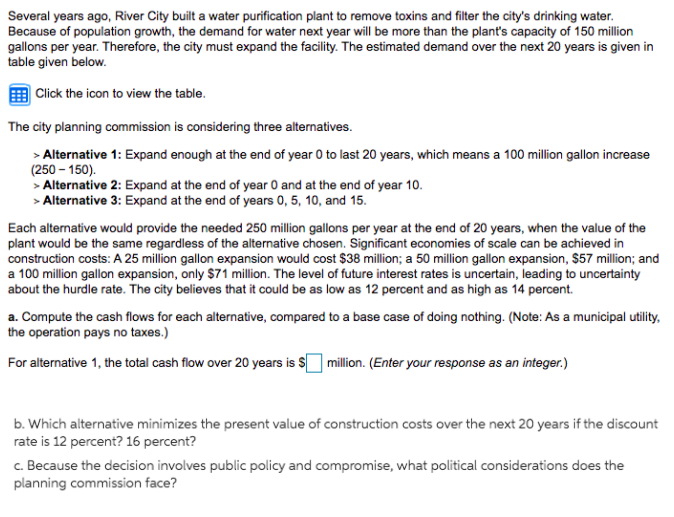

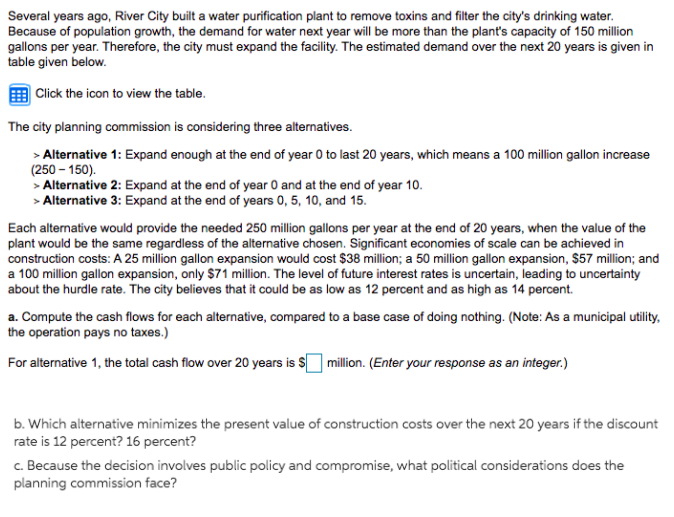

Several years ago, River City built a water purification plant to remove toxins and filter the city's drinking water. Because of population growth, the demand for water next year will be more than the plant's capacity of 150 million gallons per year. Therefore, the city must expand the facility. The estimated demand over the next 20 years is given in table given below. Click the icon to view the table. The city planning commission is considering three alternatives. > Alternative 1: Expand enough at the end of year 0 to last 20 years, which means a 100 million gallon increase (250 - 150). Alternative 2: Expand at the end of year and at the end of year 10. > Alternative 3: Expand at the end of years 0, 5, 10, and 15. Each alternative would provide the needed 250 million gallons per year at the end of 20 years, when the value of the plant would be the same regardless of the alternative chosen. Significant economies of scale can be achieved in construction costs: A 25 million gallon expansion would cost $38 million; a 50 million gallon expansion, $57 million; and a 100 million gallon expansion, only $71 million. The level of future interest rates is uncertain, leading to uncertainty about the hurdle rate. The city believes that it could be as low as 12 percent and as high as 14 percent a. Compute the cash flows for each alternative, compared to a base case of doing nothing. (Note: As a municipal utility, the operation pays no taxes.) For alternative 1, the total cash flow over 20 years is $ million. (Enter your response as an integer.) b. Which alternative minimizes the present value of construction costs over the next 20 years if the discount rate is 12 percent? 16 percent? c. Because the decision involves public policy and compromise, what political considerations does the planning commission face? i Year 0 1 2 3 4 Demand 150 155 160 165 170 175 180 WATER DEMAND Year Demand 7 180 8 190 9 195 10 200 11 205 12 210 13 210 Year 14 15 16 17 18 19 20 Demand 220 225 230 235 240 245 250 5 6 Several years ago, River City built a water purification plant to remove toxins and filter the city's drinking water. Because of population growth, the demand for water next year will be more than the plant's capacity of 150 million gallons per year. Therefore, the city must expand the facility. The estimated demand over the next 20 years is given in table given below. Click the icon to view the table. The city planning commission is considering three alternatives. > Alternative 1: Expand enough at the end of year 0 to last 20 years, which means a 100 million gallon increase (250 - 150). Alternative 2: Expand at the end of year and at the end of year 10. > Alternative 3: Expand at the end of years 0, 5, 10, and 15. Each alternative would provide the needed 250 million gallons per year at the end of 20 years, when the value of the plant would be the same regardless of the alternative chosen. Significant economies of scale can be achieved in construction costs: A 25 million gallon expansion would cost $38 million; a 50 million gallon expansion, $57 million; and a 100 million gallon expansion, only $71 million. The level of future interest rates is uncertain, leading to uncertainty about the hurdle rate. The city believes that it could be as low as 12 percent and as high as 14 percent a. Compute the cash flows for each alternative, compared to a base case of doing nothing. (Note: As a municipal utility, the operation pays no taxes.) For alternative 1, the total cash flow over 20 years is $ million. (Enter your response as an integer.) b. Which alternative minimizes the present value of construction costs over the next 20 years if the discount rate is 12 percent? 16 percent? c. Because the decision involves public policy and compromise, what political considerations does the planning commission face? i Year 0 1 2 3 4 Demand 150 155 160 165 170 175 180 WATER DEMAND Year Demand 7 180 8 190 9 195 10 200 11 205 12 210 13 210 Year 14 15 16 17 18 19 20 Demand 220 225 230 235 240 245 250 5 6