Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Several factors may influence interest rates for individual securities in an economy like the United Kingdom. One such factor is inflation. Explain how the

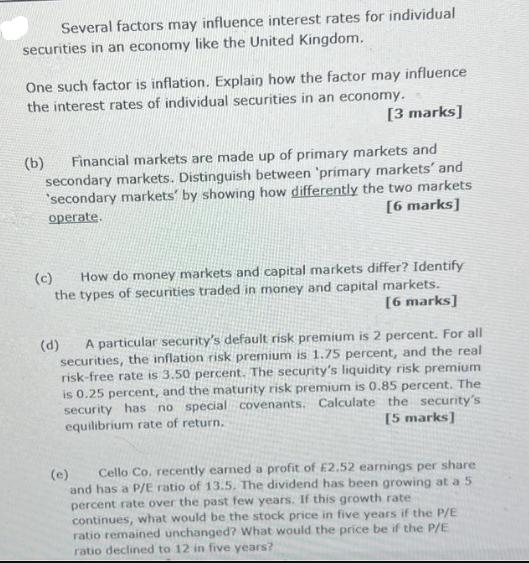

Several factors may influence interest rates for individual securities in an economy like the United Kingdom. One such factor is inflation. Explain how the factor may influence the interest rates of individual securities in an economy. (b) [3 marks] Financial markets are made up of primary markets and secondary markets. Distinguish between 'primary markets' and 'secondary markets' by showing how differently the two markets [6 marks] operate. (c) (d) How do money markets and capital markets differ? Identify the types of securities traded in money and capital markets. [6 marks] A particular security's default risk premium is 2 percent. For all securities, the inflation risk premium is 1.75 percent, and the real risk-free rate is 3.50 percent. The security's liquidity risk premium is 0.25 percent, and the maturity risk premium is 0.85 percent. The security has no special covenants. Calculate the security's [5 marks] equilibrium rate of return. (e) Cello Co. recently earned a profit of E2.52 earnings per share and has a P/E ratio of 13.5. The dividend has been growing at a 5 percent rate over the past few years. If this growth rate continues, what would be the stock price in five years if the P/E ratio remained unchanged? What would the price be if the P/E ratio declined to 12 in five years?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Inflation can influence the interest rates of individual securities in an economy When inflation is high the purchasing power of money decreases over time To compensate for the loss in purchasing po...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663ddd1a8c428_961537.pdf

180 KBs PDF File

663ddd1a8c428_961537.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started