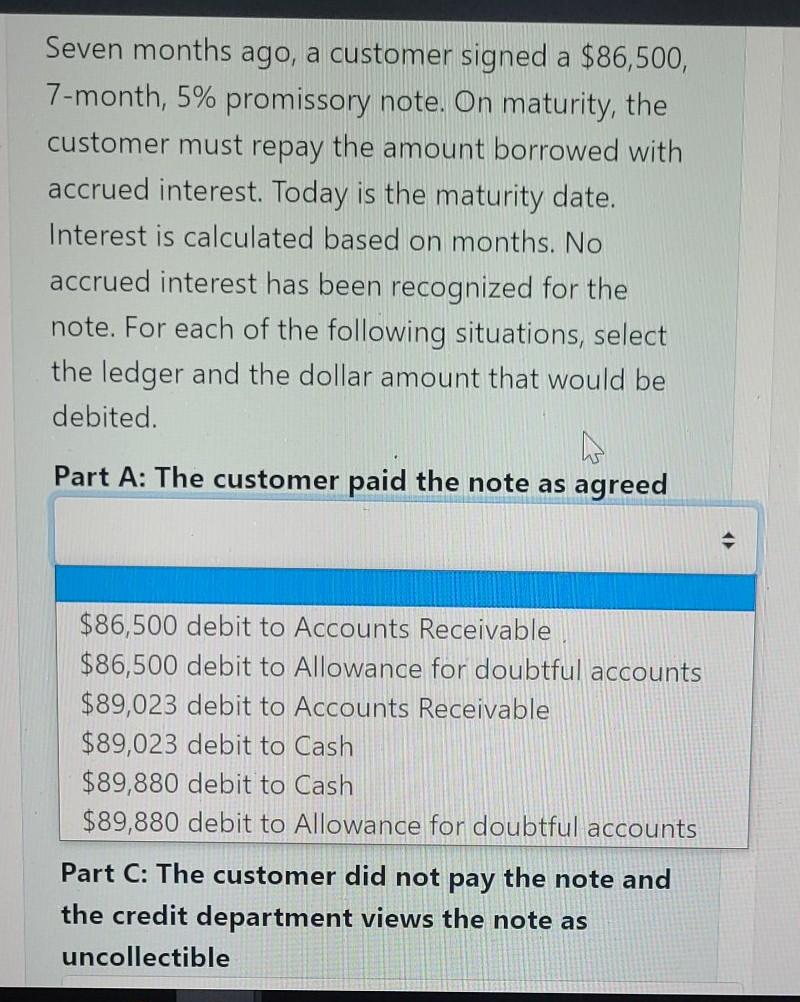

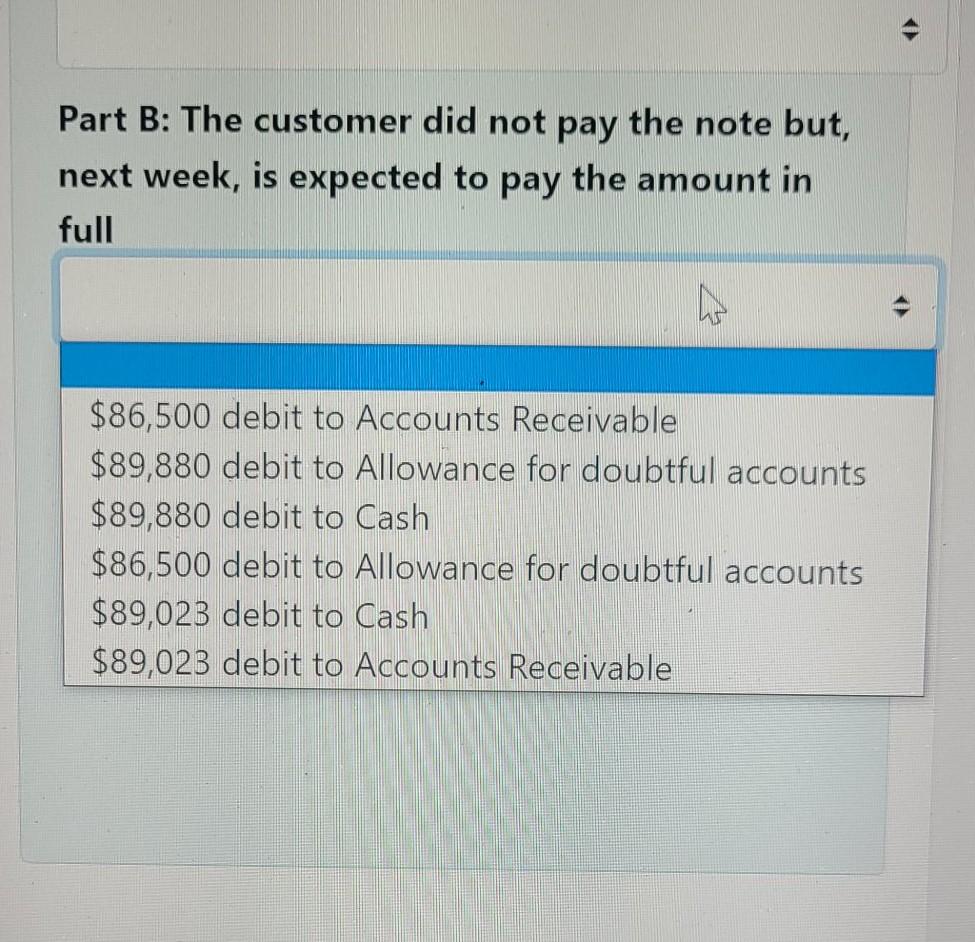

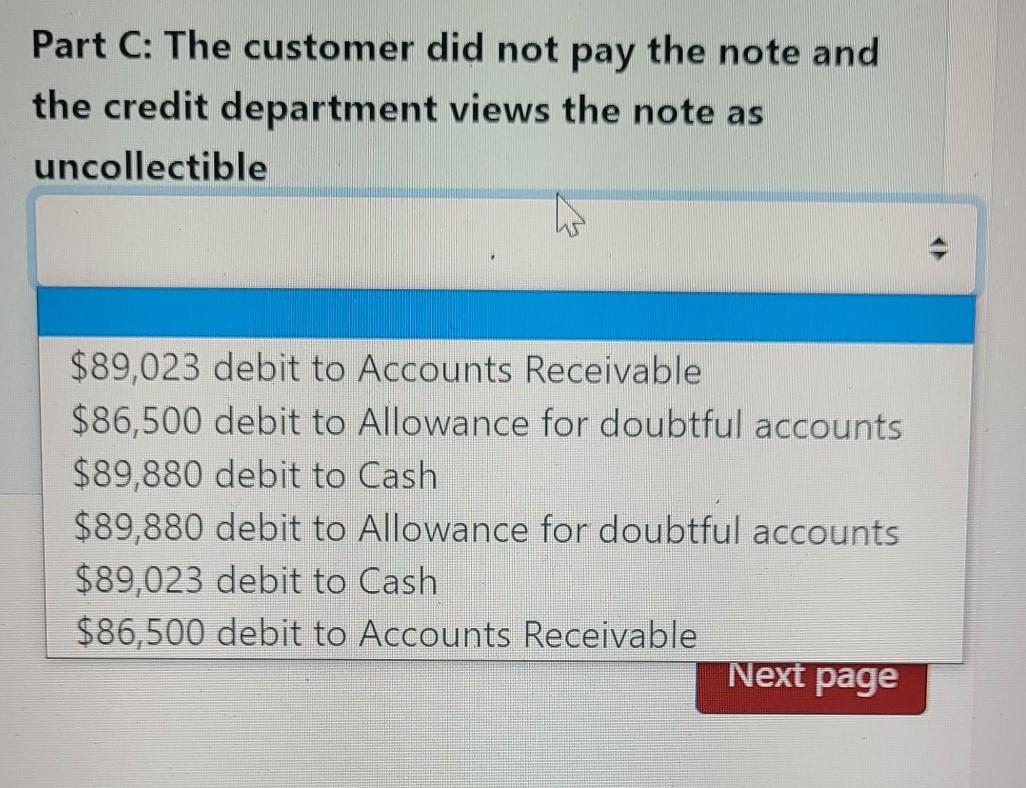

Seven months ago, a customer signed a $86,500, 7-month, 5% promissory note. On maturity, the customer must repay the amount borrowed with accrued interest. Today is the maturity date. Interest is calculated based on months. No accrued interest has been recognized for the note. For each of the following situations, select the ledger and the dollar amount that would be debited. N Part A: The customer paid the note as agreed $86,500 debit to Accounts Receivable $86,500 debit to Allowance for doubtful accounts $89,023 debit to Accounts Receivable $89,023 debit to Cash $89,880 debit to Cash $89,880 debit to Allowance for doubtful accounts Part C: The customer did not pay the note and the credit department views the note as uncollectible Part B: The customer did not pay the note but, next week, is expected to pay the amount in full $86,500 debit to Accounts Receivable $89,880 debit to Allowance for doubtful accounts $89,880 debit to Cash $86,500 debit to Allowance for doubtful accounts $89,023 debit to Cash $89,023 debit to Accounts Receivable Part C: The customer did not pay the note and the credit department views the note as uncollectible $89,023 debit to Accounts Receivable $86,500 debit to Allowance for doubtful accounts $89,880 debit to Cash $89,880 debit to Allowance for doubtful accounts $89,023 debit to Cash $86,500 debit to Accounts Receivable Next page

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started