Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Several methods can be used to compute the intrinsic value of a share of a company's common stock. One method uses the free cash flow

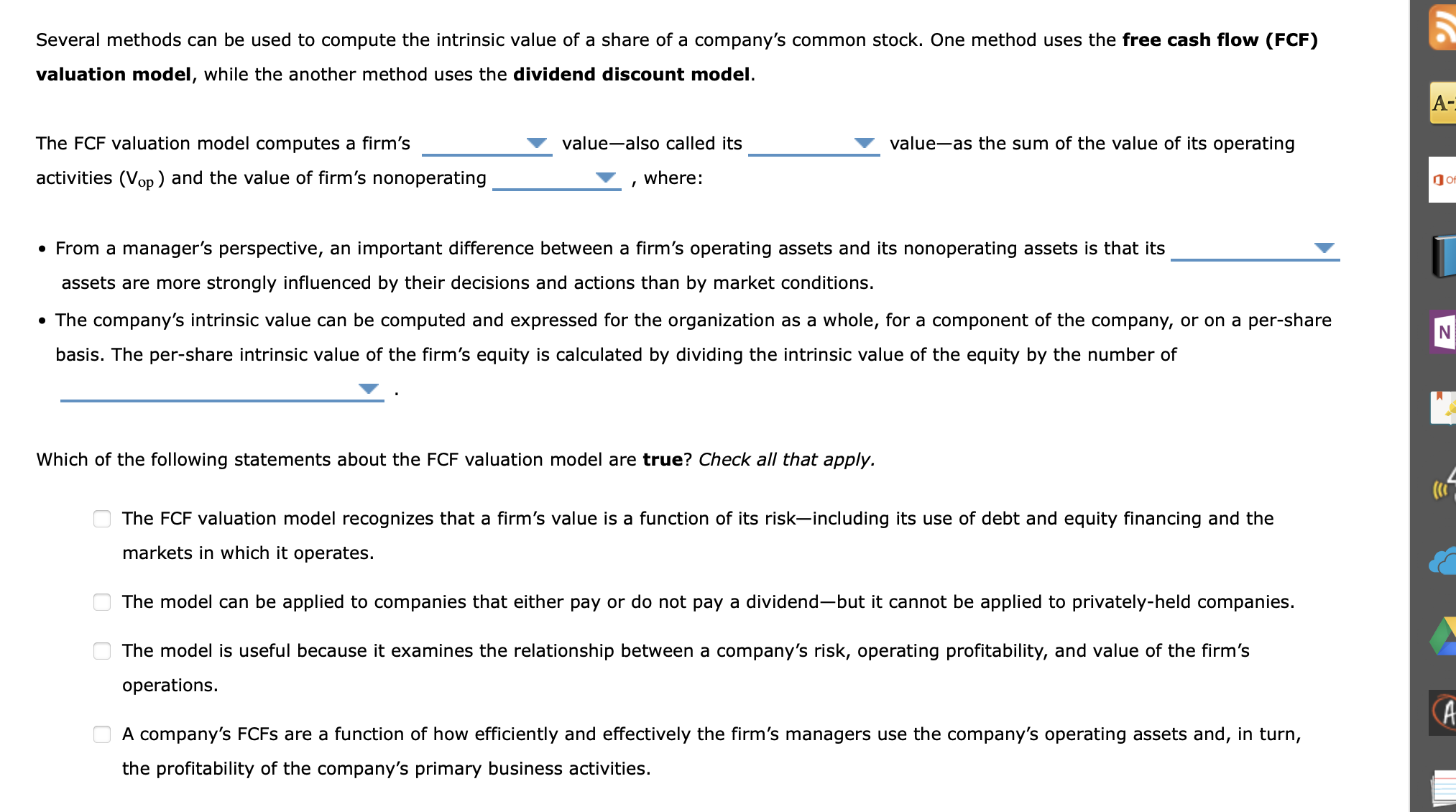

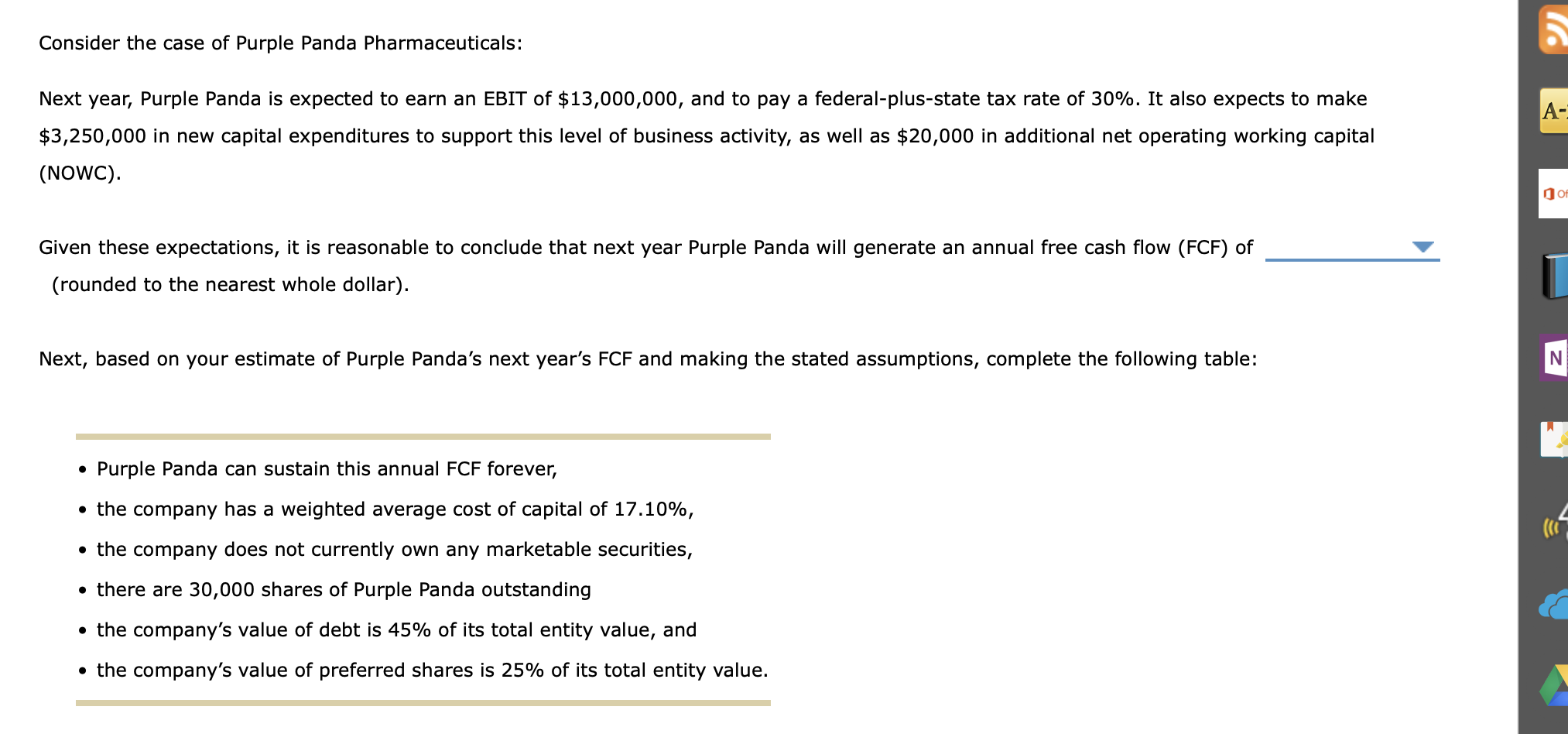

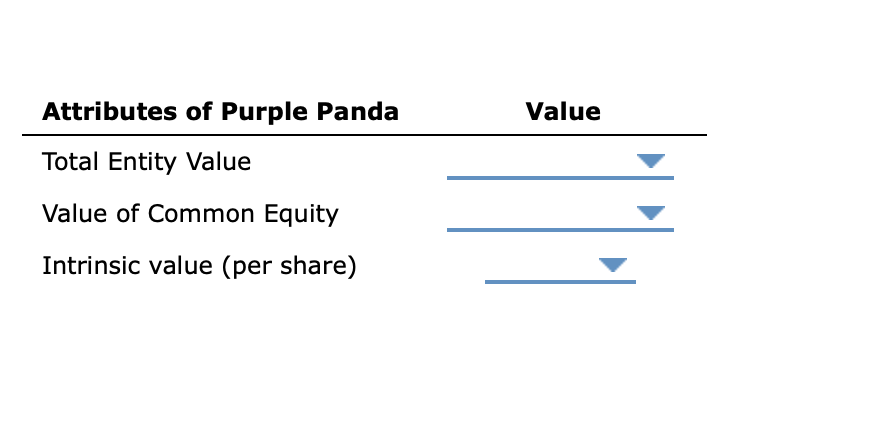

Several methods can be used to compute the intrinsic value of a share of a company's common stock. One method uses the free cash flow (FCF) valuation model, while the another method uses the dividend discount model. The FCF valuation model computes a firm's activities (Vop) and the value of firm's nonoperating value-also called its , where: value-as the sum of the value of its operating - From a manager's perspective, an important difference between a firm's operating assets and its nonoperating assets is that its assets are more strongly influenced by their decisions and actions than by market conditions. - The company's intrinsic value can be computed and expressed for the organization as a whole, for a component of the company, or on a per-share basis. The per-share intrinsic value of the firm's equity is calculated by dividing the intrinsic value of the equity by the number of Which of the following statements about the FCF valuation model are true? Check all that apply. The FCF valuation model recognizes that a firm's value is a function of its risk-including its use of debt and equity financing and the markets in which it operates. The model can be applied to companies that either pay or do not pay a dividend-but it cannot be applied to privately-held companies. The model is useful because it examines the relationship between a company's risk, operating profitability, and value of the firm's operations. A company's FCFs are a function of how efficiently and effectively the firm's managers use the company's operating assets and, in turn, the profitability of the company's primary business activities. Consider the case of Purple Panda Pharmaceuticals: Next year, Purple Panda is expected to earn an EBIT of $13,000,000, and to pay a federal-plus-state tax rate of 30%. It also expects to make $3,250,000 in new capital expenditures to support this level of business activity, as well as $20,000 in additional net operating working capital (NOWC). Given these expectations, it is reasonable to conclude that next year Purple Panda will generate an annual free cash flow (FCF) of (rounded to the nearest whole dollar). Next, based on your estimate of Purple Panda's next year's FCF and making the stated assumptions, complete the following table: - Purple Panda can sustain this annual FCF forever, - the company has a weighted average cost of capital of 17.10%, - the company does not currently own any marketable securities, - there are 30,000 shares of Purple Panda outstanding - the company's value of debt is 45% of its total entity value, and - the company's value of preferred shares is 25% of its total entity value. \begin{tabular}{ll} Attributes of Purple Panda & Value \\ \hline Total Entity Value & \\ Value of Common Equity & \\ Intrinsic value (per share) & \end{tabular} Several methods can be used to compute the intrinsic value of a share of a company's common stock. One method uses the free cash flow (FCF) valuation model, while the another method uses the dividend discount model. The FCF valuation model computes a firm's activities (Vop) and the value of firm's nonoperating value-also called its , where: value-as the sum of the value of its operating - From a manager's perspective, an important difference between a firm's operating assets and its nonoperating assets is that its assets are more strongly influenced by their decisions and actions than by market conditions. - The company's intrinsic value can be computed and expressed for the organization as a whole, for a component of the company, or on a per-share basis. The per-share intrinsic value of the firm's equity is calculated by dividing the intrinsic value of the equity by the number of Which of the following statements about the FCF valuation model are true? Check all that apply. The FCF valuation model recognizes that a firm's value is a function of its risk-including its use of debt and equity financing and the markets in which it operates. The model can be applied to companies that either pay or do not pay a dividend-but it cannot be applied to privately-held companies. The model is useful because it examines the relationship between a company's risk, operating profitability, and value of the firm's operations. A company's FCFs are a function of how efficiently and effectively the firm's managers use the company's operating assets and, in turn, the profitability of the company's primary business activities. Consider the case of Purple Panda Pharmaceuticals: Next year, Purple Panda is expected to earn an EBIT of $13,000,000, and to pay a federal-plus-state tax rate of 30%. It also expects to make $3,250,000 in new capital expenditures to support this level of business activity, as well as $20,000 in additional net operating working capital (NOWC). Given these expectations, it is reasonable to conclude that next year Purple Panda will generate an annual free cash flow (FCF) of (rounded to the nearest whole dollar). Next, based on your estimate of Purple Panda's next year's FCF and making the stated assumptions, complete the following table: - Purple Panda can sustain this annual FCF forever, - the company has a weighted average cost of capital of 17.10%, - the company does not currently own any marketable securities, - there are 30,000 shares of Purple Panda outstanding - the company's value of debt is 45% of its total entity value, and - the company's value of preferred shares is 25% of its total entity value. \begin{tabular}{ll} Attributes of Purple Panda & Value \\ \hline Total Entity Value & \\ Value of Common Equity & \\ Intrinsic value (per share) & \end{tabular}

Several methods can be used to compute the intrinsic value of a share of a company's common stock. One method uses the free cash flow (FCF) valuation model, while the another method uses the dividend discount model. The FCF valuation model computes a firm's activities (Vop) and the value of firm's nonoperating value-also called its , where: value-as the sum of the value of its operating - From a manager's perspective, an important difference between a firm's operating assets and its nonoperating assets is that its assets are more strongly influenced by their decisions and actions than by market conditions. - The company's intrinsic value can be computed and expressed for the organization as a whole, for a component of the company, or on a per-share basis. The per-share intrinsic value of the firm's equity is calculated by dividing the intrinsic value of the equity by the number of Which of the following statements about the FCF valuation model are true? Check all that apply. The FCF valuation model recognizes that a firm's value is a function of its risk-including its use of debt and equity financing and the markets in which it operates. The model can be applied to companies that either pay or do not pay a dividend-but it cannot be applied to privately-held companies. The model is useful because it examines the relationship between a company's risk, operating profitability, and value of the firm's operations. A company's FCFs are a function of how efficiently and effectively the firm's managers use the company's operating assets and, in turn, the profitability of the company's primary business activities. Consider the case of Purple Panda Pharmaceuticals: Next year, Purple Panda is expected to earn an EBIT of $13,000,000, and to pay a federal-plus-state tax rate of 30%. It also expects to make $3,250,000 in new capital expenditures to support this level of business activity, as well as $20,000 in additional net operating working capital (NOWC). Given these expectations, it is reasonable to conclude that next year Purple Panda will generate an annual free cash flow (FCF) of (rounded to the nearest whole dollar). Next, based on your estimate of Purple Panda's next year's FCF and making the stated assumptions, complete the following table: - Purple Panda can sustain this annual FCF forever, - the company has a weighted average cost of capital of 17.10%, - the company does not currently own any marketable securities, - there are 30,000 shares of Purple Panda outstanding - the company's value of debt is 45% of its total entity value, and - the company's value of preferred shares is 25% of its total entity value. \begin{tabular}{ll} Attributes of Purple Panda & Value \\ \hline Total Entity Value & \\ Value of Common Equity & \\ Intrinsic value (per share) & \end{tabular} Several methods can be used to compute the intrinsic value of a share of a company's common stock. One method uses the free cash flow (FCF) valuation model, while the another method uses the dividend discount model. The FCF valuation model computes a firm's activities (Vop) and the value of firm's nonoperating value-also called its , where: value-as the sum of the value of its operating - From a manager's perspective, an important difference between a firm's operating assets and its nonoperating assets is that its assets are more strongly influenced by their decisions and actions than by market conditions. - The company's intrinsic value can be computed and expressed for the organization as a whole, for a component of the company, or on a per-share basis. The per-share intrinsic value of the firm's equity is calculated by dividing the intrinsic value of the equity by the number of Which of the following statements about the FCF valuation model are true? Check all that apply. The FCF valuation model recognizes that a firm's value is a function of its risk-including its use of debt and equity financing and the markets in which it operates. The model can be applied to companies that either pay or do not pay a dividend-but it cannot be applied to privately-held companies. The model is useful because it examines the relationship between a company's risk, operating profitability, and value of the firm's operations. A company's FCFs are a function of how efficiently and effectively the firm's managers use the company's operating assets and, in turn, the profitability of the company's primary business activities. Consider the case of Purple Panda Pharmaceuticals: Next year, Purple Panda is expected to earn an EBIT of $13,000,000, and to pay a federal-plus-state tax rate of 30%. It also expects to make $3,250,000 in new capital expenditures to support this level of business activity, as well as $20,000 in additional net operating working capital (NOWC). Given these expectations, it is reasonable to conclude that next year Purple Panda will generate an annual free cash flow (FCF) of (rounded to the nearest whole dollar). Next, based on your estimate of Purple Panda's next year's FCF and making the stated assumptions, complete the following table: - Purple Panda can sustain this annual FCF forever, - the company has a weighted average cost of capital of 17.10%, - the company does not currently own any marketable securities, - there are 30,000 shares of Purple Panda outstanding - the company's value of debt is 45% of its total entity value, and - the company's value of preferred shares is 25% of its total entity value. \begin{tabular}{ll} Attributes of Purple Panda & Value \\ \hline Total Entity Value & \\ Value of Common Equity & \\ Intrinsic value (per share) & \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started